The Student Loan Repayment Guide

There are many different types of student loan repayment plans available to borrowers while in residency and fellowship. This post will explore all the different options, the terms of the repayment plans that are now available and which one may be best suited for you.

Being accepted into medical school is the start of an often times long and fruitful career in many aspects. As discussed in a previous post, 81% of people graduating from medical school have some level of debt. The other 19% are divided into those who either self-funded, family funded, or received the National Health Service Corps (NHSC) Scholarship.

The basics:

There are many different types of loans that one could have received throughout their education and below is a list of many of the names that you may hear mentioned from either your colleagues or perhaps from current loans that you have.

- Direct Subsidized Loan

- Direct Unsubsidized Loan

- Subsidized Federal Family Education Loan(FFEL) Stafford Loan

- Unsubsidized FFEL Stafford Loan

- Direct Subsidized Consolidation Loan

- Direct Unsubsidized Consolidation Loan

- FFEL Consolidation Loan

- Direct PLUS Loan for Graduate/Professional Students

- FFEL PLUS Loan for Graduate/Professional Students

- Direct PLUS Loan for Parents

- FFEL PLUS Loan for Parents

- Direct PLUS Consolidation Loan

- Federal Perkins Loan

- Private Loan

The main types of loans that individuals have most often are the first two on the list, either a Direct Subsidized or Direct Unsubsizided Loan.

Direct Subsidized Loans are, as of July 1,2013, only available to undergraduate students for 150% of the estimated time it takes to get the degree. For example, a bachelor’s degree takes an estimated 4 years to complete so a student obtaining their bachelors degree would be eligible for this loan for 6 years of undergraduate education. Associates degree may take an estimated 2 years and as such, borrowers are eligible to receive this type of loan for 3 years total towards this degree. These loans are no longer available to graduate students (including medical professionals/students). The benefit of these loans is that the interest is being subsidized by the government and while in school is not accumulating.

Direct Unsubsidized Loans are loans where during the lifetime of the loan the borrower is responsible for paying interest accumulated on the loan principle. From the first day the loan hits your bank account you are responsible for the interest generated by this type of loan.

The other loans are often for individuals where their financial needs were not met by what was allowable by a Direct Unsubsidized Loan or for another reason the borrower decided another loan better fit there needs.

Which Student Loan Repayment Plan is right for you?

Upon graduation you will be asked what type of payment plan you would like to enroll in. Its likely that till this day you may not have ever made a payment on these loans, which would not be unusual at this point. However, 6 months after graduation the loans first payment will come due. If you do not log into your loans or reply to the organization that is servicing your debt you will automatically be enrolled in the standard repayment plan which will have a fix payoff monthly schedule with a payoff date in 10 years.

At this point, relax because the benefit to any of these plan is that you can switch plans at any time and are not locked into one type of plan.

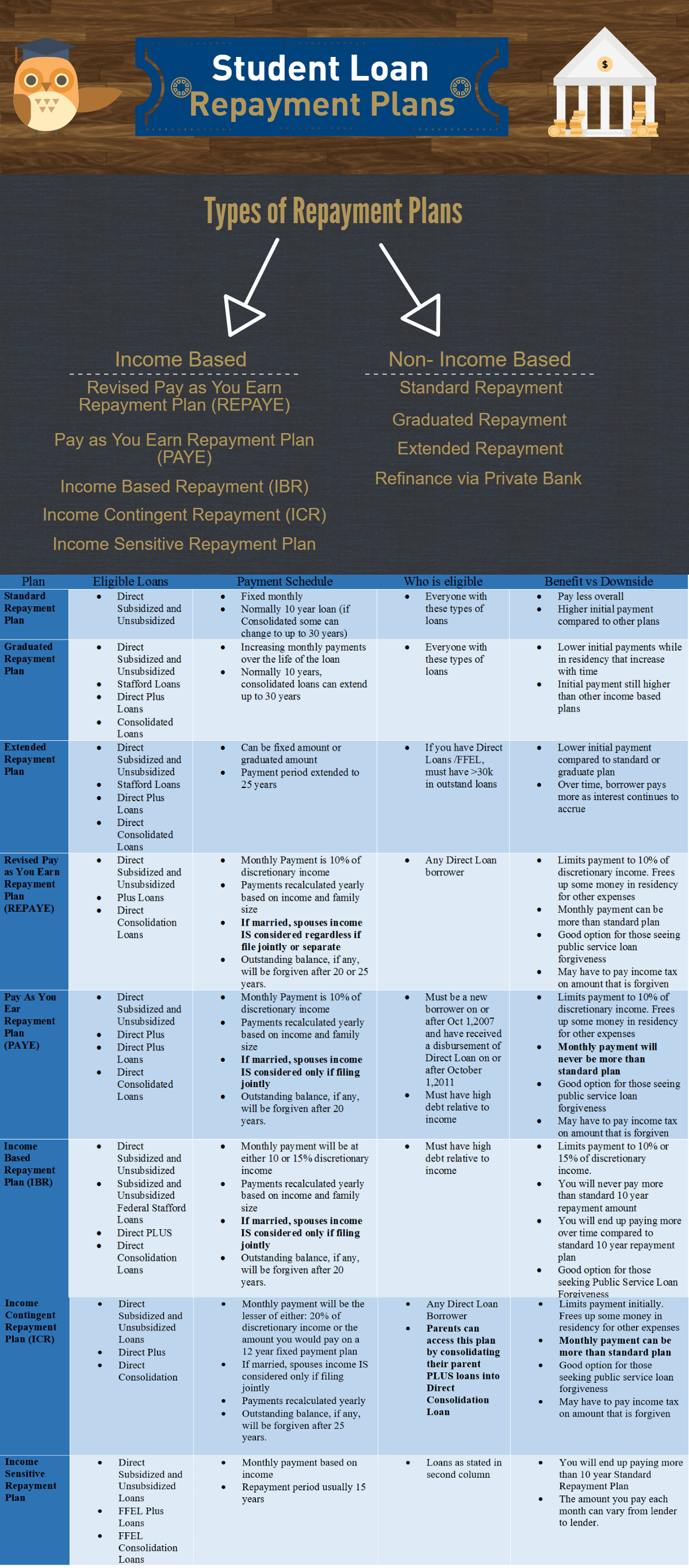

Below are the types of plans for student loan repayment that are offered for certain types of loans.

Income Dependent Repayment Plans

Many residents take advantage of the Income Dependent Repayment Plans as it can be difficult for some to pay more than 10% of ones income towards student loans, especially in very high cost of living areas such as NYC or California. As you can see above, there are a lot of options for income dependent repayment plans and each individual will have to see which one best meets their needs.

People who benefit the most from Income Dependent Repayment Plans are those who:

- Have a long time ahead in training that will qualify for Public Service Loan Forgiveness. Thus making their time as an attending in this type of plan minimal

- Those that have high student debt (most doctors)

How to determine if an Income Dependent Repayment Plan is best for you

- Make a budget and see if you are able to pay the standard repayment plan, which overtime costs the least to pay off, without struggling financially.

- If the Standard Repayment Plan is not an option during residency due to the high monthly payents then consider the graduated plan temporarily or an Income Dependent Repayment Plan

- Once you commit to an Income Dependent Plan, see the chart above to determine which one you are eligible and which one works best for you

Important things to consider

- If married to someone who makes more than you do as a resident realize that all of these programs will take their income into consideration if filing taxes jointly except REPAYE. In REPAYE your spouse income will be taken into consideration regardless of how you file taxes.

- REPAYE has the benefit of subsidized loans being covered during residency without interest accruing just as do all the other plans. It also has the benefit of 50 cents of every dollar of interest accrued on the unsubsidized loans while enrolled in this program. being coverd as well.

- REPAYE if continued after residency can have payments larger than 10 year Standard Repayment Plan

- Debt forgiven at the end of the term of the plan entered, if any, may be subject to you paying taxes on this amount as income

My recommended method of determine how to pick a student loan repayment plan during residency:

- Determine if you are able to make standard repayment plan loan payments. If so this is the best option to minimize debt, if not then consider Income Dependent Plan if Public Service Loan Forgiveness may be an option for you in the future.

- If not considering Public Service Loan Forgiveness then consider refinancing loan for a lower interest rate

- If you have decided that you plan to take advantage of Public Service Loan Forgiveness and need an Income Dependent Plan then:

- If not married then the best plan in my opinion is the REPAYE for reasons mentioned above (One of which is to take advantage of the interest subsidy while in residency for Unsubsidized loans in this program). Once out of residency then change to IBR or PAYE to ensure that payments do not surpass the 10 year Standard Repayment Plan

- If married to another high income individual, consider avoiding REPAYE as their income will be taken into consideration regardless how you file taxes.

- Enter into other loan repayment plans if you loans are not eligible for REPAY, PAYE, or IBR plan

- Avoid Forbearance if at all possible and aggressively pay down debt as early as possible

To try the calculators for yourself for the different student loan repayment programs on a government website, check out this calculator where you can see what your estimated pay off date will be with how much debt, if any will be forgiven.

Pingback: The Student Loan Resource Page - Physician on FIRE

“If not married then the best plan in my opinion is the REPAYE for reasons mentioned above (One of which is to take advantage of the interest subsidy while in residency for Unsubsidized loans in this program). Once out of residency then change to IBR or PAYE to ensure that payments do not surpass the 10 year Standard Repayment Plan”

Doesn’t IBR or PAYE requires PFH (partial financial hardship) in order to qualify? If so, I don’t think a doctor graduating out of residency will qualify for IBR/PAYE repayment program.

From the governments website(https://studentloans.gov/myDirectLoan/glossary.action):

“A partial financial hardship is an eligibility requirement for the PAYE and IBR plans. You have a partial financial hardship when the annual amount due on all of your eligible loans (and, if you are required to provide documentation of your spouse’s income, the annual amount due on your spouse’s eligible loans) exceeds what you would pay under PAYE or IBR.

The annual amount due is calculated based on the greater of (1) the total amount owed on eligible loans at the time those loans initially entered repayment, or (2) the total amount owed on eligible loans at the time you initially request the PAYE or IBR plan. The annual amount due is calculated using a standard repayment plan with a 10-year repayment period, regardless of loan type. When determining whether you have a partial financial hardship for the PAYE plan, the Department will include any FFEL Program loans that you have into account even though those loans are not eligible to be repaid under the PAYE plan, except for: (1) a FFEL Program loan that is in default, (2) a Federal PLUS Loan made to a parent borrower, or (3) a Federal Consolidation Loan that repaid a Federal or Direct PLUS Loan made to a parent borrower.”

Many doctors who graduate right out of residency will only have at most 6 months of attending salary. Many take some time off which decreases their income level. Some new graduates might not qualify, but many others will based on average income of doctors (~200k/year) and average debt (200k/ year). Once you no longer meet the PFH then you are right, you will not qualify for IBR or PAYE.