My Cash On Cash Return For My Medical Building

I started my practice in 2018, and since then have bought into a new medical building as a condo owner. Often times you will hear that owning the real estate for your practice can be one of the best investments that you will ever make. Lets take a look today at my cash on cash return and see how good of an investment so far this has given me.

Buying My Medical Office Building Condo Unit

Cost of the Condo shell: $1,050,000

Total buildout of the Condo shell: $450,000

Total Money I Put Down: 25% = $375,000

Why Did I Put Down So Much Money?

I did my bank loan through Truist. They would have allowed me to do a 5% down or maybe even a 0% down loan for owner occupied. However, since I only had one year of tax returns and not two, they had a big problem with this.

While other banks were not even willing to give me a business loan for the building, Truist was. However, they made me put down 20%. Construction of the build out went slightly over budget, so I had to put the extra 5% down out of my pocket.

My Cah On Cash Return

Market rent is $11,500 a month for my space that I am paying myself.

Vacancy is 0% since I’ve occupied the space from day one and will stay here indefinitely

My mortgage and other expenses for the real estate LLC is about $84,000 a year

That gives me about $53,000 in pre-tax cash flow per year

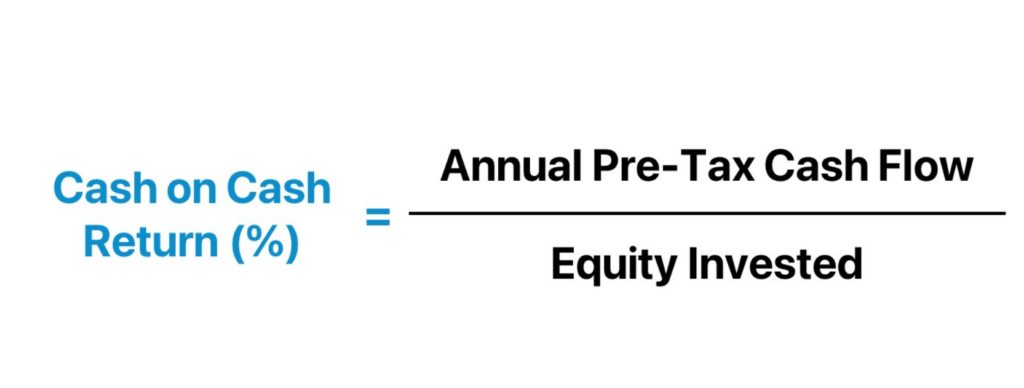

Cash On Cash = $53,000 / $375,000 = about 14%

Pretty Damn Good

Anything above 10% for cash on cash return is pretty damn good return in my book. I really doubt I could have invested that money into the stock market and have performed better.

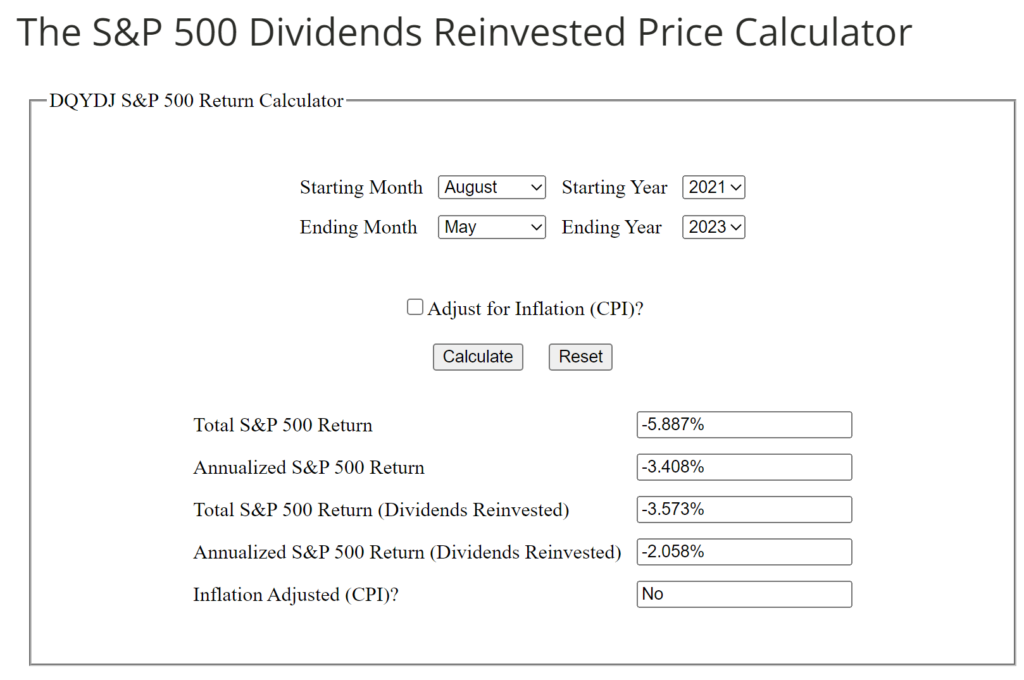

What If I would have invested In the market instead.

I know that it is a short period of time, but from when I purchased the building until now, the S&P 500 has had a negative 5.887% return. Meanwhile, my cash-on-cash return for my building is still at 14%.

What If I would have put down 5%

Gosh, what if we just dream for a second. What if I would have had the two years of tax returns and could have put down 5% for my medical office building.

My cash on cash return would have been 71%!

Fortunately for the other doctors in my building, they all told me they took advantage of the 5% down. I was lucky to even get a loan since my business was so new, so my cash on cash is not near as good, but its still damn good.

The Future

As I have said in previous post, I plan on expanding my practice in the near future. That takes a lot of money and time. Before I put another $375,000 down, I would rather rent locations for short terms (5-7 years) and if things go really well, then decide to buy at that point in time.

How does this work from a tax perspective? Practice entity is writing off the rent 11,500 x 12 = 138k. Owner entity is making a net pre-tax profit of 53k. So as long as you can rent to yourself at a higher rate than your mortgage+expenses, you can make a profit on yourself because if you were leasing only, you’d be losing all the 138k. But as owner, you are salvaging 53k. How high can you set your rent? Who is going to come back and say “hey that’s too high!”