Why I Have Not Sold To Private Equity

This is one of the most frequent emails that I get from my readers. Why have I not sold a portion of my practice to private equity? You might be thinking about having private equity buying a portion of your practice. Or you might be starting scratch with a private equity group. I’ll go through my opinions on the pros and cons behind private equity.

What Is Private Equity In Healthcare

When a business is not listed on a public stock exchange, we often default to calling this type of business a “private” corporation.

Their financials are private between the owners, board members, or shareholders of the company.

If a medical group is not publicly listed on one of the major stock exchanges, then there is a good chance they are a private company.

Investors or groups of investors will offer these private healthcare groups money for a percentage of the company. This is similar to when a doctor buys into a medical practice. A certain number of shares are being sold in private to another person or group.

Private Equity is at its core a person or group of people who want to buy shares of a company for a controlling stake in the company.

In 2021 it was reported that 25% of all hospitals nationwide have some kind of private equity involvement or ownership.

Some Rumors You Will Hear About Private Equity In Healthcare

You’ll hear lots of rumors about private equity in healthcare. Some of the more frequent ones are:

- Reducing staff concerns

- Closing portions of a hospital or healthcare practice operations

- Focusing on growing a specific aspect of healthcare practice

- Renegotiating reimbursement rates with insurance companies (Going out of network)

- Less physician autonomy

- Fully metric based on profit

While some of these may be true, I wanted to highlight a study that looked at what changed after private equity took over a hospital or group.

Let’s Look At The Numbers. Private Equity vs Non-Private Equity

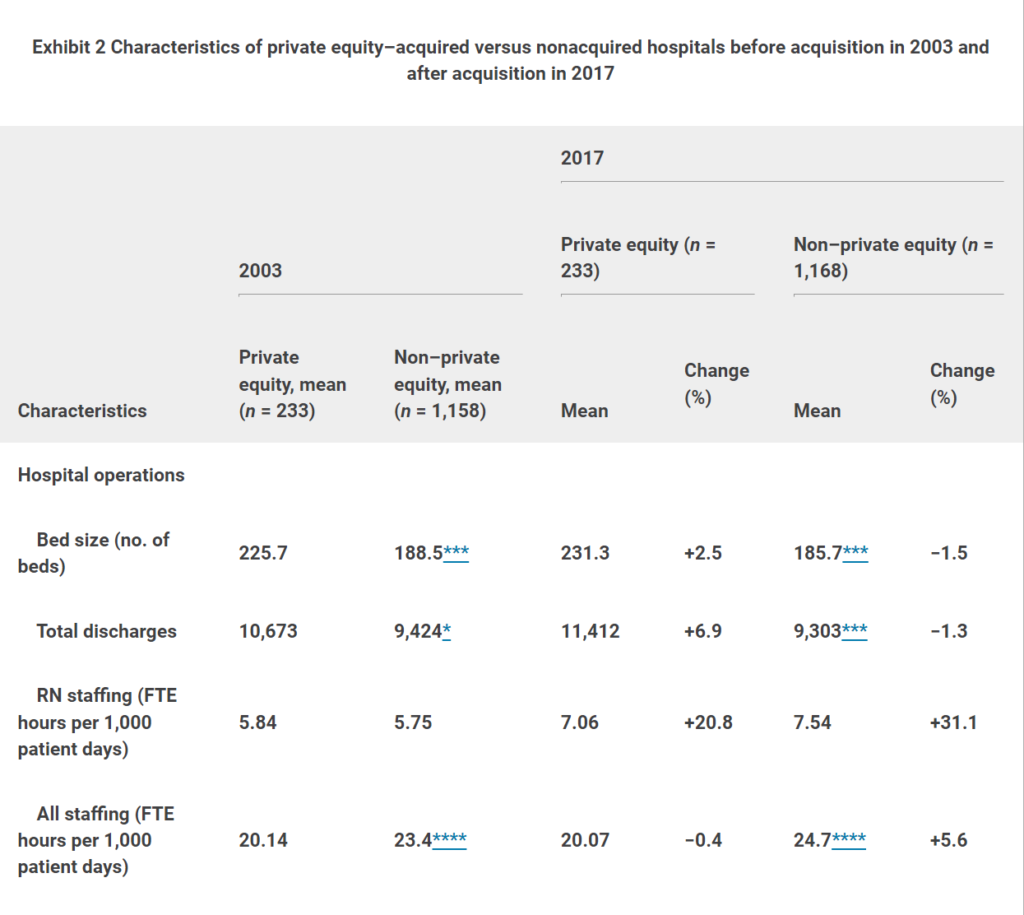

There was a study published by the health affairs organization in 2021 that looked at private equity deals in healthcare up to 2017.

The chart may be a bit hard to read. I also admit that the cited study has limitations. Keep in mind that private equity deals in healthcare are often private. We often have no idea what the profit is for many private companies.

Essentially when private equity got involved in these healthcare facilities, bed count went up and total discharges went up. Overall staffing did go down. However, nursing staffing went up but it did not go up as much as non-private equity owned hospitals in healthcare.

Private Equity Focusing On Profit

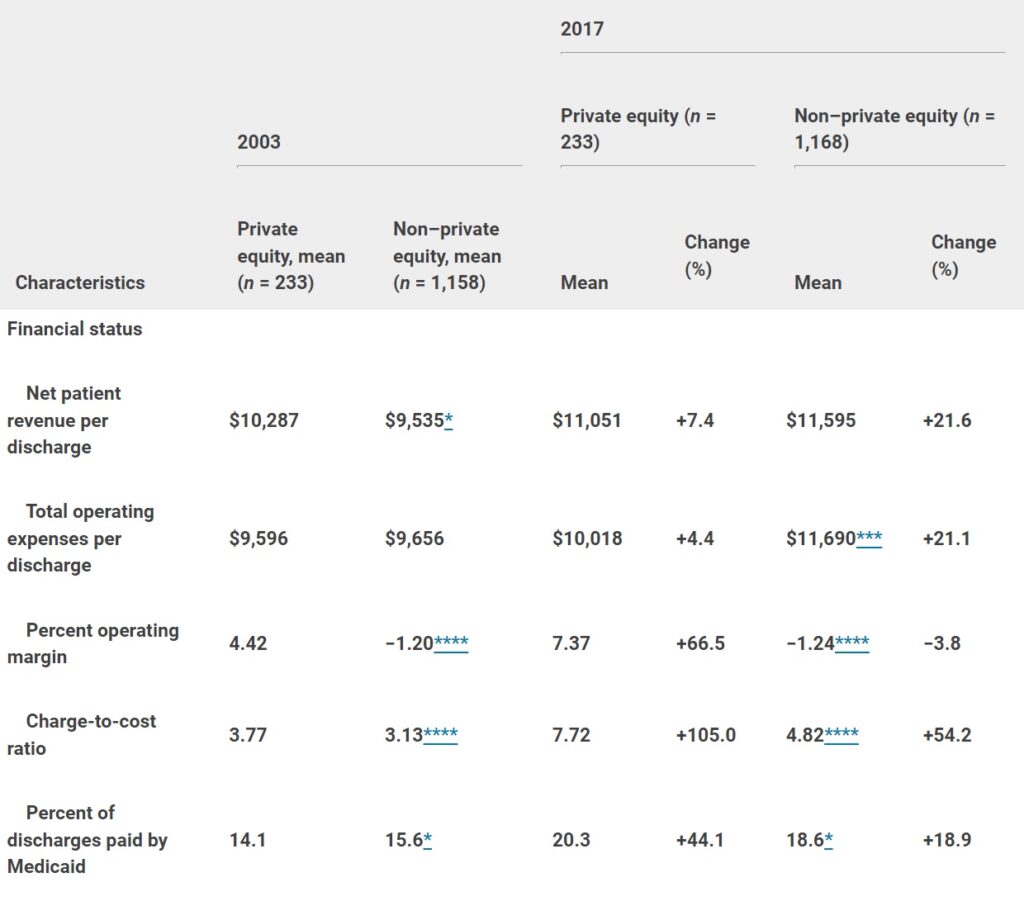

Looking at the same study I cited above, let’s look at profit for private equity hospitals.

While this data is not perfect, you can see that private equity tended to increase charges for services rendered.

The shocking statistic to me is the percentage of discharges paid by Medicaid. A 44% increase here is massive. The operating margin percentage also increased substantially. Probably because private equity in healthcare bought hospitals that they did demographic research beforehand cherry picking where they want to put their money.

The Reality Of Being Small And Getting Private Equity Involved

When you are a small practice, less than 20 doctors, you are going to find this situation probably not a good deal for you.

Private equity for small groups will want growth. A friend of mine recently sold out her practice. In her contract, she was required to stay on 5 more years and open 5 more clinic locations in that timeline. If she did not, then she did not get a substantial portion of her bonus.

If you are small and sell out to private equity, there will be clauses in there about you staying involved in the company for a period of time. There will also be metrics about expected growth. They want you to grow. Growth companies are valued completely differently compared to stable companies. Private equity wants you to grow so that in 5 years they can sell your practice to someone else at a higher valuation than they bought it.

Joining Large Private Equity Deals Can Have Benefits

The largest anesthesia private equity group has been making some news articles lately for how big they have gotten. North American Partners in Anesthesia is a group of about 6,000 practitioners at 500 hospitals.

While I do not work for this large group, I will say that one of my friends works for this group and tells me that “so far” things have been great.

Profits have increased for the group. My friend reports a decent work life balance, and he does not seem to notice any substantial changes in his day-to-day practice. Of course, I’m relying on one anecdotal report which might be an outlier in a practice as big as 6,000 people.

My Problems With Private Equity In Healthcare

I wanted to highlight that these reasons are my opinion, and my reasons for not liking private equity involvement in my business may not be applicable for you and your business.

Divesting Plan With Private Equity

When selling a portion to private equity, you give up control. Everyone who makes an investment plan to eventually divest that investment and sell for hopefully a higher return than when they bought it. Private equity will want a return on their investment.

Private equity in healthcare does not line up with my timeline for divestment.

What I mean by this is that I plan to work in medicine for another 10 plus years. Private equity often wants its money back in a 5 or 10-year timeline.

While I don’t fault them for that, I don’t want to focus on growing a practice and making an investor happy.

Control

Let’s call it like it is. I went into business myself because I wanted control. I liked the idea of being able to control my schedule, control my destiny, control how I practice medicine. Control over my life, my practice, and my destiny is a big reason I opened my own practice. Otherwise, I would have just stayed employed.

I simply do not want to give up control to a group of investors who are going to tell me how to run my business.

Divorcing From Private Equite Groups

I posted previously about checking fraud with one of our business accounts. If you join a large private equity group in healthcare and decide this is not working for you, good luck getting out of this contract.

The private equity group will often have clauses about ownership of patient records. Getting all your patient records out and setting up new contracts with health insurance companies will be a headache.

Good luck with an easy transition if the partnership does not go well and you choose to go back to private practice. In the private equity deals that were offered to me, there were so many clauses in the possible contract regarding termination that I didn’t want that barrier for my practice or future.

Privia

I will plan an entire post on this group in the future, but I will highlight this group since they solicited me to join their private equity group.

Privia makes you use their medical record of choice, Athena. They also make you use their tax ID (of course) to get better insurance contracts. Understandable since you practice under their contracts.

If you decide that Privia is not a good fit for you, good luck getting all your patient information out of Athena / Privia.

It is exceedingly difficult switching medical records. Since you will not have absolutely admin access to Athena, I suspect you will have issues getting your patient data out of Athena easily.

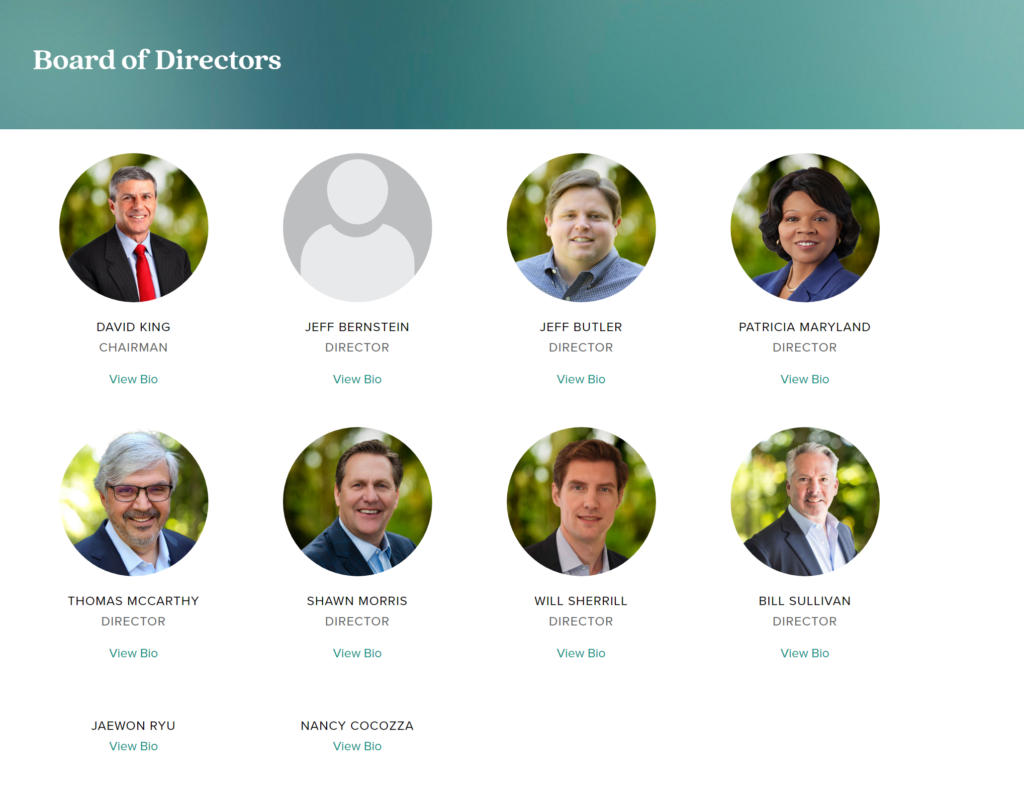

They also claimed multiple times to be doctor centric and run. However, looking at their board of directors, not a single MD or DO in sight.

For me, it felt too corporate. Too many buzzwords about me ‘owning” my own location but using all their contracts for all the benefits of higher contracted rates with insurance Companies.

My Contract Rates Improved

My initial contracted rates with commercial insurance plans were terrible. However, as I grew larger, I was finally able to argue for better pay. One of big selling points for Privia is they claim to have 20-25% better fee schedules with insurance companies. While that is great, once I got large enough to argue for my own bump in pay, the difference is now probably only 5-7%.

Privia and their 15% overhead costs were too big of a price to pay now that I am larger and can argue for better pay from insurance companies.

Final Thoughts

Private equity is not always a bad deal. Define what your goals are before you take on private equity. If it is to grow it large and be done with the business in 5 years, then this might be a good option for you. However, go into this knowing that there are many strings attached when taking private equity money. Just like any investor, they want to ensure to the best of their capability that they see a return on their investment.

Excellent post! I work with Dr’s with their medical billing and have gone down this road many times with clients, and it always comes back to; “I don’t want to work for someone else”. They would make the trade-off of making less money for the ability to be in control and to be an entrepreneur. Then there are the ones who tried divesting, only to loathe the fact of having to work for someone. So they come back and open up their practice again. Some folks are just not cut out to be an employee, and I commend them for that!

Pingback: Journal Club 01-27-23 - Passive Income MD - Always Be Updated