My Retirement Mistake In Residency

Retirement is something that, for the average resident, is rarely on their mind unless someone takes a special interest in personal finance and investing. On day one of residency new residents are often more concerned with student loans and preforming well during ones training than saving for retirement. My orientation included a week of lectures, some more interesting than others. One hour of these lecture was filled discussing retirement. In a large auditorium a lady told us that we would have the option to set up a Fidelity account and contribute to retirement if we wanted to, but there would be no employer matching. During this week of orientation I decided chose to forego my retirement savings for the 3 years. In this post, I look back to see how bad of a decision this might have been.

Reasons I chose not to contribute to my 401k during residency

- Get out of a financial deal. Family and money rarely mix and at the beginning of intern year I found that almost no bank would refinance resident loans. My family has been recently financially fortunate in that one of my family members had enough money to have one of their investments as a long term CD at a local bank. The bank was willing to give me a loan to cover my student debt at a fixed interest rate of 3.3% with the CD as collateral. Though the CD does not come due for years, I wanted to get out of this deal as soon as possible as to not mix family and money for longer than needed.

- Accelerate debt payoff. I knew that I would most likely not commit myself to 20 years of public service. I also did not want to be tied to any particular job for the main reason of my student loans. For this reason, I decided against income based repayment programs. Instead, I refinanced my loans from 6.8% to 3.3%, effectively saving myself $3,850 per year. After refinancing I did however have loan payments larger than I would of if I would have had if I had taken the option of an income based repayment plan. As such, I had to give each dollar that I was making a mission since there would be very few left over at the end of each month. There were no dollars to spare in my plan to aggressively pay down this debt backed my a family members CD.

- Refinancing saved me $11,500 during residency in interest

- I listened to the wrong people. The argument from my attendings and family was that the 5k I might have contributed during residency, while I had a high debt to income ratio, would be easy to replace and catch up to when I was an attending. I fell for it and chose not to think about missing out of retirement savings as I went with the majority of my class and did not contribute to any retirement plans.

- The need for liquid cash. Our residency did not provide any food, benefits beyond health insurance, and charged almost $200 a month for parking. If I would have contributed 15% of my income towards retirement, this would have amounted to $500 each month that I at the time did not have. I simply needed my money to be more liquid in case of an emergency presented itself. Not touching that money for decades in a 401k would have required me to either live even more frugally (which would have been very hard to do) or take out another loan. Both were not practical options at the time.

- No employer contributions. If there would have been some incentive for contributions then this would have made my decision much harder as I would have effectually been turning down free money. Since there was no employer contributions it was easier to walk away without leaving money on the table.

- Listening to other pay a penalty for withdrawing money early. Residents more senior than I was informed me that they ended up having to cash out their 401k early, yielding huge penalties which basically made their investment worth much less. Not only was there a penalty, but they then had to pay taxes on this income taken out of the 401k. They gave stories about how there were surprise one time costs such as fixing a car or a baby. With all the unknown of not knowing where my life would take me I decided it was better to have the cash more liquid.

Benefits I missed out on:

- Tax Savings. Saving with a 401k/403b long term is one of the greatest ways to save for retirement due to the tax advantages. Not only did I miss out of putting pre-tax money into this account, I also could have differed taxes on this money till retirement.

- Roth IRA eligibility. It might be one of the last times I could meet the requirements to invest and take advantage of a Roth IRA which I did not take part in. This next year I will have a good problem, which is that I make too much for a Roth IRA. I should have taken advantage of this while I could.

- Compound interest. I missed out on 3 years of compounding interest. Compounding interest is one of the seven wonders of the world to some people. Its a great thing to watch your money make you even more money.

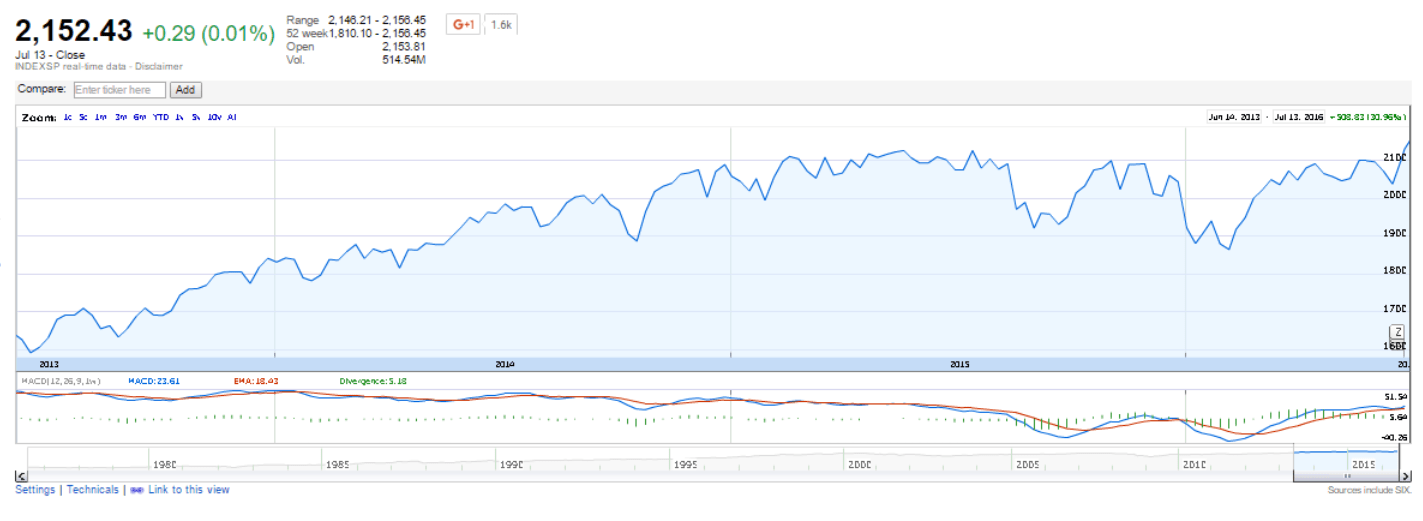

- Stock market returns were excellent. If invested in a fund that mimics the S&P 500, my portfolio would have dramatically increased in the past 3 years. It appears that over that time period the S&P $500 is up 30.95%. Of course there are other funds which may have preformed even better or possibly worse. By not investing this money I lost out on those potential gains.

- Not playing Catch up. Catching up requires more discipline as I have become accustomed to living on a budget that does not have contributions. Changing this mindset will be important

Overall if I could do it again I would have held on paying on the loans so aggressively and contributed to my 401k plan. In the end I missed out on tax advantages that will end up costing me in time and money as I will need to catch up now that I am out of residency. The upside to this scenario is that the loan backed by my family members CD has decreased significantly which has made them happy and me happy to see a lower number. I am grateful for the all the opportunities that I have been given, including the opportunity to refinance my loan. However, in the end I think the smarter thing would have been to attack the debt more aggressively after graduation and take advantage of the tax benefits of a 401k and a Roth IRA while I was eligible.

What do you think? Would you have done something similar or backed off on paying the loans in order to save for retirement.

So… we’re not proofreading articles anymore? Beyond the shocking number of grammatical errors, the author means that he has missed out on a Roth IRA, not a traditional IRA. Come on, Doximity.

Thanks for bringing it to my attention. Sorry for the unfortunate mistakes and will correct them asap.

I came to the article to see if this Traditional vs Roth IRA error had been corrected as well!

Also, you can still do a Roth IRA, through the backdoor Roth. I’m surprised that someone who calls themself “Investing Doc” doesn’t know this…

“Refinancing saved me $11,500 during residency in interest”. Not sure if this means that he refinanced DURING residency and not after. If you can afford NOT participating in IBR (where you only pay 10% of your income) and can pay off the minimum $3000 or so PER MONTH then go for it.

Pingback: WFP’s Recommended Reads: November 2016 | Wrenne Financial Planning | Lexington, KY