One Year Post Residency Financial Update

There is no better time than now to give a financial snapshot of what life looks like one year post graduation. One year ago, I graduated from residency and was anxiously wondering how things were going to work out. I signed a contract with no guaranteed income which had me worried if I would make as much money as I hoped for. If a new graduate is reading this, I would like to tell you things will be just fine. Life will be better than you could imagine as long as you keep a modest lifestyle. So here it goes. This is what financial life looks like for me one year post graduation from medical training.

Lets Get The Housing Issue Out Of The Way

I’ve had a very tumultuous move to my new city. Some of you may remember the post about my previous friend leaving me homeless when I moved to my current city. I had all my things loaded in a moving truck and when I arrived to my new city this previous friend answered the phone to tell me the bad news. The condo that he was closing on had been significantly delayed. I needed to find another place to stay. He agreed to give back the money I put down as a deposit and our friendship never survived the ordeal.

My situation left me in temporary arrangement by having to live out of an Airbnb rental while trying to find an apartment.

Several weeks later, I found an apartment, but spent twice as much on rent than I initially budgeted for. The stress was overwhelming, and I prayed every night that my truck with all my belongings didn’t get broken into. Looking back, I am grateful for renting because I had no idea what part of town I would have ended up wanting to buy a house in without renting first.

Trying To Buy A House In A Sellers Marker

Six months into my job I realized that I loved the city, the people I work with, and plan on staying at my job for the foreseeable future. I felt like I was ready for the next step, buying a house. Unfortunately, I’m buying in a strong sellers market.

I went under contract on a house that has a pier and beam foundation (very common for the area). The house had what the seller was describing as “settling.” I decided to get a foundation crew to look at it and I received a written quote for $4,000 to fix the issue.

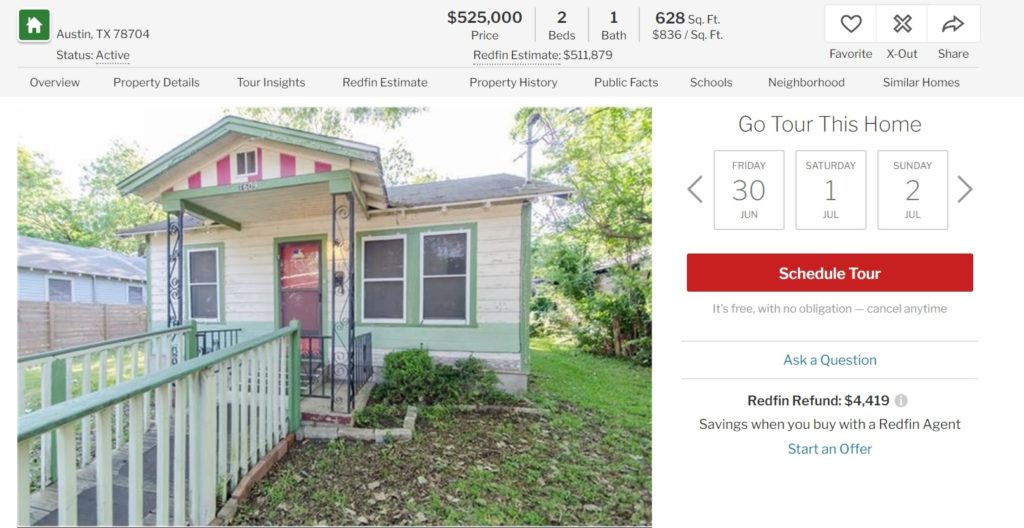

This house on a 4,700 sq ft lot could be yours at over $800 a foot that is described as a tear down. **This is NOT the house I was going to buy***

After talking with my friend who is a structural engineer, he informed me that I needed more than a foundation crew. Turns out structural engineers are much different from foundation repair companies. The foundation company may have an engineer on staff, but the person coming to access your house can have as little as a high school education.

The structural engineer looked at the house and immediately informed me of the structural issues totaling over $20,000 in repairs. He also informed me that there was evidence that the sellers covered up some of the known damage to the house. I terminated my offer, received my earnest money back, and continued looking for a house to buy at the time of this posting.

Picking Up Extra Shifts For Extra Income

The easiest way to make extra money post graduation is to pick up extra shifts. Some of these extra shifts have been obtained via Locum Tenens contracts. I’ve picked up quite a few extra shifts since starting work. Most of these extra shifts occurred in the past 2-3 months since I focused on performing well at my current job before considering additional work.

Burn out is real and I’ve had to back off a little bit on how many shifts I have been picking up. I would like to be in this career for the long run. Working like a resident is only able to be done so long before I burn out sets in.

To date I’ve made about an extra $40,000 pre-tax to my income by picking up extra shifts.

What Does Financial Life Look Like One Year Post Residency

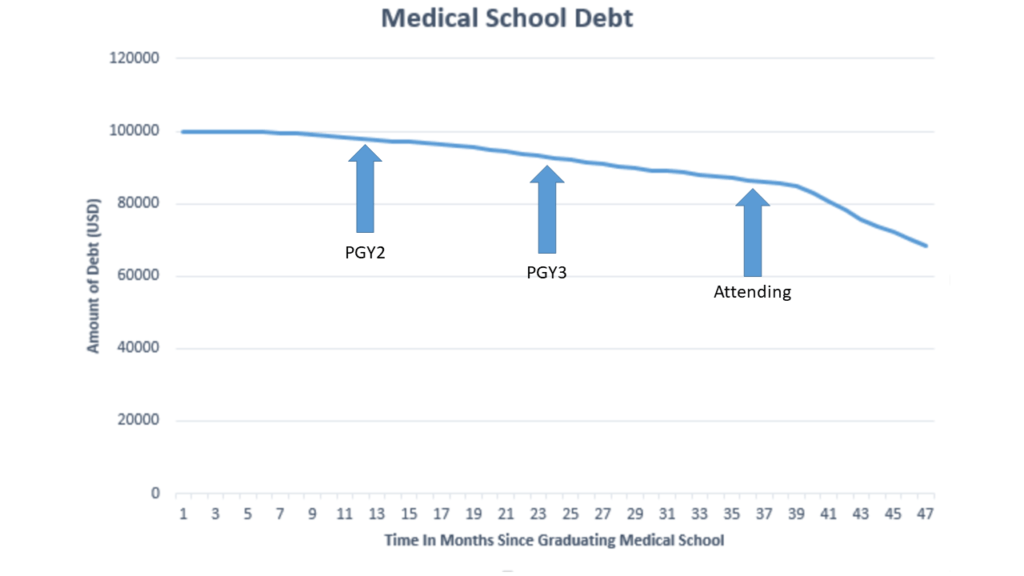

I’ve been fortunate to save up way more than I thought that I could. Especially since there is an almost 2 month delay between when I bill and get paid. The below numbers are slightly skewed since work began 2 months post residency. In effect, this post one year after graduation means that I’ve only received about 8-9 months of full pay. However, this is not uncommon for many new graduates, so I decided to continue with this post to give readers an idea of how much things can change in 12 months. The delay in starting work is also why the chart below lags in debt payoff.

Assets:

- Savings: ~$59,000

- Retirement: $47,000

- Stocks: ~$5,000

- Total = $111,000

Debt / Liabilities:

$68,000 in student loans (Down $18,000) from 12 months ago.

Other expenses that have contributed to my financial situation: My fiancée is currently not working while she finishes her PhD. I should also mention that while she is not working I’ve also been covering the interest on her loans until she graduates this summer. I also have been giving her a bit of spending money each month for small purchases. This is a personal decision since I would feel slightly weird if she had to check in with me for every guilty purchase including coffee from Dunkin Donuts. To date, I’ve contributed about $8,000 to her debt and spending cash since my graduation. I think its only fair since she did move 3 times to follow me around for med school, residency and now my new job.

Payoff Medical School Debt Vs Investing

Another personal decision I’ve made is to decide to put some money into is a savings account at 1.05% interest. Some money has also been placed into an index fund, and a small amount (5k) remains in individual stocks. In the past 12 months, my average return on money invested in the market has been 13.8%. Fantastic, but this rate of return definitely can’t be expected to continue.

The $50,000 in index funds has given me a return of approximately $5,900 over the past year. Meanwhile I’ve paid about $2,200 in interest in my student loans for a net gain of $3,700 by investing rather than paying off my student loans earlier.

Since my interest rate is 3.3% with a maturity date of 1/2020, I’ve decided that I will no longer pay more than the minimum payment in order to pay the loan off on time. I’m even considering refinancing to a variable rate loan to bring my interest even lower to 2.3%.

The risk of investing so far has paid off for me. With the interest created by my index funds, I’ve almost had 2 extra months of payments in interest created. If the market decides to take another dip like that of 2008, I have enough cash on hand with a stable job to where I can pay off the remainder of the balance while riding out the dip.

The Past Does Not Predict The Future

The United States is currently in its 3rd longest bull market ever. Will this bull market become the longest ever bull market in the stock market history?

Previous longest bull market: 1991-2001= 10 years

March 2009 was the low of the last recession. At the time of this posting it has been 8 years since the last recession.

I cannot help, but be reminded of one of a quote from Warren Buffett. “Be fearful when others are greedy and greedy only when others are fearful.”

No one knows what the future holds. The only way I can prepare for any potential bear market is to avoid over leveraging myself, live modestly, and ensure that I have money set aside to comfortably pay off my debts.

Only time will tell how the market does. I’ll stick to my plan in good times and bad. In the meantime, I’ll continue to enjoy the fact that my dream of becoming a physician those many years ago has come true. It’s an honor to be a part of a profession that can have such a positive impact on others lives.

My Budget While In Residency

Thanks for the update. Nice progress. I agree with your concerns about a long-running bull.

Great update! Appreciate the transparency as I think this will help increase the confidence of many that are in a very similar position.

Thanks a lot! I have been working hard lately and financially it definitely has been paying off.