REPAYE vs PAYE for Medical Students and Doctors

One of the most common questions that medical students, residents, or fellows will ask is should I use REPAYE or PAYE? These two programs seem to be the most popular plans available with IBR being a close third. Determining what plan is right for you could save you thousands of dollars if unable to use the standard repayment plan or refinance for lower interest rate. Those individuals with an interest in using one of the government repayment plans, this post go through the benefits of REPAYE vs PAYE.

The Highlights of REPAYE vs PAYE vs IBR

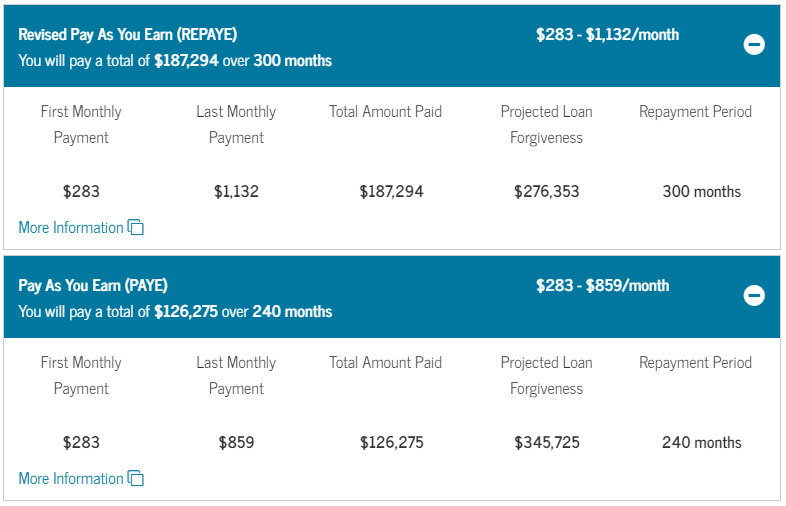

REPAYE

- Monthly payments will be 10% of discretionary income

- If married, your spouse’s income or loan debt will be considered regardless how you file

- Outstanding balance is forgiven after 20 (undergrad loans) -25 years (For graduate school / med school loans)

- Monthly payment CAN be more than 10 year standard repayment plan

- Half of interest that accrues is subsidized under this plan

PAYE

- Monthly payments will be 10% of discretionary income (Same as REPAYE)

- If married, your spouse’s debt or income will ONLY be considered if you file jointly

- Debt forgiveness occurs after 20 years

- Payment plan will NEVER be more than 10 year standard plan

Payment plans assume $200,000 in loans at 6.8% interest using student loan forgiveness

IBR

- Monthly payments will be 10-15% of discretionary income

- If married and filing jointly, your spouse’s debt or income will ONLY be considered (Same as PAYE)

- Payment plan will NEVER be more than 10 year standard plan (Same as PAYE)

- Debt forgiveness occurs after 20-25 years

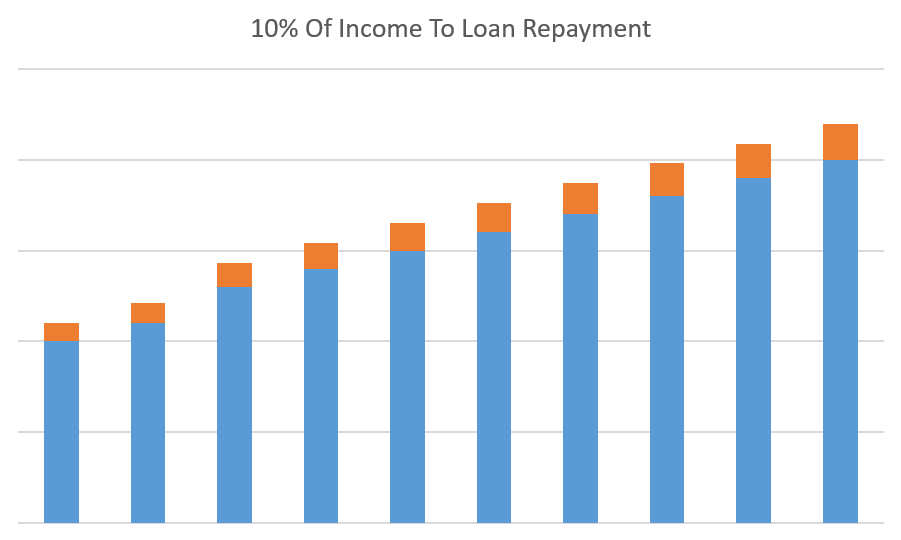

REPAYE Interest Subsidy

Under this plan, the largest benefit is half of any interest accrued is subsidized. Let’s take a look at an average residents salary and debt loan while in residency

- Debt = $200,000

- Interest Rate 6.8%

- Average income $52,000 / year

- Average loan payment per month with REPAYE $283

- Gross amount of interest accumulating = $13,600

- Interest paid per year by resident = $ 3,396

- Amount of interest forgiven each year via REPAYE $5,102

- Effective interest rate 4.2%

The interest subsidy is something that many residents choose to take advantage of. On one hand, the numbers above look very appealing. However for there to be an interest subsidy, there needs to be more interest building each month than what the debtor (med student, resident, or doctor) is paying.

Your loan is potentially growing in amount every month. This plan only slows the rate of growth due to the interest subsidy. One of the drawbacks of this plan includes households with high incomes. For example, you’re spouse makes a sizable income. Then in this case, you can potentially pay more per month than a 10 year repayment plan using REPAYE.

When To Avoid REPAYE

If married and combined income is high, then payment on REPAYE can potentially be higher than the standard 10 year plan.

Calculate for yourself how much your payment will be on various income repayment plans here.

The Best Choice

This will vary with what is most important to you. The best choice for lowest interest paid over the life of the loan will be the standard 10 year repayment plan.

The best plan to maximize net income while in residency after loans will most likely be REPAYE. After residency or upon marriage to someone who earns a substantial salary, you are always free to switch plans.

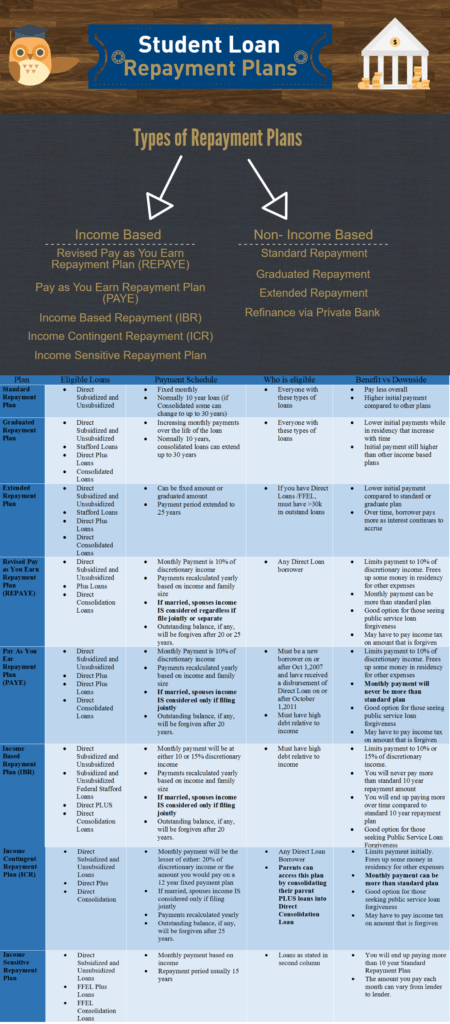

The government plans can be a bit overwhelming since there are now 7 of them. Do your homework. It may save you a lot of money for your particular situation.

For those interested in more government repayment plans click the follow picture.

Great post InvestingDoc. I do want to mention my bias for REPAYE at least for those residents who make a typical resident salary and have a typical medical graduate debt level. The interest subsidy along makes it worthwhile.

Thanks FP! I agree with you, REPAYE is a favorite for many and for good reasons.

Pingback: The 2019 Student Loan Resource Page - Physician on FIRE