Should You Pay Off Debt Or Save

Physicians often face a dilemma upon graduation, to pay off loans, save, or spend the money on upgrading their lifestyle. As noted in another post, the average debt of graduating residents is nearing $200,000. With all of this debt on a new graduates shoulders and a life awaiting them outside of residency, its not uncommon to ask the question, would it be better to save or pay off debt?

Know Where You Stand Financially With Your Debt

Evaluating Your Debt

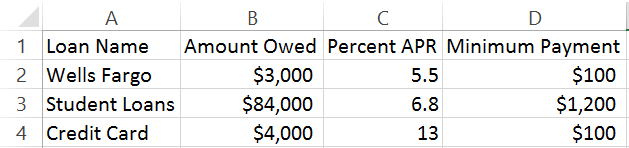

First step is to figure out how much debt you own and at what percent. Surprisingly many of my friends had no idea what APR they were paying on their loans. Make a list of who you owe, how much, at what percent, and minimum payments. Once this is obtained, the next step is to figure out how much a month that can be put towards the loans. Your spreadsheet can look something like this. This may seem simple, but its impossible to answer the question without knowing this first.

Create A Budget With All Essentials

Next, create a budget that includes all the essentials for day to day living. This includes things such as:

- Rent/Mortgage (Household expenses)

- Food

- Insurance

- Child Care

- Transportation

I would also include retirement in this calculation as a needed expense to take advantages of the tax advantages. Subtract the total of all these from your net income. This left over amount will be able to tell you how much free cash is available to pay off the loans.

When Its Better To Pay Down Debt

- The most important reason is personal choice. Some people are debt averse and will do anything to avoid any type of debt regardless of interest rate. If this is the case then the answer is easy, pay down the debt if its keeping you up at night.

- Usually the rule of thumb is that if the interest rate on the loans are greater than 4%, that its wise to pay down the debt. This is because historical returns, depending on the source, range from 6-9%.. The difference between the two, or the opportunity cost, is not that great when the interest on loans are at 5% and the potential return on investment is only 1% higher. This rule of thumb also accounts for the fact that there are very few investments that are sure thing and basically none that are sure things at higher than 4% interest rate.

- Debt to Income Ratio is greater than 1.5X income. Eventually it will most likely be important to buy a house and grow some roots in the community. Having non house debt greater than 1.5 times your income will affect what type of house you will be able to afford. Buying a house with a large non house debt load will also cause a large portion of your capital to go towards paying down debt with no ability to save for retirement. Haivng more than 1.5X income in debt, it is most likely wise to pay down debt before buying a house and creating more debt.

- If there is no plan to take advantage of PSLF or any of the government repayment plans

- If you are able to max our retirement accounts and have a low risk tolerance with no desire to invest in the market with the hope for higher returns.

When Is It Better To Save

- Interest rate is <4% and fixed

- If there is enough money left over after maxing out retirement accounts and paying down debt with a payoff date <10 years

- Currently have children and plan to take advantage of tax advantaged plans such as a 529 plan for your children

- Currently without a 6 month emergency fund

- If earnings in the near future are expected to increase and the plan is to put that money towards debt and not lifestyle

- Expected windfall in the near future that will be applied to debt payoff only (this is if the money is not in a trust or other tax advantaged account)

- Large one time expenses in the near future

Overall the decision is most likely not black and white. If you are contributing to your retirement account while paying down debt then overall you will have a blended average of the two benefits. The decision may change over time as priories in life change, but the most important aspect is to have the emergency fund set up to avoid taking out even more loans at high interest rates. Use the calculator below to determine how long it will take to pay off your loans with varying payments.

[CP_CALCULATED_FIELDS id=”9″]

Pingback: Pay Off Debt Or Invest - What Should Doctors Do? - Debt-Free Doctor