The Most Expensive Real Estate Bankruptcy by a Doctor

The rise in real estate prices from 2013 to 2022 has been historic. However, for some cities that have been spared the big drop in 2008 values, the rise in home values has been dramatic. For example, the house we just sold more than doubled its selling price in the four years since we bought it. This got me thinking, what might be coming for doctors who are highly leveraged in real estate? How many doctors over leverage themselves to the point of bankruptcy in the future? Also, what has happened to doctors who have over leveraged themselves in real estate in the past?

Today I will focus on two of the largest bankruptcies in real estate by doctors. I also will parallel my experience buying a new building and overleveraging myself. Luckly, I didn’t have any negative implications from my overleverage. All data is found on public websites, and my opinion about real estate should not be taken as personal directed financial advice.

Dr. Denton Cooley

An American heart and cardiothoracic surgeon famous for preforming the first implantation of a total artificial heart. He was born August 22, 1920, and died on November 18, 2016. While he was famous for many accomplishments as a surgeon, he was also the founder of the Texas Heart Institute. This institution has trained thousands of wonderful physicians who continue to advance cardiovascular medicine. Beyond his advances in surgical techniques, creating an organization that continues to excel at cardiovascular care is a wonderful accomplishment that far outlives him.

During his time, it is reported that the mortality of artificial heart valve surgery fell from 70% down to 8% in the early 1960s.

The $100 Million Dollar Bankruptcy

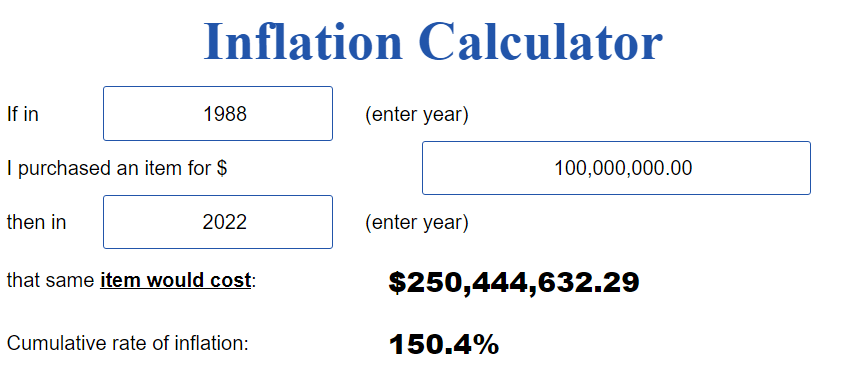

In 1988 Doctor Denton Cooley filed for bankruptcy, citing $100 million dollars in debt.

Inflation adjusted, that would be the equivalent of a quarter of a billion-dollar bankruptcy today. That is massive.

Real Estate And Bad Timing

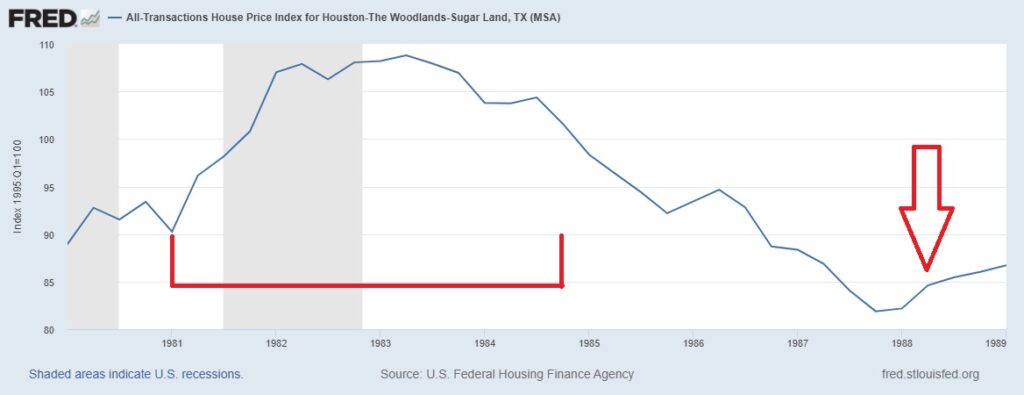

Dr. Cooley invested heavily in real estate in Houston and the surrounding metro area. Unfortunately, most of his investments occurred in the early to mid 1980s.

The Red “U” is his max buying period, and the red arrow is when he filed for bankruptcy.

He bought a sizable portion of his assets right at the peak. There are reports that the over $50 Million dollars in real estate in the Houston Metro where he was paying $9 Million dollars a year in interest alone. Even with a large income, it is tough to keep up with that level of interest payments per year.

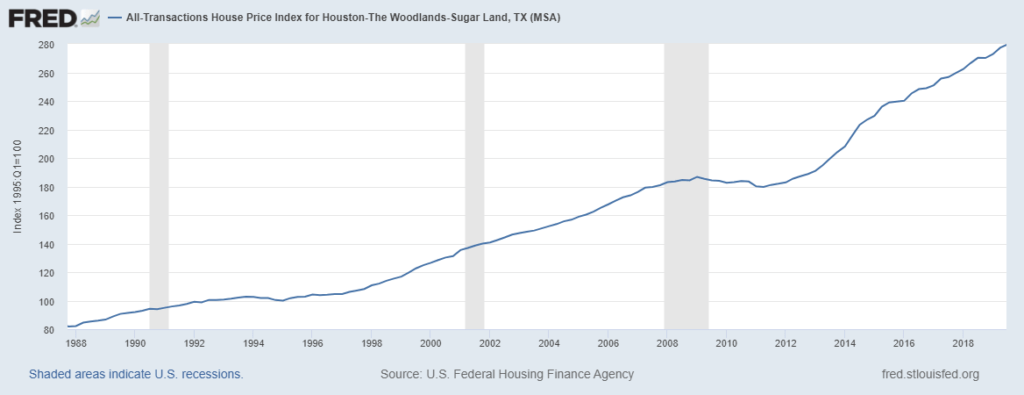

What Happened To Real Estate Values Since The Bankruptcy?

At the bottom left is the low point where Dr. Cooley filed bankruptcy. Since then, you can see that the Houston area has had a steady rise, with each decade having a steeper slope up and to the right.

Unfortunately, he had bad timing in the real estate market. Even worse, he owned most of his real estate in a city that is highly dependent on Oil and Gas jobs, a highly “boom or bust” industry.

Even today, the 1980s oil bust still sets the precedent for massive loss. Unemployment jumped to 1 in 8 people in the Houston Metro area, and office vacancies were upwards of 20%. Unfortunatey this economic bust hit exactly where Dr. Cooley had most of his real estate holdings.

What Did Doctor Cooley Have To Say About The Bankruptcy?

Outwardly, he appeared to take the business failing in stride. He continued to practice medicine, train many excellent cardiothoracic surgeons, and focus on his professional endeavors in medicine.

However, I can’t help but speculate that the suicide of his daughter in 1985 and then the subsequent bankruptcy must have had a huge mental toll on this doctor. As a father myself, I can’t even imagine the pain he went through emotionally.

From $40 Million Dollar Net Worth To Bankrupt

At the time of his bankruptcy filing, Forbes listed him as having an estimated net worth of $40 million in 1980s dollars. Since he had $100 million in debt, I can see why he had to file for bankruptcy with the economic downturn.

Be Cautious With Leverage

By many accounts, he was one of the highest, if not the highest paid physicians of the time. He had multiple streams of income coming in as he was performing surgeries, and a professor for the Texas Heart Institute, which he founded.

Despite all this income, he still over leveraged himself in real estate and lost most of his net worth at the time due to the bankruptcy.

Where Is Real Estate Headed?

My prediction is that unless there are a lot of people losing their jobs, that the real estate market will not have a massive downturn like it did in 2008.

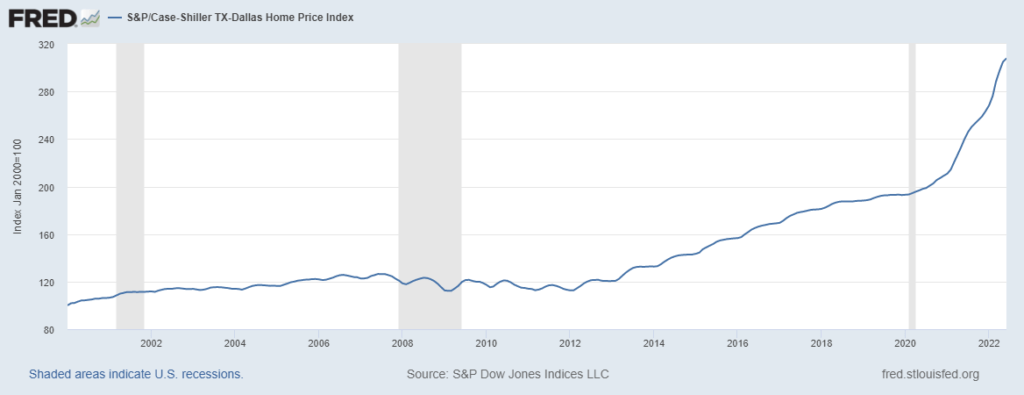

However, it is hard to look at a graph like the one for Dallas and wonder if we will see some cities having quite large corrections in value. This type of rise in home values, this quickly has potential to hurt a lot of people financially.

I believe we will see scaling back on home prices growth. However, until jobs significantly start to erode, I don’t expect a massive crash anytime soon.

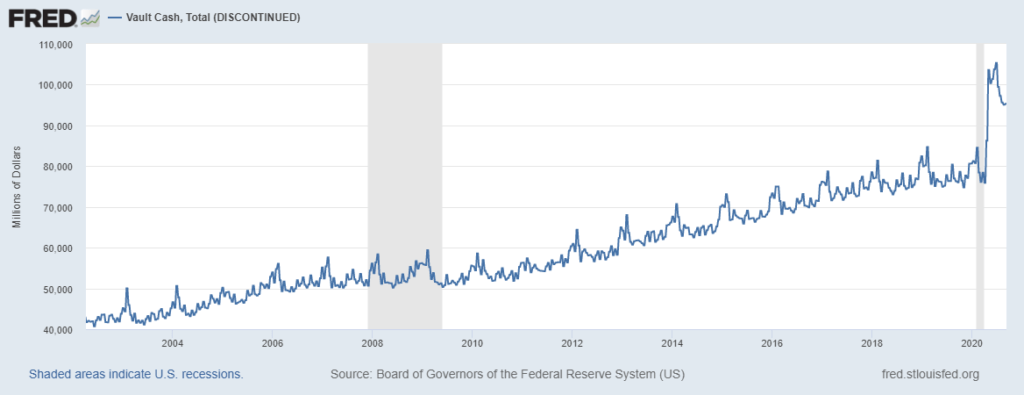

With everyone “expecting” a recession, it is interesting to see cash stored in federally insured banks skyrocket. This leads me to speculate that companies and some people are stockpiling cash to weather any short-term market downturn. Which may blunt the downturn since there will be less “panic” selling.

Things Can Always Get Much More Irrational

The Fed makes all the rules. The real estate market could always get much more irrational before getting better. Something like a 40-year mortgage loan could always be created, which would continue to inflate prices for homes. There could always be another stimulus, tax abatements, or other means to inflate the property market.

Real estate is the one item that the average person looks at what their monthly payment is and then decides how much house they can afford. This is despite most people saying buy a house 2-3 times your income. In reality, most people buy a house based off their monthly payment.

Doctor Alex Khadavi Bankruptcy

Another honorable mention for real estate gone wrong is Dr. Alex Khadavi. By some accounts, he spent 3 times more than he wanted to on this property and filed bankruptcy with $88 million in debts listed.

There really is not much to say about this one, other than this is an example of someone who massively over spent on a house that their income could not support.

My Over Leverage

I started my practice and less than 1 year open, I signed a contract to buy a new medical office condo. Since I was not in practice for 2 years at the time of buying the building, the bank had an extremely hard time approving me for the loan. This led to a lot of sleepless nights. I was stressing, trying to figure out how I was going to pay for the new building.

Luckly, by the time the building was breaking ground, I was open for 2 years and the bank gave me a lot more leniency. However, looking back I bought it too soon. I went from 800 sq ft office with 2 exam rooms to 3300 sq ft with 8 exam rooms. It was a large jump in size. I had to put upwards of $400k dollars into the project since the bank wanted me to have a lot of skin in the game due to my business not being in practice very long.

I was initially planning to rent out my home and buy a new home this year. However, since our property value doubled, I decided to take the tax-free gains of selling my primary house and moved to a new house. It made sense for me to take the $500k in tax free gains now rather than maybe $2,000 a month in rent. Also, I realized that I had way to much of my net worth tied up in real estate. So, I was over leveraged and decided to sell my house instead of renting it.