10 Reasons To Buy A House During Residency

A good financial adviser or blog would almost never make a blanket that applies to everyone and the same goes for this blog and the reason for this post. My last post touched on 10 reasons why residents should not buy a house during residency. For many residents, buying a house for residency is a poor financial decision. However, for some resident physicians buying a house may actually make sense. There are a lot of benefits to owning a house, many of which involve unique individual factors highly influenced by local markets and future job prospects. Some other blogs may tell you that renting is almost always the right decision. I do believe that many residents fall into a category where renting is the better option but its not the right option for everyone. For those who do not fall into the renting is the obvious choice, here are 10 reasons why you should considering buying a house in residency.

Many residents extend training beyond residency

Extending training by 1-3 years beyond residency for fellowship alows for more application of the house or condo. In this case, if you plan to stay at the institution where you did residency it may make sense to buy instead of rent. There is some risk with this scenario, you still has to match to fellowship in the location where you bought the house. In certain markets such as NYC, LA, NOLA, and Houston there are multiple programs to apply to. Applying to multiple programs in each city will help ensure that you will end up staying put for fellowship, making home ownership work in your favor for the long run. Analyze what your chances of extending training are and how likely you are to stay in the same city. If the chances are high then it might make sense to buy instead of rent as you will be in training for 5-7 years which in many markets give you a good change to make money over renting.

Become a landlord to eventually cash flow the property

If single and in a long training program such as surgery where the program takes 5 years, then getting a roommate while owning a property can give you extra cash in your pocket every month. This comes with the stipulation that you must be okay having a roommate or someone living in your house. You must also be okay with keeping up with maintenance. If those things don’t bother you then you can potentially make extra money off of the purchase in certain markets after you eventually move. There are hundreds of website, blogs, and postings about physicians who love to invest in real estate. If this is something you know and something that yu desire to eventually do (become a landlord), then do your homework and consider staring early.

Provide more room and less frequent moves for your family

Don’t forget to thank the person who supports you though residency and for many residents that person also includes a family. If a house is affordable and the spouse has a reliable job its not unreasonable to consider purchasing a place to live, especially if residency will be 5 years. It’s not realistic to put life on hold and to ask the family to take on extra burden to live in a studio apartment in some locations. Taking your families needs into consideration for living arrangements. They should be a priority as they are supporting you though one of the hardest times of your life. Discuss what their needs and wants are as a partnership and family but do so realistically.

The bottom line is not the number one priority to every person

Chances are that if you found this blog then you are the type of person who puts financial stability and retirement as a top priority. Just like there are many colors in a Crayola box, there are many ways to live ones life (right or wrong in your eyes). Even after crunching the numbers and time spent on rent vs own calculators, to some residents its worth having a place to own where memories can be built. Even if the calculator tells them this type of person they will come out slightly behind with renting, the emotional factor of owning a place is worth it to them. Not everyone focuses solely on the bottom line for every life purchase and I’ll concede that. It might not make you rich but there might be a wealth of reasons otherwise for a resident to buy a house. For example, one of my classes mates bought a condo to have a secure place for his grandparents to stay every time they come to the US from China to assist taking care of their new child. Another friend of mine bought a condo to help his sister-in-law have a place to stay near the medical center for her cancer treatments. This person is in a 5 year program and felt there were many benefits to owning over renting beyond the profit and loss statement.

Tax break

I’ll right away concede that this is a weak argument but its still somewhat valid. The money paid in mortgage interest can be deducted from your taxes. You will have to possibly talk with your accountant or run the numbers yourself to see if this benefit will actually have any impact on your decision to buy vs rent. In many cases, the tax break of owning a home is not a large factor in building wealth or making buying a better financial decision

You can put your stamp on where you live

Living in an apartment means that you have to abide to all the strict rules of the complex. This means no painting of the walls or changing out the fixtures on the sinks. Making a house or condo feel like home can be an excellent thing especially after a long call and for those with a new family. Some residents make do while renting, others like to DIY and change hardware around the house. This type of behavior would most likely be off limits for renters. Buying offers the benefit of no one limiting you on what types of changes you can make to the inside within reason (structural or code limitations)

Build equity

As discussed in the 15 vs 30 year mortgage post, most mortgage payments in the beginning apply to the interest and not principle. Over the course of 5 years or more its likely you will build some equity in the place that you have bought. When selling the house this equity will be paid to you if the selling price is more than what is currently owed. There is a risk that the price of the house may go down, but even if the house stays the same price each payment builds a little equity in the house.

Gifted by a relative or parents

Parents with money to spare and multiple children who are interested in obtaining an education in one location may end up buying a house or condo in an effort to have multiple children use the house for schooling. This has worked well for many of my friends. The catch is that money and family often does not mix well and there are numerous opportunities for disagreement and arguments. If the family can make this work, there are huge potential finacial benefits. If not, there is also a large downside of creating a rift in the family

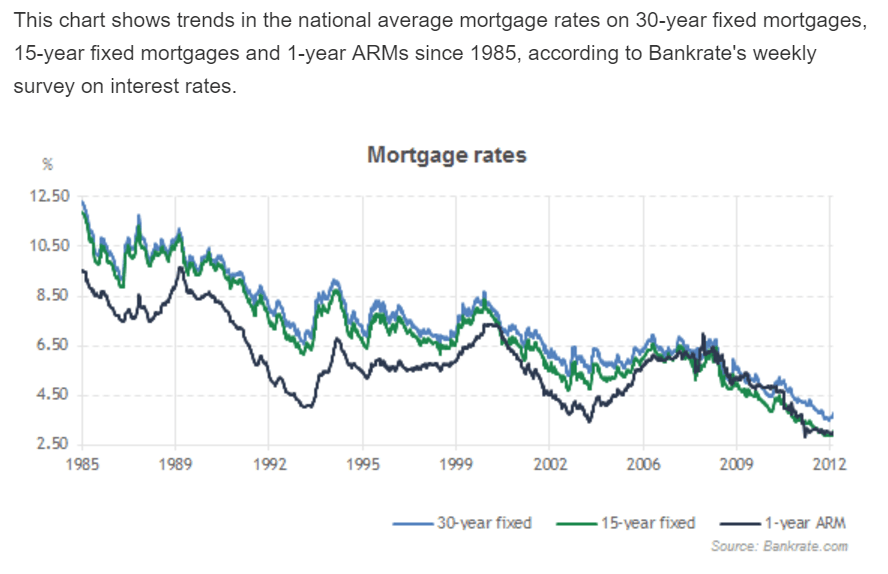

Loans for houses are currently at all time lows

Borrowing money is currently quite “cheap” and with many speculating that rates by the fed will raise soon. This argument has many risks with associated with it since if the rates rise there is the risk of borrowers having a harder time getting a loan and subsequently more difficult to sell the house/condo. Regardless, the low interest rates have been sparking more individuals to buy in an effort to lock in a low fixed rate for the 5+ years of residency and fellowship.

If your spouse has a non resident salary in a stable job

Having a significant other with a reliable income and stable job can add to the argument to buy a house instead of renting. Especially if residency is longer than 3 years and the couple is able to save up some money for a down payment. Dual income families are a quick way to build wealth and will be much easier to pay off a mortgage compared to a single person with student loans.

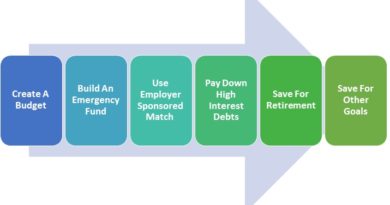

Overall to rent vs own is dependent on many factors and a very personal decision. Overall I do tend to favor renting for residents unless in the following situations:

- Residency is 5 years

- Mortgage monthly cost vs rent cost ratio is <1 ( 1.5 in HCOL areas)

- Plan for fellowship after residency with more than one program to apply to in the city where you will be buying

- Rent vs Own calculator state break even point is 3-4 years

- Must be okay either fixing or calling someone to fix broken appliances even post call

- Be the type of person who likes to take some moderate to high financial risk at that stage in your life

- Preferably have a dual income situation

- Buy in a good location with good resale or ability to rent easily

Thanks for the post, great summary at the end. I was one of the fortunate ones to own a property during residency and kept it afterwards. It provides a small amount of cash flow and is being paid off by a tenant. Twenty years from now when it’s fully paid off, it’ll provide some fantastic cash flow.

That’s fantastic and will provide continued returns for many years to come! Some of my friends who bought are making great money off their house or condo. They are excited to add more places to their portfolio.

Thanks for sharing your insights. I was told before that buying the property during residency is a great thing, I didn’t believe it until now.This really helps me!

No problem Rachel, I’m glad it could help. Each market is slightly different. In the right market for the right person, there are definitely advantages to home ownership! Thanks for reading.

ID

Pingback: 10 Reasons To Buy A House During Residency | Passive Income M.D. | Passive Income for Physicians

I find this topic very interesting. This a lot to consider! Unfortunately, we bought a small house in med school that takes up too much of our monthly budget. That’s the kicker for me. More margin would be good. But, we have a 7-month-old so the space is really nice, and we are 0.1 miles from parents who are extremely helpful, so the location is unbeatable. Because we could only afford a 30 yr mortgage, we aren’t building a “ton” of equity, but if we need to move in 2 years for PGY-2, then we might walk away with 10-15K, which would be nice~ very market dependent though. Or, I’m toying with keeping it as a rental. Because the mortgage principal is still high, it wouldn’t be a huge cash flow during residency, but even if we could just hold on to it/break even for 5 years, it would be quite beneficial once I start practicing and am able to attack the principal.

I think this is a terrible post. While it’s entirely possible to buy a house during residency and have it work out well, I think it’s a poor default choice. Let’s take your points 1 by 1:

1) Even if you extend training beyond residency, there’s a halfway decent chance you’ll be somewhere else for your fellowship and need to sell or end up being a long distance landlord. Both lead to bad outcomes most of the time. Just not enough time to recuperate transaction costs (15% round trip) through appreciation and long distance landlording is expensive and ineffective due to the difficulty and cost of hiring good property management.

2) You don’t buy the same kind of place to live in that you buy as an investment. One aspect or the other will suffer, Usually it turns out to be a lousy investment.

3) You can rent a place just as large as you can buy, probably for less money, at least in most communities. I don’t know why people think you can only rent apartments and not houses. Most landlords would love to have a resident stay in their place for 3+ years straight, so no need for “frequent moves.”

4) You can build memories in a rental house just as much as one you own. That’s nonsense. Your memories don’t go away when you sell a house do they? Of course not. Silly argument. Now if you want to buy a house just for the experience and recognize it’s probably a bad financial move, then fine. But recognize it’s a consumption decision like buying a car or a European vacation, and probably not one you can really afford as a resident.

5) I agree, the tax break is a weak argument. Most residents end up taking the standard deduction and really don’t have much of an income tax bill anyway. Maybe if you’re married to another professional or something then it makes a little more sense.

6) Again, you can rent a house and many landlords will let you make a stamp if you like (and will even buy the paint if you’ll do the labor.) But again, that’s a pretty expensive consumption decision there.

7) You can also lose equity. The point isn’t “building equity,” the point is whether you’ll build enough to overcome transaction costs and the other costs of ownership.

8) Okay, if someone else is going to give you a lot of money to buy a house, then sure, buying a house is going to work out better than renting.

9) Interest rates are still very low, but not at all time lows. But I guess you wrote this in 2016, so I’ll give you a pass. 2012-2013 rates were about the same though.

10) The spouse aspect does help make it a smarter move, but if you’re still moving in 3 years, it’s probably not enough to make it work out well.

Residents should rent most of the time. Buy a house when you’re in a stable social and job situation that you expect to persist for at least the next half decade.

I did not know that a medical doctor in training can extend his residency in order to increase one’s chances of getting a house to settle in. My son wants to study medicine when he goes to college and your tip gave me a great idea. I will find a real estate agent to look for houses he can stay in. Doing this will help him be prepared in the future.

My spouse has a stable job and isn’t a doctor so we should probably buy a home if there are some properties for sale. This way, we can put a stamp on where we live so my relatives can visit me while I train. Also, it would be nice to get some tax breaks so I can start saving for our future children’s tuition.

Pingback: Should You Buy or Rent a House During Medical Residency?

Pingback: Buy vs. Rent (for 3-5 years) | Physician Home Advisor

Pingback: 10 Reasons To Buy A House During Residency - Passive Income M.D.