Buying A House In A Sellers Market With A Physician Loan, Part 1

It’s been over six months since I started my job in Austin, TX. In that time, I have built an emergency fund to last 6 months, a wedding fund, and savings to have the ability for a small down payment for a house. The next financial step that I’m interested in is home ownership. One of the largest reasons I am considering buying is that I plan to stay in Austin area in the foreseeable future. Also, apartment living is becoming tiresome. The neighbor’s dog barking constantly all day long and college aged kids partying till 3 am has quickly gotten old (or maybe I’m just old). Dare I say that I crossed the threshold years ago where I value sleep more than bar hopping with my time off.

Over the past 3 months, I have been house searching and putting offers on various houses in the more desirable parts of town. The experience has been eye-opening and lead to me question if there is some sanity to the process. This post will be the first in a series of 3 about my experiences when using a physician mortgage to buy a house in a strong sellers market.

Buying A House In A Sellers Market

I went into the process of buying a home knowing that Austin is currently a seller’s market. I knew that the process might be tough, but I underestimated how tough. Every house that I have bid on has had multiple offers. For one of the houses that I bid on, there were 12 offers, 4 of which were all cash. The winning bid on a $380k house went to someone who paid $68k over asking price. Oh and by the way, the top 3 offers reportedly (from my agent) had no inspection or contingencies. Turns out my offer of $10k over ask wasn’t even in the top 5 offers.

To date, I’ve bid on 5 houses – 4 of which I’ve bid over ask and have lost every time. The last house I bid on was on the market less than 24 hours. The scenario occurred like this – I woke up to an email that a new house was on the MLS and quickly toured the house that morning. By 2:30 pm I had a written offer sent to the sellers agent and was told that there were already 5 offers on the house with 3 more verbal offers in place awaiting paperwork. I bid $20k over ask on a $410k house and wasn’t even in the top 3 in terms of money offered. At 7pm, I heard that the sellers had accepted another offer and de-listed the home from MLS the same day it was put on the market. Insane….I know.

Is There A Bubble Brewing?

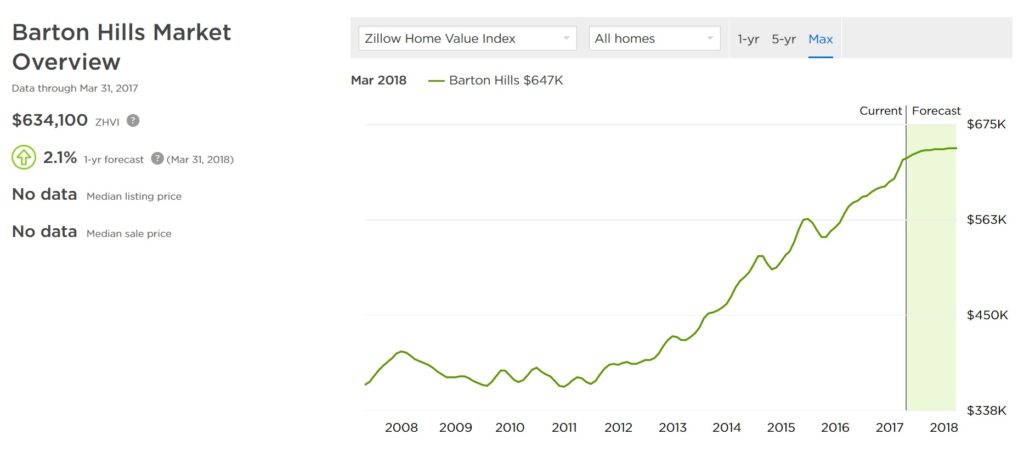

Each location is unique. When houses are on the market for one day and go for >50k over ask, I think it is reasonable to ask if there is a bubble brewing? Take a look at this chart from Zillow about home prices in a more desirable neighborhood in Austin where many doctors live. This price trend is not unique to this neighborhood. It seems to be the same for almost all areas of the Austin area.

From 2013 to now, the average house price in this area went from ~$350,000 to $634,000. For people who have owned these houses, they have a year over year increase of 14%. Real estate growth is a factor of many products including how many new homes have been built or renovated. However, even assuming money has been put into the area, a 14% year over year growth in real estate for sure raises my eyebrows and concerns that what if a bubble is brewing.

Factors Contributing To High Housing Prices

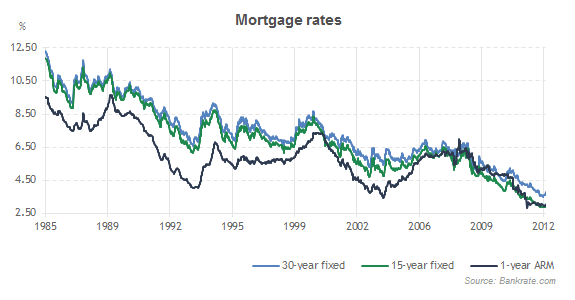

- Mortgages are still relatively cheap compared to historical prices

- Mortgage prices are feared to rise in the future leading to more individuals trying to lock in lower rates while they are available

- Jobs and wages continue to perform strongly nationally

- Housing supply remains historically low

- Consumer confidence remains high

Texas Has Cheap Houses Right?

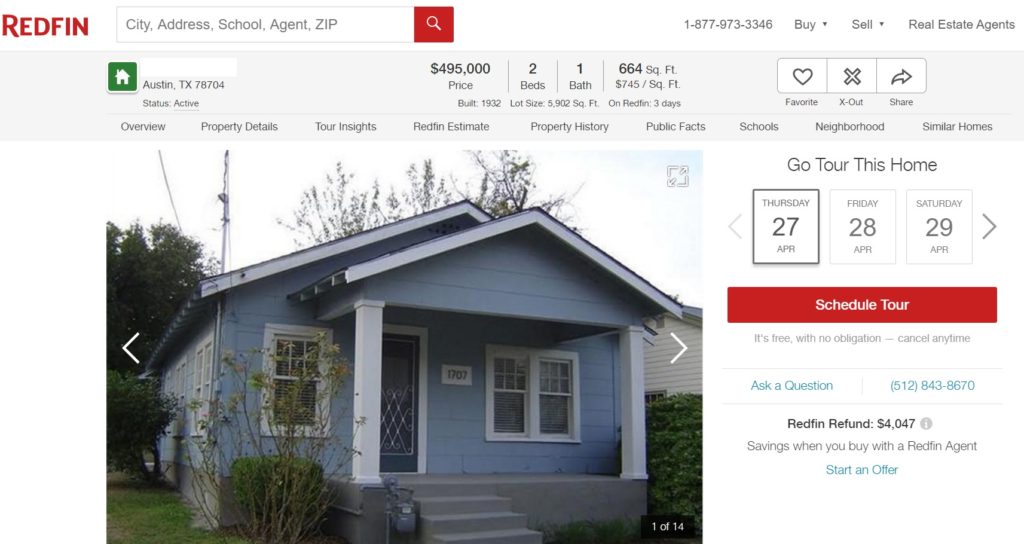

With real estate everything is about location. Take a look at this house that was recently listed in one of the hottest areas of town but still not located downtown where prices are highest.

I’ll admit that this house is at the higher end of what is listed in regards to price per square foot but it’s not uncommon for some parts of Austin to be over $600 sq ft. If you have time, take a look for yourself what houses look like in 78704. You’ll find houses like the one above or houses that are clearly tear downs where lot values are $100-200 dollar per sq foot just for the dirt. The example above is nearing $800 per sq ft and I was told by my agent that it has had numerous showings already. I’ll be watching closely to see how quickly this house sells.

Using A Physicians Mortgage In A Sellers Market

The physician loan process has been quite easy. It’s no different thus far from applying for a regular mortgage. I call a bank, send in my tax information and pay stubs and compare rates and fees.

One of the unforeseen consequences of using a physician mortgage is that in a seller’s market, some sellers will not pick your offer when they see that 100% of the house is planned on being financed.

This is often because houses are going for over asking price in the market I’m located in.

Once the offer is accepted, the bank will then determine if the house is worth near what was offered on the house. If the house assessment by the bank is less than the bid by the buyer, one of two things will happen. The bank will ask the buyer to pay the difference out-of-pocket or the deal will fall through. In each house that I’ve put a bid in on, I was specifically told that my offer was less competitive due to the financing terms since many buyers are putting down >20% down payments, if not all cash.

My fiancee and I have written letters containing our story, a picture of ourselves and our dog, and all the features we love about the house. This strategy may have worked for other people, but I’ve lost houses by a little of $5,000. Seems to me that money talks, a letter can’t hurt, but it sure hasn’t helped yet.

Getting Priced Out As A Doctor

My previous short term rental wanted to increase my rent from $1,650 a month to $2,100 a month upon renewal. To me, that was too much money to pay and too much of an increase. I decided to move to a new short-term rental that would end up being cheaper while we wait another 6 months for the perfect house to come on the market. (This has been part of the reason why posts in the past month or so have slowed down. Moving and working many extra shifts to add to savings has affected how much time I had to work on the blog.)

In an effort to hedge my bets against a potential housing bubble, I have decided to limit my home purchase to the mid $400k range. This works out to be about 1.3 times my gross annual income, pre-extra shifts worked. I figure that this will leave enough room to still save for retirement, wedding, and other expenses. It will also limit my exposure to one asset class in the event that the housing market were to adjust downward.

This market really has me wondering if there is any sanity to the current housing market in my specific location. I wonder how much longer the sellers market in Austin can stay this strong. Time will tell.

Next Post to follow (links will be added with future posts to come in the coming weeks)

Buying A House In A Sellers Market With A Physician Loan, Part 2 (The mortgage process and bank fees compared)

Buying A House In A Sellers Market With A Physician Loan, Part 3 (Benefits and disadvantages to using a physician loan)

I’m have gotten lucky, this insanity has not quite spread to Indiana yet. I’m currently closing on a house now, and was able to still have an offer accepted below asking price on a house only on the market 7 days. I am moving very rural, the owner was transferring and needed a quick sell, and the asking price was way above the market average (below 1.0 of salary for me, though).

I’m hoping as I put my current house on the market I’ll get a little more “urban” bump from this crazy sellers market. It’ll be interesting to watch and see if this is bubble territory.

I also went with a physician loan, now the second time, and both times that aspect has been very smooth. Looking forward to the rest of this series – good luck!!

I’m glad to hear that you will be taking advantage of the sellers market and purchased a house at below 1.0 salary. You’ll have the house paid off in no time!

Tell me about it. My friend just sold his rental home, and he had like 60 offers on it. More than 3/4 came from Chinese buyers who were willing to pay cash on the spot. Crazy times indeed.

Best of luck with your purchase. I know nothing about you and so this advice is something I gave my sis recently, please take it for face value. If you are buying a home as an investment then the decision can fairly easily be made by the math and you will likely have a tough time in this economy unless you are looking at homes in absurd ends of the spectrum.

If you are buying a home as a place to enjoy your privacy, raise a family, have room for the dog, enjoy the ownership experience, then I don’t think $100-200k +/- would make a difference in this economic environment.

Thank you Dr. Mo. I think I’m leaning more towards the second one and I agree that there is some premium price that I’m willing to pay for the “right” house.

Wow, crazy how prices have risen so quickly in austin. Have you considered moving out the burbs? you get a lot more value but have the horrendous commute to deal with. Luckily I live and work in the burbs (buda/kyle). Good luck with your home search!

Thanks a lot, the search is still on for a house! The market does seem to be a bit insane at the moment. Most houses that are priced right are off the market in under 72 hours. I’ll be sure to give an update when I end up buying a house.

Austin has definitely become a hot spot over the past few years, and this is obviously reflected in the housing prices. I think that you are on the right path and I hope that you find something soon. You seem to know what you are doing. Good luck with everything!

Thank you, I appreciate it and will definitely post an update once I settle into a house.

Did parts two and three ever get published? Just sold my first home after 4 years (was in a 5/5 ARM at 2.875% plus PMI) and will be considering a doctor’s mortgage for our next home (9-12 months, renting initially for the new job).