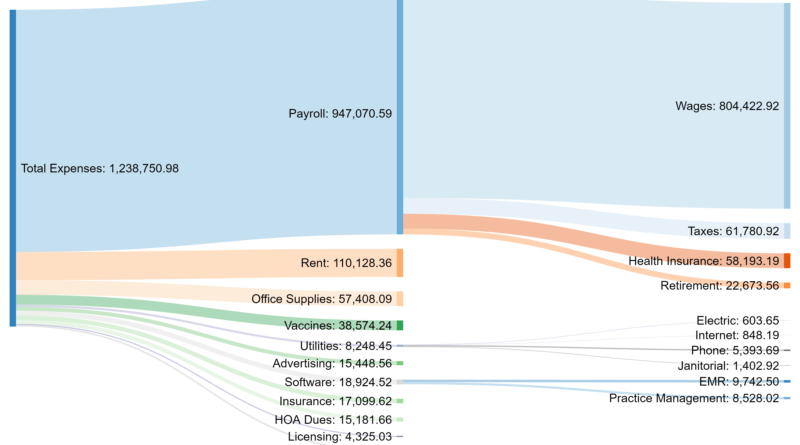

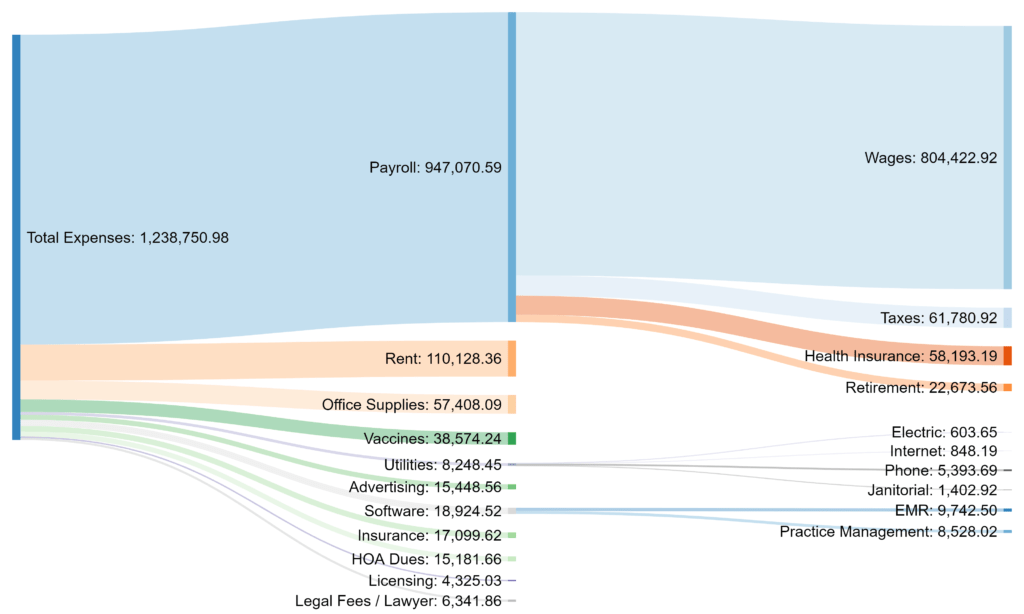

Breakdown Of Spending For Our Medical Practice 2021

It is expensive to run a medical practice, but have you ever wondered how expensive? At the end of every year, I do a breakdown to see where we might be able to save money. Maybe you’ll find it of some interest.

In an effort to help those of you who are deciding on possibly starting your own practice, let us take a look at my breakdown of where money was spent in 2021 in my practice. Or, maybe you’re just curious how much it costs to run a small practice. Well, here is our spending on our medical practice for 2021.

If you’re wondering why I am sharing such detailed information. Well, the answer to that is this spending post is almost meaningless since I am not sharing income numbers. This post does though give you a good idea on what the costs may be for a small medical practice. Or it can tell you how a medical practice spends much of its money.

Payroll

This is the biggest chunk of the spending, and it does include the W-2 salary I take and all 15 employees. This also includes the salary paid out to the other doctor who was with us briefly who cost me a lot of money.

One thing that I would like to note, is that Employer based taxes we paid almost sixty-one thousand dollars last year. Not chump change at all and more than I was guessing before looking at actual end of year values.

We also covered all medical insurance costs for our employees during 2021 which costs us also almost sixty thousand dollars per year or about $450 per month per employee.

We have a retirement plan but only about half the staff opted in. Seems that half the staff has no interest in being a part of the 401k match and want all the money up front. Their loss.

Rent

Often your second biggest expense and it is our second largest expense. We paid a lot of money in rent this past year, which you can see is about 10% of all gross spending last year. Commercial rents I thought would be getting less expensive due to the pandemic, but this is not the case where we are at. They are actually much more expensive now than before the pandemic.

We currently are looking at more commercial real estate to keep growing the practice. Ideally, I would like rent to be <8% of spending, especially as we grow our telemedicine offerings.

Insurance

This includes malpractice insurance and other various insurances for our company to protect us in the event if someone slips and falls in our office.

This costs for a doctors office will be widely variable due to which state you are in. In some states one OBGYN may pay 50k a year in premiums, whereas in our state a mature policy for general outpatient medicine is about 5-6k a year.

We have so many different insurance policies for our clinic that I have to have a spreadsheet to keep track of them.

Advertising

For a period of time in early 2021 I was advertising on Google AdWords or Facebook. During the pandemic surges, we occasionally would see a drop in visits. Combine those drops in visits with hiring a new doctor, we put some advertising dollars out there to market them. For the last 2+ quarters of the year we went back to spending $0 a month on advertising.

Software

We have to pay for an electronic medical record and then pay for the billing platform to bill insurance for those visits. The practice management that you see is the software to bill insurance companies. In total that is about $20k a year for our practice.

We were lucky in that we bought the dictation service Dragon back when it was still offered as a one-time payment rather than subscription. That was $1,400 per user but is good for life. Dragon has since discontinued this offering.

Office Supplies

This should really be titled “growth costs.”

All of these supplies came as a result of adding on more doctors and needing more computers, printers, desks for them, otoscope…etc. You get the idea. This really is a onetime expense category. I put vaccines in a separate category since no vaccines are included in this figure.

HOA Fees

This category is a bit wonky. Some of the cleaning fees were in the HOA category for a while. Our electric bill also comes mainly through the HOA but there was one or two bills that came outside of that. That is why you will see electric as such a low cost.

We get a bill every month for HOA costs which is common for triple net (NNN) leases.

Legal Services

I contacted my lawyer a few times in 2021. Most notably when a patient physically threatened us/me, he changed his Facebook profile picture to a gun after threatening us, and kept calling out office cussing. He then would call after hours, leave a voicemail of him hang up while laughing.

This costs category has a sneaky part that I’m a bit embarrassed to admit for fear I might get some negative judgement. This category does include the cost for a handgun for protection after he said, “you know I am a veteran and veterans know how to do bad things” and laughed and hung up on me. All this because we would not give him controlled substances at his demands. He really freaked me out and I went ahead and got myself protection.

This amount also includes a restraining order against him and other medical fees for growing the practice. Such as, new physician employee contract review by my lawyer, and looking at additional commercial rental agreements for additional practices.

Deaf Interpretation

We have a few hearing impaired patients. The cost is on us to provide an interpreter and this cost can not be passed on to the patient. We simply had to eat that cost for the 2 visits we had in 2021 with this patient. Our other hearing impaired patients oddly have not been in to our practice in 2021. I did not directly include it in the graph, but it was about $450 in 2021.

Spending For 2022 On Our Medical Practice

I am expecting the one-time expenses to go up even higher for 2022 as we look to open another location. That will most likely cost us about $150 per sq ft to renovate the space that we find to meet our needs. In a 2,000 sq ft place, that might be a $300,000 cost.

This will highly depend on how much tenant improvement, if any, we can get from landlords.

We also hired more doctors and are interviewing for another 2 APPs to join our clinic. Staffing costs will of course rise as we have more providers.

So, there you have it. That is a breakdown of what a small medical practice spends in one calendar year.

Hi doc! I really appreciate the content that you are putting out there. Would you also be comfortable sharing about your gross and net revenue as well as tax management strategies ( i.e deductibles, llc expenses etc…)? These are commonly gray areas that not too many people are willing to discuss. Just a bit of transparency in those areas could go a long way. Thank you in advance.

I will plan to have a post about this in the future, I just have to figure out a way to do a post like this without giving out way to much personal financial information. That is probably why many people do not post this type of information online.

Hi doctor, thank you so much for sharing the content but it will be more useful if you share the profitability rate or the expense % to revenue. At the moment with this information, we cannot benchmark to set our numbers right for existing practice or preparing plan for the new practice.

I feel like for us, the numbers will be skewed since we are spending a fair amount of money on growing the practice. In terms of overhead, our practices continues to hover around 33%ish for our overhead expenses.