Why The Rate Negotiation Process With Insurance Companies Is Broken

With inflation reaching record levels, many medical practices are going through the rate negotiation process with insurance companies trying to get better pay. If you have never done this before, that’s okay. I was new to it also until a few years ago. Let me tell you the theme of dealing with commercial insurance companies for rate negotiations. Intentionally difficult and broken. They purposely obfuscate the process to low ball you and try to confuse you.

I’ll break down what it is like to negotiate a rate increase with an insurance payer. At the end of this, you might not find yourself wondering if a two-tier system would truly be better.

Usual Terminology For Insurance Contracts

The first step for rate negotiations with an insurance company is to already be in network with them or try to become in network with their company. When a medical practice becomes in-network with a commercial insurance plan, this means that both parties agree to a certain contract rate for CPT codes rendered to their patients.

There will be some usual terminology such as CPT codes and fee schedule based on percentage of Medicare.

What Is A CPT Code?

CPT codes are a way to define services provided that can be translated into a billable code. For example, if there is a surgeon who performs gallbladder removal with exploration of the common bile duct using an endoscope. The code is 47564.

I’ll focus on Category I CPT codes. These are codes that correspond to a procedure or service rendered. Category I CPT codes are codes that are done with usual rate negotiations for the almost 10,000 procedures codes that are universally accepted. These codes are usually a 5-digit number. They range from 00100–99499 and have a certain order to them.

The CPT code tells the insurance company, without having to read the entire operative report, exactly what procedure you have performed on the patient. It also helps data mine where care is given to the patient.

There are modifies to these codes. While that will be beyond the scope of this article, know they exist. For example, you can have a modifier that you had an incomplete procedure performed. You can even have more than one code billed during a visit that is submitted to insurance companies. For example, an annual visit to a pediatrician where a child gets their checkup, and a flu vaccine is three codes. The annual exam code, the vaccine cost code, and the administration of the vaccine cost (by your medical assistant).

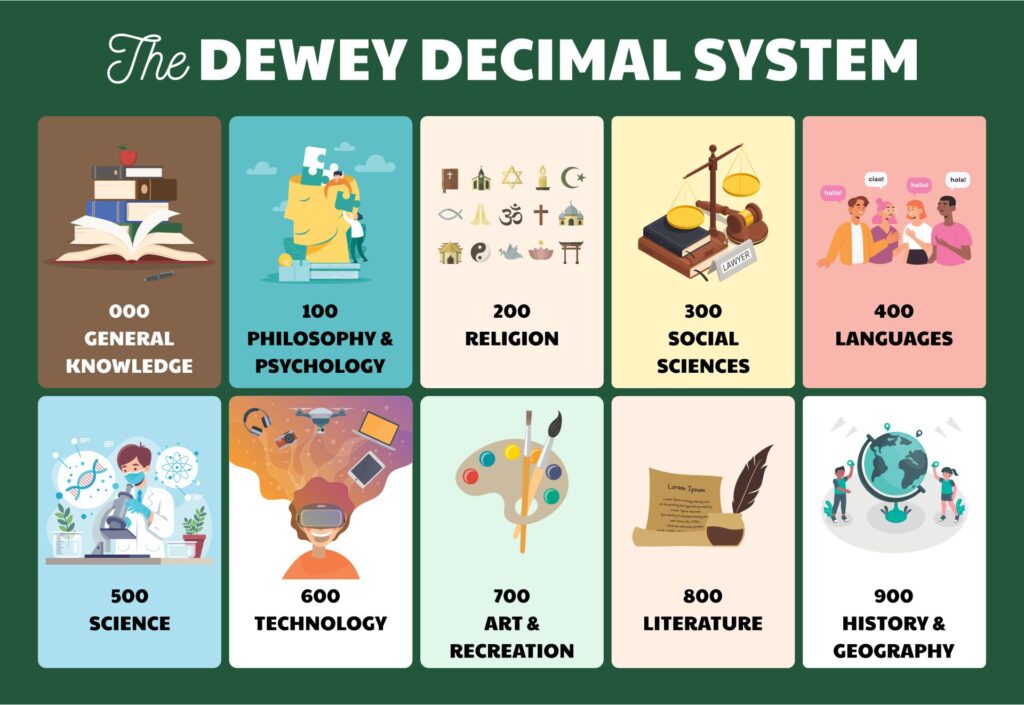

Structure: Much Like The Dewey Decimal System For HealthCare

The Codes have a system to keep things in order and simple. CPT codes are usually 5 digits long.

| Code Range | CPT Sections |

| 00100-01999 | Anesthesia |

| 10004-69990 | Surgical Codes |

| 70010-79999 | Radiology Codes |

| 80047-89398 | Pathology |

| 90281-99607 | Medicine Procedures |

| 99091-99499 | Evaluation and Management Services |

Why Medicare Matters for Commercial Contracted Rates

90% of our contacts with insurance companies are based off Medicare rates.

Usually, our contact with a commercial plan will say something like: “The rates between [Insurance Company] and [Your Company] will be based on 85% of 2020 Medicare fee schedule rates.”

It is less common that an insurance company gives us a fee schedule that is different based on each CPT code. So, the better Medicare pays, the better the commercial plans also pay us.

If You Are A Solo Doctor, You Most Likely Have Worse Than Medicare Rates

One thing that shocked me when I started my practice is that I always thought commercial insurance pays better than Medicare. Maybe it was just my training, but everyone kept saying that doctors would not survive on the low Medicare reimbursement rates. I thought commercial insurance always pays better than Medicare.

WRONG

Many commercial plans will pay you less than Medicare unless you:

- Are a specialist

- Are in an area of high demand and there is low supply for your specialty

This even goes for General Surgery. I know two people who are general surgeons where their rate negotiations lead them to a lower than Medicare for commercial plans.

It was always drilled into me that “we” in the healthcare profession love commercial insurance and hate Medicare because of pay. How many times have you heard, “That doctors office would not survive financially if they only accepted Medicare rates.”

Turns out that for many non-specialist, you are most likely making less than Medicare rates on your plans if you are small.

Know Your Worth, And To Many Insurance Plans You’re Not Worth Much

Insurance plans by law are required to have a certain number of doctors in network in many areas.

If you are a small doctor’s group or office, this works against you sometimes.

For example, in our area, even though we now have over 15,000 lives that we care for, we are still an exceedingly small group.

When we went to an insurance company asking for better rates, they simply told us no and offered to terminate our contract if we didn’t like it.

To these big insurance plans, they don’t NEED your small practice, and that is reflected in their payment structure to you.

The Bigger You Get, The More Leverage You Have

If the largest medical group in town decides to terminate a contract with a commercial payer, that is a huge deal. Those large groups have leverage and can negotiate. Just be aware that as a small doctor’s office, you will have very little to no negotiation power or leverage. So, meter your expectations accordingly.

Job Hopping For Better Pay

In the tech industry, it is the normal protocol for employees to jump between employers to get better pay increases.

Once the threshold is set for pay, it is hard to move the needle in any big way. You have grown roots. You are anchored into that current contract and situation. Once the insurance company know you will accept $100 for a code that they might pay another doctor $200 for, they will use that $100 to anchor their negotiating tactics to.

Sometimes you must threaten to leave a contract for better pay.

How We Have been Successful With Rate Negotiations

In another post, I talked about how we had a huge raise from one insurance payer.

I talked a lot in that post about steps to be successful in negotiating. However, the first step is you have to have a meeting with a person. While the first step is emailing asking for a pay raise, the ultimate way to get a pay raise is to actually have a meeting with someone in their organization.

If you are emailing back and forth, you are talking to a low level agent with the group. You are NEVER going to get good rates by only talking to them. You HAVE to talk to their manager at a meeting.

If you cannot get that meeting, then I’m sorry to say that you most likely are not big enough for them to care.

Grow Big Or Go Home….Or Get Bought Out

The only way to have leverage is to grow big or be absorbed by another large group. The alternative to this is to go out of network with these insurance payers.

Thinking of all the man hours we are wasting negotiating these contracts, and how much time they are wasting coming back with replies is mind blowing to think of all the administrative time wasted on this.

The larger we become the more leverage we have. Two years ago we were turned down from joining a certain network. This year, we had the same network come to us and ask us to be in network with them even though we did not reach back out to them.

As a business, you have to grow, become more valuable to your patients and the insurance company, or be absorbed by a larger group that is more valuable to them.

Everything Is Meant To Be Confusing

The entire process is, in my opinion, meant to be confusing. However, with a bit of effort you can figure out how to navigate the process and succeed.

Many insurance websites do not even have the name of the person listed that you are supposed to contact for rate negotiations. You will find yourself emailing various people before finding the right person to talk to.

It takes a lot of time to figure out who your contact with insurance companies even is. For example, you can go to Ciga’s website and find how to become in network. Once you email then, they can take up to 2 weeks to respond to every email you send. The process is frustratingly long.

While I am not necessarily advocating for 100% single payer, since then I would not be able to negotiate with anyone, the current process of a very broken one.

Good luck to those of you who are undergoing a rate negotiation or about to undergo one.

Thank you for sharing your experience. I am just starting this process and not looking forward to it.

Pingback: The Sunday Best (09/04/2022) - Physician on FIRE