Financial Breakdown Of A Primary Care Clinic: How Much Money Does It Make

Today we are going to take a look at the financial breakdown of a primary care clinic that has recently opened. The numbers in this post are not my clinics financial numbers exactly. I don’t want to “dox” myself and I want to give anyone interested an idea of what is generally possible if you work hard. I’ve used the national average income for primary care physicians for gross revenue. The expenses are based on my expenses 6 months into being open. In some cases, I have rounded numbers to the nearest dollar amount for ease of reading. Keep in mind that this is a generalization. Costs may be slightly higher or income might be higher or lower.

Now, lets have some fun and look at the monthly financial breakdown of a primary care clinic.

Gross (Total) Revenue

This is the total amount of money that is brought into the clinic before any taxes, expenses, or deductions.

In order to understand gross revenue, we must first understand how doctors bill.

Doctors bill based off RVU’s, relative value units. Every service provided by a physician has a unique code and can be billed for. For example, smoking cessation counseling, time spent between 3-10 minutes: The code is 99406.

The government has assigned an RVU to each code. For example, a complex new outpatient visit is 3.17 work RVU’s or 2.38 RVU’s. There is a difference between (work RVU abbreviated wRVU) and (RVU). This will be outside the scope of this post, but if you want to know a bit more, here is a link to AAPC about RVUs. Basically, the larger RVU number includes facility fees, overhead, the work done, and total RVU also includes malpractice premium payments due to risk for each procedure.

Medicare on average pays about $66 per wRVU (in my area for 2019). The average primary care physician bills for about 5,000 RVU’s per year, which would equal about 7,000-8,000 wRVU per year. It’s unclear to me if these papers also count consumables such as vaccines in those RVU’s, which will add to the overall revenue.

To make numbers simple, lets say that the average primary care doctor bills for about $500,000 in insurance reimbursements per year. This is not an unreasonable amount at all for a full time primary care doctor who is seeing 15-25 patients a day. With this estimate our doctor is bringing in a gross revenue per month = $41,666.

Keep in mind this is an average number, work hard and you can increase the amount you’re bringing in each month.

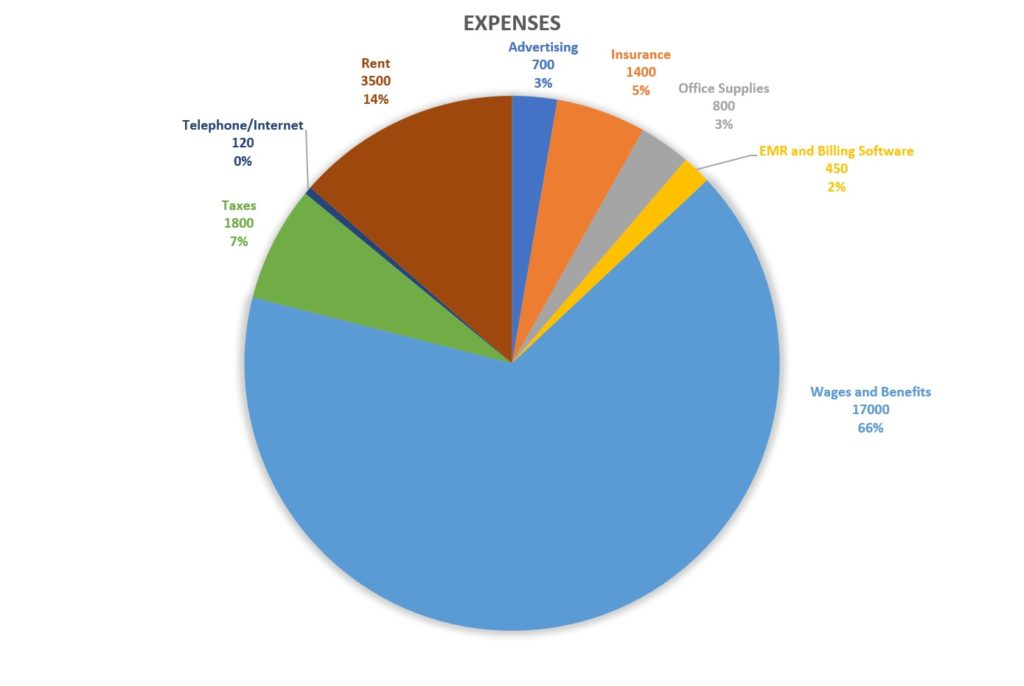

Expenses

Below are my average recurring expenses for the clinic at the six month point.

For my example, lets say as a new practice you decide to pay yourself $10,000 a month until you get a better sense financially of how things will go. This is exactly what I decided to do. I think this is a reasonable salary contribution for a start up medical practice. However, you might not take a salary for the first month or two after opening your practice ( I didn’t). As an owner, you will also be able to take distributions from the company in the form of dividends for any net income. I take these distributions quarterly.

It may be enticing to try to pay yourself totally in distributions to avoid paying payroll taxes, but this is something that will land you in trouble with the IRS. According to the IRS, you need to pay yourself a reasonable salary for your position worked. Reasonable is left up to interpretation and is based on many different factors. I am not a tax expert, so if you want to know exactly how you should pay yourself, then you should consult a local accountant. My accountant has told me not to even get close to the 50% salary, 50% dividends for payment structure. That for sure more than 50% should be taken as salary.

So, lets take a look at my average monthly bills for my first 6 months open.

- Advertising: $700 (FYI: Now that I’ve maxed out my panel, I’ve stopped paid advertising)

- Insurance (This is not including health insurance for employees. This is Malpractice insurance cost, workers comp): $1,400

- Office Supplies $800

- EMR and Billing Software: $450

- Wages + benefits for employees: $17,000 (2 employees + Doctor)

- Taxes: $1,800 (As the employer you will have to contribute to taxes per employee paycheck. Social Security 6.2%, Medicare 1.45%)

- Telephone $120

- Rent: $3,500 (I share rent with another physician which is why it may appear low)

Total expenses: $25,870

Net Income:

The income left over after all expenses as above: $16,796

So, the doctor in this situation is getting paid $10,000 in salary and $16,796 available left over for distributions. This won’t fly with the IRS and I suspect will earn you a letter from them plus possible penalties trying to avoid paying payroll taxes. So, salary will have to be adjusted up and distributions will have to go down to avoid trouble with the IRS.

Total yearly gross salary for this primary care doctor who owns their own clinic is $321,552 per year.

Total overhead excluding the doctors salary: 36% in this example.

For those of you who do not think this is possible, my clinic continues to hover around 30% for my overhead (excluding physicians salary). We run lean, work hard, and overall love what we do. It was hard finding good help. I had to fire my first employee pretty quickly. However, despite all the negatives to running a business, this has been the most rewarding thing that I have ever done. If you choose to work more or less, you can make significantly more or less income accordingly.

The Drawbacks:

There are many drawbacks for the primary care clinic. Yes, the high potential salary is a blessing, but there area always drawbacks.

First, the doctor in this example is always on call, and if you averaged out pay per hour it wouldn’t be great compared to hospitalist work. I am on call 24/7, every holiday and every weekend while self employed. A huge drawback for many.

Second, there is a lot of stress to owning and running a medical practice. I have no business manager. This puts extra money in my pocket but extra work on my lap. If you are not the type of person who doesn’t mind writing an employee up for being late, working on payroll hours, or fixing a broken printer, then you won’t mind the job. There is a lot of bureaucratic paperwork that goes along with the job, like reporting to the state wages and paying payroll taxes quarterly. I have spent many hours after clinic on setting up the business of a primary care office.

Third, the stress of the unknown can get to you. Many sleepless nights were had when I started my practice. I was so worried no one would ever show up. I also was worried how things would go practicing solo, not having other doctors to bounce ideas off of if I had a question in clinic.

Finally, primary care is hard. If you want to open your own primary care clinic get ready. Primary care is very hard. Dealing with possibly 5+ chronic illnesses, worrying about preventative medicine, dealing with some demanding patients, and on top of that running a clinic can burn anyone out. You can easily get buried in paperwork and frustrated with patients who are angry with you. The job is already tough and adding another difficult factor to the job for most people seems to be a huge reason to avoid owning their own practice.

The Grass Can Always Appear Greener

It is not all roses, but I will say that demanding patients are everywhere. There are tough days, there are many more great days. Most of my patients are wonderful, kind, and want to get better. It is a blessing to have such potential high income in our profession. Overall, I wouldn’t change how things are going for any amount of money. I’ve built a steady panel of patients and things have become more on autopilot every day I show up to work. To all the people considering starting their own practice: The beginning is definitely the hardest. It gets so much better!

If you are even considering opening up your own practice, I say go for it!.

So now that you have filled your panel, any thought on adding a mid-level? Any chance you could do the financial breakdown for adding a PA/NP to a practice for those less informed of insurance and other considerations?

I will for sure be adding a mid level provider. I’ve already added a doctor and I am trying to hire another doctor so there will be 3 docs total. Once the doctors are up and running (they don’t have to have a full panel just the swing of things down in the practice) then I will bring on a PA or NP to my current clinic to cover me or the other docs when we are out.

From the glance of it, it looks like financially this is the most lucrative for owners of a medical clinic, not employing doctors. I started with physicians because when I’m off I don’t want to have to be asked medical questions and wanted someone who is completely capable of seeing all the patients and dealing with illnesses on their own independently. I’ve learned that starting up a business and running a business takes a lot of admin work and bringing on physicians allows me to take a step back every now and then and almost completely unplug.

I’ll absolutely post the financials as I go along though, even when I hire another doctor or NP.

Congrats on having a smooth running model! I hear that if you outsource billing, they take about 7% of the collections.. Did you include billers Payment in the employers list.. What EMR are you using now and do you like it. Did you take straight Medicaid when you started?

Hi, Thank you!

Billing companies I have found will take anywhere from 4-6%.

I have a biller in house so part of the overhead is collecting money and submitting bills.

I am currently using practice fusion.

I do not take straight medicaid. Where I am at, the fee schedule is so bad for medicaid that I wouldn’t even cover overhead with payments.

Thanks for checking out my website

Thanks for the reply!

Did you have any trouble contracting with the insurances.. like closed panels or capitations or holding you for too long?? If so, how did you manage.

I have a scenario where I’m independently credentialed but was contracted under a different employer tax ID. Now that I plan to establish my practice under my tax ID, I need to negotiate contracts with the insurances.. I’m trying to figure out if it will be to hard and if I have to take MSO or IPA help with contracting under their group rates, but there will be MSO restrictions..

I appreciate any input.. Thank you again!

Thanks for this encouragement. I am early into staring my own practice as a mid level for home care primary care and already exhausted… you have encouraged me today.

I’m happy to hear that I encouraged you! Best of luck on your endeavor!

This is great info. I’m an NP and have been open for 5 months and as of now I have about 850 patients. Looking at your numbers above, my question is: how did you do it with so few employees? I have myself, 2 MAs and my husband (he is an LPN up front to make appointments and also handles billing. I’m seeing about 15-18 patients per day. I will say, my MAs are great , but only one can draw labs. It puts a burden on us when someone needs to be off. We went through a few rough weeks also due to employee and child illness. I don’t want to burn out my assistants for sure, but also want to make sure that I do not become too top heavy. We did come from a corporate model where there was enough staff and the workload was not heavy. My patients are familiar with all of us as their care team. I am considering hiring someone else just so I can relieve myself of admin duties and my husband can mostly manage. The position would be part time at 24 hours per week. We also have 2 kids that are very active. Should I hire an additional person? I know we are going into sick season soon and I would expect to see at least 20 per day. Thanks for any advice!!

Hi,

You need to automate. If you are solo, and you are seeing 18 pts a day, your check in forms, scheduling, everything should be automated. When I was running solo with 850 pts, I automated all of this. I also had an external biller while I was solo so I did not have to have them fully on staff since it would have been too much in payment for just one person bringing in the income. If blood draws are burdensome then send them to a lab nearby to get the blood drawn done. Push people to message in rather than call…that eats up a lot of time.

Do an audit of where you think everyone’s time is being spent and ask yourself is there a better way to accomplish this task. Instead of a patient spending 5 minutes on the phone trying to get insurnace information, send them a text, tell them to take a picture of it and text it back in. Lots of ways to be creative to get your employees off the phone and helping with seeing more patients more efficiently.

Very happy for your success! Everything is a journey and even though the initial phases were tough, look at you now! Congrats!

Thanks for the kind words! Have a good day.

Great job on getting your practice running! Overall, how quickly (months) did you fill up your panel?

I started totally from scratch and reached 5000 patients in my panel in about 18 months. That’s when I felt totally overwhelmed and stopped accepting new patients. Looking back I probably should have cut back earlier. However, I hired new doctors to join my group and they have been growing their practice.

Wow!!! Where was this?

I was subleasing from a surgeon. This is located in a major city in Texas.

Finding this post today has really lifted my spirits. I’ve always been so close to opening but then fear of the unknown gets the best of me. Also, did you take out a business loan to open or did you finance it yourself.

I financed everything myself by doing locums. The only exception is that I did take out a loan to buy the building that I am currently in.

This is great information and a great exercise for providers to gain an appreciation of a practice balance sheet. I helped my wife start her solo PCP practice 20 years ago with a few patient charts and a file cabinet. One note about the above numbers: Be sure to run them for the reimbursement AVAILABLE in your area. Most private PCPs in our area make their expenses on a capitated plan that new practices don’t have access to, so our revenue was all FFS—at about $60 a visit.

That number changes things, as a provider would need to see about 35 patients a day for 20 days a month just to break even on the above expenses, which is almost double the above patient visits a day.

It is great to see a provider sharing information to help others. I have been amazed at how little sharing exists in practice management among providers.

Thank you for sharing your experience! I’m sure many will find it very helpful. As for expenses, it seems like you didn’t mention anything about medical equipment. I’m really wondering how much money it might take to buy equipment. They say that it’s extremely expensive.

Hi,

What type of medical equipment? Yes, some things are very expensive. Exam tables are about $1000 – $1500 each. Computers about $1,000 each. We paid about $300 for our EKG machines each. Yes, you can spend a lot of money on equiptment if you are going to need surgical supplies or asthetics devices.

I appreciate this essay. I am also considering private practice, and there doesn’t seem to be enough guidance these days as most, if not all, of my colleagues are employed by a big hospital. There is more doom and gloom about decreasing reimbursements and increasing administrative headaches imposed by CMS, than the upside. It’s nice to hear encouragement from another doctor for a change. I just found your blog, and look forward to learning more !