Amazon Buys One Medical And How Our Practice Compares

Amazon recently announced in July 2022 that they intend to buy One Medical. This deal is most likely going to close by the end of 2022. I would like to break down the finances of One Medical based on their last financial release on their website. This is to give you an idea of what kind of numbers a primary care clinic might be making who scale exceptionally large. It also will help some of you who may have never looked at a company financial disclosure before figure out what the report is telling us.

One Medical

A primary care clinic founded in 2007 in San Francisco. Founded by a physician, Tom Lee. The company has grown from one location in 2007 to now more than 180 locations throughout the United States.

Tom Lee, MD

I have so much respect for Tom Lee. He has done quite a bit in the medical space since he graduated from medical school.

One of the first employees of Epocrates.

In 1998 Epocrates was founded by Richard Fiedotin and Jeff Tangney. In 1999, less than a year later, Tom Lee joined and became the Chief Medical Officer of Epoctates. He remained involved in Epocrates until 2008, a year after One Medical was founded by Tom Lee, and he devoted his full time to running One Medical. He was replaced by Amir Rubin in 2017 as CEO of One Medical.

Currently he has a startup called galileo, which is a yearly subscription to have access to a physician via telemedicine only.

One Medical Goes Public

When a company gets listed on any stock exchange, their shares are publicly available to be traded by anyone. This is why we call the act of being listed on a stock exchange “going public.”

Prior to going public on the stock exchange, companies and their finances are private. This means that we have no idea how much money they were making or losing. Private companies are not required to file public data about their finances. For example, your local mom and pop favorite restaurant is most likely a private restaurant and they have no obligation to post their profit or loss statements online for anyone to read.

In 2020 One Medical went public, giving us a glimpse into their finances.

The stock hit a peak price of $58.70 in February 2021 giving One Medical a valuation of $11.4 billion at that time. In July 2022, Amazon announced that it was going to buy One Medical for $18 a share in July 2022 for a valuation of $3.8 billion. A fall of valuation of almost 70% from its peak.

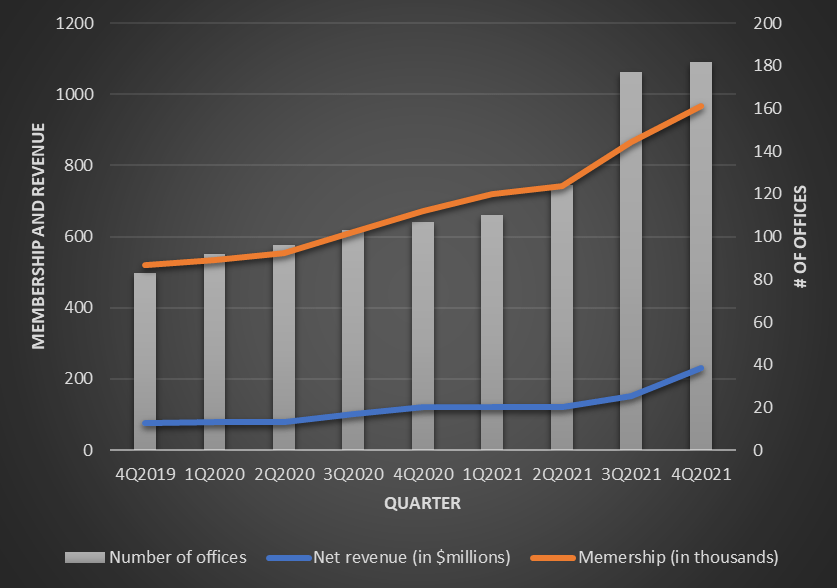

A Look Into Revenue, Membership, and Office Numbers

When One Medical went public, they had about 80 offices. At the time of selling to Amazon a little over 2 years later, they had over 180 offices. Now, part of this growth is a bit skewed.

You see the big jump from 2nd quarter 2021 to 3rd quarter 2021?

One Medical bought a company almost as large as them in terms of gross revenue, Iora Health.

Buying Iora Health

In September 2021 it was announced that One Medical would be buying a majority share (73%) of Iora Health for $1.4 billion. At the time One Medical was bringing in about $480 million in revenue, and Iora Health was bringing in about $318 million in revenue.

4.4 X EBITDA is what they technically paid for Iora Health. So, if you are wondering what a medical company sold for as some of you may be considering selling your practice, there is one example.

This means that One Medical paid about four and a half times what the company makes in a single year for 73% of the company.

Paper Gains

Buying Iora Health in this most recent press release (July 2022) showed that about half of their revenue now comes from Iora health patients.

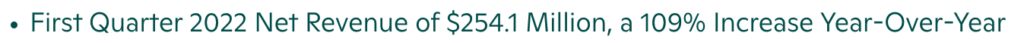

In their own press release they put out the headline of:

While this is true, a large portion, if not almost all of this growth, was due to them acquiring a company that was almost just as big as they were. So of course their numbers for revenue were going to grow.

You can see that last year they had zero income from Medicare since they did not see Medicare patients.

This year after buying Iora health which only sees Medicare patients, they suddenly doubled their income.

Actual Growth Of Just One Medical

The year over year commercial grow for net revenue was only 4.39% (Commercial revenue = 126,680 / 121,352).

According to their own press release, they now have 188 clinics. Last year they had 92 clinics.

It takes time to grow a new medical practice, but opening that many new clinics and seeing only a 4% growth in revenue in my opinion is not great in my opinion.

How Much One Medical Spent To Run The Primary Care Clinic

In 2021, One Medical brought in $121,352,000 in net revenue. This means that is exactly how much money they brought in from commercial insurance. The above chart shows how much money they spent on various categories while running the practice.

Cost Of Care

This is the cost it takes to deliver healthcare in your office. This would include the doctor’s or APP salary, the MA salary. One Medical spent about 58% on the cost of care in 2021.

In our office the cost of care is about 38%. We mitigate our costs by trying to automate everything that we can.

As you can see, administrative bloat is not even figured into cost of care in their figures, while in my figure for my office, it is.

Marketing

I am in a market that has 3 One Medical office locations that have opened within the past two years. In my area, they are marketing heavily. It is almost impossible for me to log in to Facebook or Instagram without seeing one of their advertisements.

I logged in at the time of writing this post, scrolled down and the 4th post on Facebook was an advertisement, and it was One Medical. Here is a screenshot of their advertisements.

Our advertising expenditure, even at its highest, was about 1% of net revenue. However, when you open 3 new practices, all about 5 miles from each other, you most likely are going to have to spend a lot of money on recruiting new patients.

This is exactly what One Medical did, spent a lot of money to advertise to grow their patient base.

General and Administrative

I spent about an hour trying to figure out exactly what this category includes. Does this include rent? I had a hard time figuring out exactly what they are putting into this bucket.

However, spending 53% of net revenue on this category is massive.

Our administrative costs are a bit skewed. Since I am the administrative person, I don’t take an “admin salary” at this point in time. That is coming soon, but for now I do not take any admin salary.

I posted on another topic exactly where my spending of dollars goes. For those of you interested, look here at that post.

However, spending this much on administrative costs goes to show how much even a “revolutionary” company can not escape admin bloat.

Spending Money On Growth

One Medical is a wonderful company from many accounts. I have never been a patient but I know several physicians who use them as their primary care doctor.

However, in the past several years they focused primarily on growth. The stock market only cares about one thing. Growth.

When snapchat recently announced that they were not growing as quickly, their stock dropped almost 40% in one day.

We are focused on growth. However, we have not taken private equity money. This means we have cash reserves, but not so much reserves that we “don’t care” about spending and only care about growth.

Maybe that will come with time.

Does The Price Make Sense?

I have a hard time understanding the price that Amazon paid for this practice.

One medical has about 770,000 patients that they care for according to their own press release.

A value of $3.8 billion for that many lives, means that they are paying $4,935 per patient life they care for. I have a had time believing that the lifetime value of each patient to this practice is that high, since many of these patients may only come in once a year for their annual physical exam.

To put this into bigger perspective, the average primary care doctor has about 4,000 lives they care for. This would give the average primary care panel a value of almost $20 Million. Most primary care practices are going to be valued much lower.

I don’t know anyone who would pay $20 Million to buy one doctors panel of patients.

(My opinion)

On the surface Amazon appears to have grossly overpaid for One Medical. They must have bigger plans for this patient base, since the lifetime value alone of the patients they care for in no way will come close to paying off this purchase price.

What do you think?