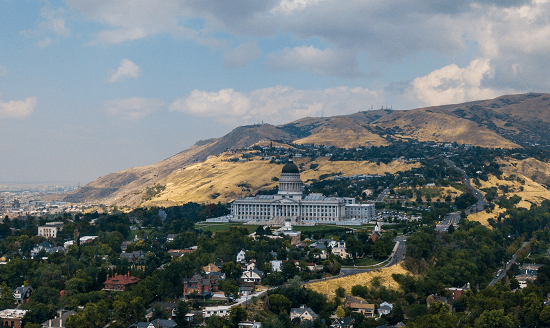

My Cash On Cash Return For My Medical Building

I started my practice in 2018, and since then have bought into a new medical building as a condo owner. Often times you will hear that owning the real estate for your practice can be one of the best investments that you will ever make. Lets take a look today at my cash on cash return and see how good of an investment so far this has given me.… Read the rest

Read more