Everything You Need To Know About Buying Into A Medical Practice

Rather than starting your own practice, it is much more common to take a job where there is a potential buy into the practice. Today’s post is going to go through everything you need to know when you are thinking about buying into a medical practice.

Be warned. Today’s post is going to be a long one but a fun one! The post is really geared for those who are in smaller to medium sized groups who are thinking of buying more than 10% stake in a medical group.

Let’s learn about valuing a medical practice.

Typical Language When Buying Into A Medical Practice

Most contracts for employment are going to be quite vague when talking about buy into the practice. This gives the employer plenty of wiggle room. After all, what if the new hire does not work out and is not a good culture fit.

My shortness contract for employment that I was offered was 2 pages long. The longest was around 25 pages long.

Somewhere in your contract should be a statement about if partnership is available. There also should be an explanation of when you are eligible for that discussion. A usual language for this section may be the following:

“Upon completion of 2 years of full time employment with the medical group, the physician employee will become eligible to potentially buy shares in the medical practice if gross receivables is at least 2.5 times salary paid over this time period.”

It can even be vaguer than this. My most vague contract simply stated:

“Upon completion of the third year of full time employment, employed physicians may begin discussions about buying shares in the medical group.”

You can see that this is a very open ended statement. Just make sure that somewhere written in the contract is language that you are eligible for buy in and you know how it might leave you open to financial difficulty.

Stability Of Your Industry

There is a ton of change in the medical profession that is ongoing.

When taking a job, you absolutely should look at the stability of your industry and your location before buying to a medical practice.

For example, if you are a dermatologist and every dermatology group in town was bought by a private equity firm and the owner of the group is 60 years old…you can not help but wonder that just maybe the owner is going to look to cash out for retirement soon and sell to private equity.

Contracts are important. If you are a critical care group, what is the current working relationship with the hospital. How long are those contracts for? It is very common for large groups such as Team Health or Sound Physicians to take over contracts from smaller privately held groups.

The only concern I would have is if the contract was coming up for renewal around the time for potential buy in for partnership. It would not be ideal to buy into this critical care group only to find out 2 months after you bought in that your group was losing the contract with the hospital.

If you are reliant on something else for your groups revenue you need to know that relationship and what the contract is like. This is very true for ER groups, critical care groups, hospitalist groups…basically any group that does not have control over the setting of where you are seeing patients. These groups are also not worth a ton of money since sadly they are easy to replace in desired cities.

What Type Of Medical Practice Are You Buying Into

Let’s split the types of medical practices into 3 stages.

- Growth

- Mature

- Distressed

Growth Medical Practices

Growth practices are more in the expanding phase rather than a mature phase in terms of finances. For example, let’s say there is an allergy clinic with 5 locations. They now opened 2 new locations in the past 3 years, that would be a practice in the growth phase. Expect valuation of this company to be different than the other two phases of companies.

The same can be said for a smaller surgical group that bought a new piece of expensive hardware that they expect to bring in extra revenue.

These large financial purchases may affect the net cash flow and earnings significantly on paper.

Mature Medical Practices

These medical practices are going to be often larger, possibly multispecialty, and much easier to value the practice. While the practice may be growing, spending $100,000 on a new machine to bring in new revenue does not affect the financials nearly as much when the group may have 50 doctors who are all bringing in half a million dollars a year in receivables.

The financial numbers are pretty well known, and you can easily estimate what next years income is most likely going to be assuming no major changes.

These types of practices often have a very standard fee that they give to everyone with a pre drawn up contract. It is going to be hard to buy in at a different valuation unless you bring something very unique to the table.

Distressed Medical Practices

These practices are those that are either not growing, shrinking, or closing. Distressed medical practices are often only worth what the hard assets are worth. For example, if a medical spa is closing its doors, the business is only worth what the resale value is on the medical equipment.

These businesses can be wonderful opportunities for already established businesses to buy additional equipment cheap. Other than that, I would stay away from these types of practices. Patient lists are worth almost nothing. I personally would not spend more than maybe a thousand dollars for the mailing list of all the previous patients.

Lets Talk Money

Accounts Receivable

This is one of the first things you will be exposed to when evaluating buying into a medical practice. Account receivable is usually only available to those who are immediately available for buy in. This is not going to be provided to you prior to this. No company is going to open their books to someone who both members is not seriously considering partnership. You will not have access to this prior to signing an employment contract.

First thing to know is what Medicare multiple is the group using?

This is the “made up” high number that people love to show off online about ridiculous costs of health care. Of course, an EKG does not cost $60. If Medicare pays $20 and the company is using a 3x Medicare multiplier, then it will show up on the A/R as an outstanding $60 for this EKG until it goes through the insurance company.

The reason for the high value is because every insurance contract is totally different. My contracts for radiology services (x rays) in the office pays as low as 30% Medicare, and as high as 150% Medicare depending on the insurance plan.

I set my asking price high enough so that even for my best payers, that I never undersell myself. United may pay me $30 for a chest x ray while another insurance company may pay me $150 for the same x ray.

**Just throwing out a made up example**

Why Do We Care About Medicare Multiple

In accounts receivables you will see outstanding balances broken up into 30 day increments. Once you hit 120 days then its just 120+ days outstanding.

The first 30 to 90 days may look like there is a ton of money outstanding. If your company is using a 3x multiplier, that 90,000 on the books in the billing platform may actually be only 30,000 that is realistically going to actually be income.

This is why some hospitals will say they wrote off $1,000,000 as “good will” to the community. They might be using a 5x Medicare multiplier. This really puts the value at $200,000, and writing off this debt that they realized they were never going to get paid on anyway.

Know How Much Bad Debt Is Outstanding

You want most of your accounts receivables to be current when buying into a medical practice. This means that you are still back and forth with insurance companies and/or just waiting for patients to pay. I consider current anything less than 90 days. Anything beyond 90 days gets much less likely to recover. Anything more than 120 days and you are likely to never see a dollar from those patients.

You want the majority of the debt to be current. Ideally >90%.

Buying Into Accounts Receivables

This is much less common unless you are buying a medical practice outright from a retiring doctor. Most buy in agreements for ongoing practices do not have you buy into account receivables.

How to Value The Company

This is going to vary widely based on specialty and as you will see below, it is hard to come to an agreement even among professionals when buying into a medical practice.

Keep in mind that the larger the group, the less valid this article may be for you. A large multispecialty group that has 200 doctors may simply say, this is the cost of buying in the medical practice, this is the estimated pay out, and it is what it is.

Lets though take a look at a few ways we can figure out when buying to the medical practice.

Sales price based on gross revenue

My least favorite way to value a company.

Revenue alone means almost nothing. Yet, most publications that discuss how to sell a medical practice often mention this first.

Why revenue means almost nothing by itself is because you need year over year growth rates and you need a breakdown of expenses plus free cash flow.

If the business brings in 1 million dollars in gross revenue, then having 500,000 in expenses is a big difference than a company that has 950,000 in expenses.

Personally, I would not even consider buying into a medical company solely on gross revenue. You very well may be getting a raw deal because they most likely do not want you to focus on the other numbers and want you to be in awe of the bigger gross revenue number.

Run like the wind from someone who wants to sell you something based on gross revenue and not focus on the other aspects above.

Sales price based on earnings

Often the go to for valuing a more mature company when buying into a medical group. When you look at a public company you will see something called a P/E ratio. This is the price per net income after tax.

Lets say that a medical practice has 1000 shares of their company.

The medical practice brings in $1,000,000 in gross revenue. This practice also has $800,000 in expenses. The net income is $200,000 at the end of the year.

The earnings per share would then be $200,000 / 1000 shares = $200.

Of course you can work this in reverse. If there are 5,000 outstanding shares and you are being offered to buy in at $200…

$200 x 5,000 = value of $1 million.

What Is A P/E Ratio

The price of the business =P

The net earnings of the business = E

It is simply the price of the business divided by its earnings. That is it.

So, if we sell the above company for $600,000 then the ratio is 600,000 / 200,000 = 3

The higher the ratio, the higher investor sentiment is for growth of the business. The lower the ratio, the less excitement there is about growth in the business or ability to recoup the investment in the future.

Another way to think of this is that assuming no change in income, it will take 3 years after your investment of $600,000 to recoup the initial investment dollar amount. **more later about why this is not a correct assumption**

Use this ratio to determine if your buy in seems reasonable. This P/E ratio is going to vary widely based on the phase the company in is as below.

For example, if you are being asked to buy in at a ratio of 40, that means it is going to take much much longer to recoup your investment if massive growth does not occur.

I personally would not buy into a small private practice company with a P/E ratio higher than 5. Otherwise, I could just grind it and start up my own business without the buy in.

When Price To Earnings Does Not Work

Businesses that are in a growth phase, it is not reasonable or practical to use price per earnings. After all, earnings may be negative in the initial start up period. Custom medicine boxes

Lets look at One Medical, a group of primary care clinics that recently went public on the stock market this year. They are losing money each quarter because they are opening clinics at an astounding rate. They lose tens of millions of dollars every month. However, the stock market is valuing their company around $4 billion. Valuing the company solely on price per earnings is not reasonable or possible while in the high growth phase.

Price per earnings will most likely not be a good way to value these types of companies. Instead using one of the following:

- Cost To Make A Competing Business

- Discounted Cash Flow

- Valuation By Stage

- Comparing to Competitors

Growth Eating Into Earnings

This past year my business made some substantial investments. I put over $400,000 into the business that is listed on my taxes as expenses rather than profit.

So, if I tried to sell my company based on last years numbers, my price per earnings would look absolutely terrible.

Instead there is a metric called Internal Rate Of Return

Internal Rate Of Return

Where:

- C = Cash Flow at time t

- IRR = discount rate/internal rate of return expressed as a decimal

- t = time period

Lets take an example of a free standing ER that buys a CT scan.

The CT scan may cost about $150,000 for everything to be installed and turn key.

Initial investment = $150,000

Lets say that the CT scan will bring in $50,000 worth of facility fees a year to the free standing ER. It will then take 5 years to pay off the machine.

This gives an IRR of 19.86%! The higher the number the better. Some would argue that anything that is higher than simply investing in the stock market is a good number. Personally I look for IRR of around 20% at minimum since I am taking much more risk with this investment compared to buying a mutual fund.

This IRR needs to potentially be taken into the equation when valuing a company that has made large purchases and waiting for that payoff to occur.

*Note that this method has two flaws. One large flaw is that projected revenue from the one time purchase can be way off from expected, leading to a dramatically different IRR. The second is that business can depreciate these assets on their taxes which is not taken into account with this equation.

Discounted Cash Flow

This method helps determine the value of the investment based on future cash flow. Often times this may be the best method to consider when buying into a company.

Lets take a job offer that I had 4 years ago.

Starting pay was $150,000 guaranteed money. This could go on indefinitely if I wanted to, or after 3 years I could buy shares of the company and become a business partner.

The business partners had a salary of $200,000 a year with potential of $75,000 a year in dividends. To make the math easy lets just say we are going to make the $275,000 every year as a partner after buy in.

Discounted Cash Flow is finding the present value of expected future cash flow at a discounted rate.

The difference in the $150,000 salary as an employee and the potential $275,000 as a partner is $125,000.

Tomorrows Dollars Are Worth Less

If we are brining in $125,000 extra per year why do we not simply multiply $125,000 by 5 years (a multiple of price per earnings of when it would then make sense to pay it back like I gave an example of above.)

$125,000 x 5 = $625,000

Answer: Inflation exists and there is a cost of capital allocation. Tomorrows dollars are worth less than today.

$125,000 income 5 years from now is not going to have the same buying power as $125,000 today.

We have to discount this cash depreciation in our calculation based on inflation and where we might also get better returns (like a S&P 500 fund).

Example:

Lets assume that there is no growth in the business example above brining in an extra $125,000 per year for partners once we buy in and that things stagnate.

There is a cost of allocating this capital in the business, this capital could have been invested somewhere else like a S&P 500 fund. Lets assume that S&P 500 fund may make 10% returns on the average over the same 5 years looking forward.

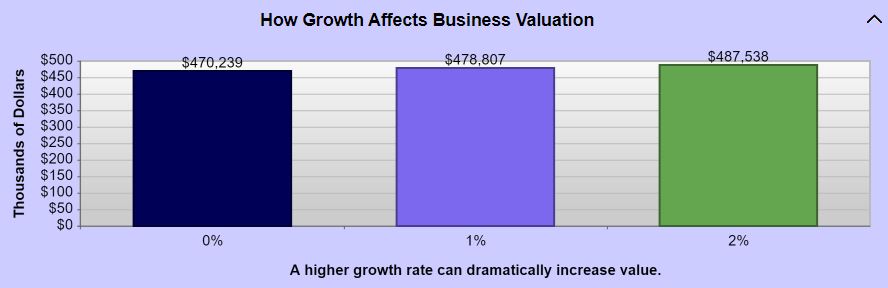

Using a discounted cash flow calculator for our example, in 5 years the net present value of the company is $470,239 for this deal.

This means that if you pay less than $470,239 today for the buy in, that you are getting a good deal. If you pay higher than that, you are getting a bad deal.

The discounted rate you pay in TODAYS dollars since they are worth more than tomorrows pay checks comes out to $625,000 – $470,239 = $154,761 lower than simply multiplying net pay times years you want to calculate.

I like this calculator to figure out Discounted Cash Flow.

Taking Growth Into Account When Buying Into A medical Practice

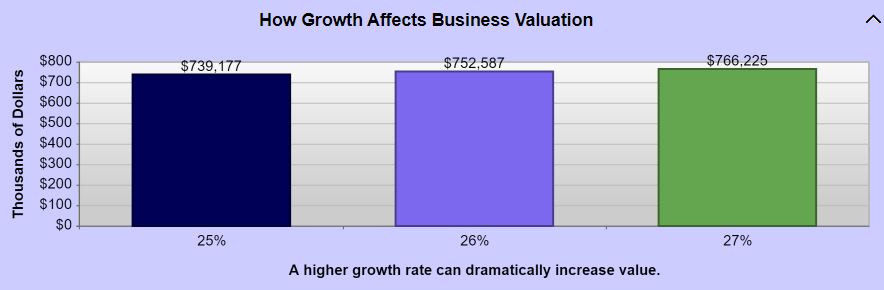

Keep in mind that when using discounted cash flow, my above example assumed no growth.

When factoring in growth in my practice, which since it is so new has been hovering at lets say 50% per year. Even if I halved that to lets say 25% growth year over year, take a look at how dramatic the value changes when we start accounting for growth. This is also why hyper growth companies are hard to value (looking at you Tesla). How long will that ridiculous growth continue?

Be Conservative Financially

Medicine is a small world. In light of many changes in the field, such as ability of VC money to own practices, health insurance plans starting up their own practices, and independent practice for non physician providers, I would have a hard time not discounting the investment if I was buying into a group. This is why I use a timeline of 5 years rather than 10 years.

You need to figure out if your company has any moat, and if not, I would discount that heavily. What I mean by a moat is protection from simply being made irreverent next year.

For example, if I was an ER group and our buy in was coming up but so was our contract renewal soon after with the hospital…I would be very wary of that buy in. You very well could buy in and have the hospital go with a “cheaper” group.

This happened to an Anesthesia group in Texas about 3 years ago. A lower bidder came in and got the contract with the hospital for anesthesia services. The doctors were apparently asked to sign on to the new group at a lower pay rate and if not they were replaced with CNA’s or new doctors entirely.

That group had a valuation with many partners who owned shares in the company. The valuation of their group almost overnight took a massive financial blow once they lost the hospital contract.

It happens all the time, and it can happen to your group.

How I got Screwed…Or A Blessing In Disguise

When I took my first job the offer was verbally a buy in for $30,000 with the partners saying that some years the partners received no dividends. Other years they got $100,000 in dividends. I had vague language in my contract similar to above. That after 2 years I was eligible to buy in at the current valuation at the time of the buy in. That last line screwed me.

My group hired a lot of new graduates at the same time I was hired and when it came time for me to join the group, all of a sudden my group decided to more than triple the buy in since we added a lot of value / profits for the company.

I shot myself in the foot by working so hard that I created a ton of profits for the company which then gave it a very high valuation. Now I was faced with an almost 6 figure buy in since I had no clause of a discounted buy in after adding value to the practice.

I decided to walk away from that job. Things work out in the end though. Soon after I left, the group I was with lost its contract with the hospital and the value of the company tumbled to reportedly much less than my $30,000 buy in as listed above.

It Gets Way More Complex

This post is already nearing 4,000 words and is long enough. Just know that valuing a medical practice gets much more complex. There can be a “goodwill” component or brand worth. There may also be other factors like buying into a laboratory that runs labs for the practice. Other factors are how many shares are you being offered of the medical practice and what does that mean in terms of dividend payments. That will be another post for another day as I just scratched the surface of buying into a medical practice.

I hope you enjoyed todays post!

Hey this is great thanks so much.

Thanks for this. Especially the moat analogy. In this spot right now and it helps to have this perspective of looking at it.

Thank you for all your articles. There isn’t much info out there on starting (and growing) a private practice so it’s all been very helpful in my considerations to buy in to my existing practice or start my own.