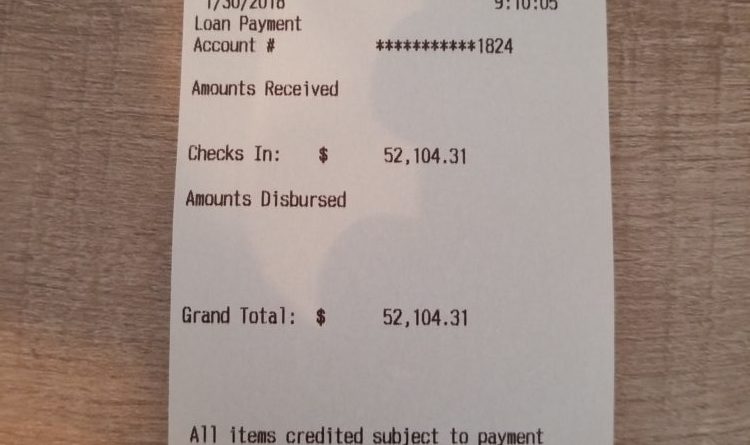

How I Paid Off $150k In Loans In 1.5 Years

About one and a half years after graduating residency, I paid off all my student loans! In total, I paid off about $150k in student debt. Yes, this post is a bit delayed since I paid off my debt almost 2 years ago but it is one of the most common questions that I get emailed to me. How did you pay off all your debt so quickly? … Read the rest

Read more