Best Practices: Your Medical Business Checking Account

I recently found out someone tried to fraudulently cash a check from my business account. I got a call from Wells Fargo, my bank, alerting me that someone in a city 4 hours away was attempting to cash a $8,955 check with my business account number on it. The check was written out to an individual, not a business. Wells Fargo immediately tagged it as fraud.

This really blew up into a set of issues for my checking account. I could not find a good post online about best practices for checking accounts for medical businesses. So, today I decided to create one. That way maybe you can avoid any issues like I have after dealing with check fraud.

Fraud Alert Call

I received a call out of the blue from a lady who claimed to be from Wells Fargo alerting me that someone in Houston was attempting to cash a very large check made out to themselves. The total amount on the check was $8,955.00.

She asked if I knew the person or if it was a legit check. I said no, in fact I had my check book in front of me and confirmed it was not a legitimate check.

She didn’t ask for any of my personal info other than my name and told me she would take care of the rest.

They immediately paused payment on the check, reversed the charge in my checking account and put a pause on payments on all future checks.

I found out that Wells Fargo has a whole department that is set up just for medical practices. This group within Wells Fargo is based out of Arizona. I spent less than 30 minutes on the initial phone call and the money was back in my account.

Options After Fraud Occurs On Your Business Checking Account

The bank gave me three options.

- Close the account immediately and move my account to a new account. They would forward all ACH payments for 90 days to the new account. However, they can not forward ACH payments beyond 90 days.

- Pause all outgoing check payments on the account but leave it open otherwise. A requirement is to enroll in Positive Pay. More about this below.

- Reopen the account completely with no restrictions. However, if another check fraud occurs again then I am 100% liable.

Positive Pay

Positive pay goes by many different names. It is a way for your bank to ensure that a payment is legitimate. It requires the following:

- Name on check has to match exactly to the person or business receiving the payment

- Check number has to match

- Date of the check has to match

- Amount on the check has to match

If those 4 things do not match up, then no checks are cashed.

With Wells Fargo this cost is about $75 per month and may be waived if you have enough money stored in your account at any given time.

Most large businesses use Positive Pay. Something that I had no idea even existed prior to this fraud occurring on my account.

Small Business Administration Advice

There are rules on SBA about financial management for small businesses. While I find some of this information helpful, it can be a bit overwhelming and not very specific to physicians or medical practices.

I would view the SBA as a good starting point for any of your starting business questions.

Best Practices Structures For Your Business Checking Accounts

There are at minimum two accounts that you should have set up at any time for your medical practice.

- A checking account for receivables only. This is where all your payments will come into and besides transfers to other accounts owned by the business.

- A business checking account for payroll or other payments to be made by the business. IF this account gets compromised then it is much easier to simply open a new account for payments.

Problems Since I Only Had The One Account

Since I only had one business account, now that the checking account numbers have been compromised, I have to open multiple new accounts.

We also have to spend the upcoming months updating insurance companies about our new bank account for ACH payments.

This really created a huge headache that could have been avoided if we would have had 2 business accounts opened from the start. Not necessary an expensive lesson since I am not out any money, the bank is technically. However, a time intensive lesion now that we have to spend many hours updating all this information.

Avoiding Fraud And How This Happened

My suspicion is that my bank account information was stolen by the cleaning crew.

My checkbook at work is locked up. However, my checkbook at home is hidden in a drawer.

We hired cleaners before my kids birthday and about 3 weeks later is when the fraud occurred. I went into that drawer and found cash missing also, which leads me to believe it was the cleaners since no one except my parents and my wife’s parents has been to our house during the pandemic.

In order to prevent any fraudulent activity you should:

- Lock everything up in a safe, both at home and at work. All Rx pads, anything with a bank statement on it needs to be locked up in a safe at the end of the day before going home.

- Make sure you have fraud protection on your accounts. Some business accounts do not offer free Fraud protection. Make sure that your account has this feature active.

- Don’t share any information over the phone. Wells Fargo Fraud team called me and only asked for my name. Not my date of birth, not my, account number….nothing. They simply asked me: “Is this [InvestingDoc] I’m talking to? Did you write a check for this amount to this person on this date?” They did not ask for anything beyond that.

- Frequent review of account activity online. I normally reconcile my QuickBooks accounting every 2-5 days. I know some people who do this monthly. Check your accounts at least once a week.

- Limit who has access to your bank information. Only the absolutely necessary need access.

- Consider signing up for fraud monitoring services, there are many major brands online. LifeLock seems to be the best known.

Typical Business Checking Account Structures

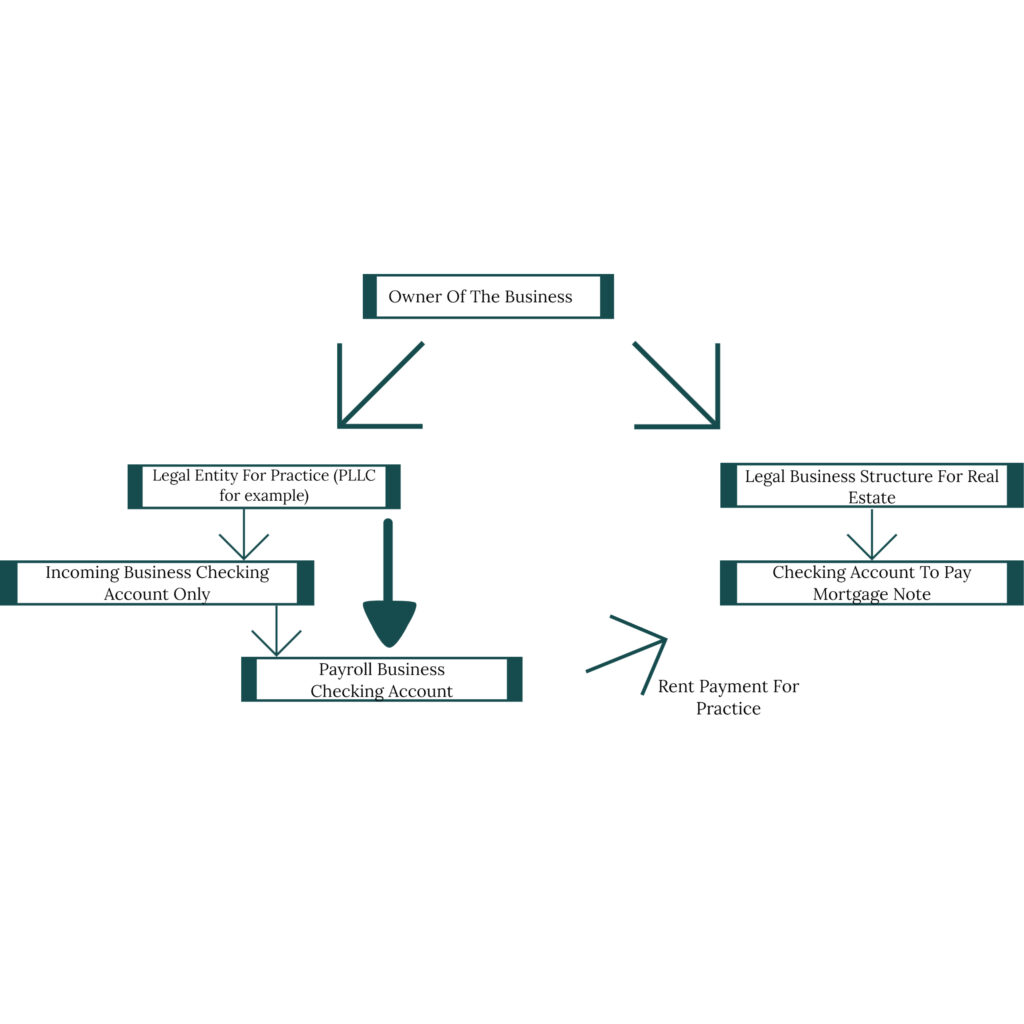

Here in the example above, the owner of the business (you), own the legal entity that has the medical practice. You have two checking accounts, one for incoming payments, one for outgoing payments. If you own the real estate where you practice, you then have a separate business that owns that real estate. That business has its own checking account. You pay yourself rent from one business checking account to the other. Two different, businesses, but this is the normal set up for most medium to large size practices.

Time Suck

Including the time spent on the initial phone call with the fraud team and the 4 hours it took me to open a new business checking account, I’ve spent a total of about 10-15 hours in two weeks on dealing with this fraudulent check. Not to mention the hours it will take to move our insurance payments to the new account.

Following the best practices as above would have saved me a ton of time and headaches.

I am sorry to hear that you had to deal with fraud–that’s never fun. But thanks for bringing this up, maintaining separate business checking is accounts is not something that would ever have crossed my mind. It’s about 15 years too late for me (at this point, I doubt I will want to start a private practice on my own), but this is actionable advice to someone thinking about starting their own practice.

It is never too late to start up your own practice if it is something you want to do 🙂

Once I figured out how I should have structured things, it was a oh boy moment. This would have saved me a ton of time since I could have just simply opened a new checking account if needed and not worry about my deposit account being compromised. Lesson learned and hopefully it helps someone else out if they are thinking of starting a business.

As a medical entrepreneur, you have a lot to think about when it comes to your business. One important element is your business checking account. You want to make sure you are using the best practices for your account so that you can avoid fees and maximize your earnings.