How to Choose a Financial Advisor

By the end of residency I would be willing to bet that many graduates had at least one financial planner give a talk to their class. My residency was no exception with multiple groups who billed themselves at wealth builders came to visit out campus to get people to sign up for their service. Some of them were good, but most others had complicated fee structures and aggressively pushed poor investment choices such as whole life insurance. Picking the right financial planner early, if you decide you need one, can potentially save thousands of dollars in fees or more in poor investments.

What are financial planners?

Financial planners advise their clients on how to invest, save, and plan for retirement. Their services can range from helping set up estate planning to being available to consult on any financial question that may arise, such as car or house buying.

Financial planners are not individuals who are accountants to do your taxes, a stock broker who will exclusively buy stocks, or insurance agents to sell you home or auto insurance. They exist to look at your financial big picture and help you achieve your goals.

What does it take to be a financial planner?

Anyone can call themselves a financial planner. There are some non profit organizations that exist and offer certification as a financial planner. The most widely known one is a Certified Financial Planner (CFP). If a financial planner has these initials behind their name, they have at least passed the minimum educational requirements dealing with financial planning. According to their website courses include education, examination of skills, experience, and ethics in financial planning.

Not all financial advisers are equal. Ask if your financial planner is a fiduciary. This means that they act in your best interest. Seems like common sense, but some financial advisers will push products that allow them to get a larger commission when the product is not the best fit for their client. A fiduciary means that they have pledged to act in their clients best interest at all times.

Watch out for fees

Since residents do not have a lot of money and are hesitant to spend money up front some financial advisors will instead ask for a larger percentage of fees. When I was a resident, every group that came through billed themselves as a no up front cost to have them manage your wealth. Once I got in contact with these groups, hidden in the fine print is a 2-4% fee for managing assets.

Since I had little to no assets as a resident or new attending it would be easy to gloss over. As assets build over time the 2-4% of fees per year quickly add up to a substantial amount of money over time. Be sure to read the fine print. Annual fees should be 1% of all assets or less. Don’t be surprised if as a new attending with little to no assets a group either declines to represent you or asked for a set feet up front.

Who should use a financial planner

There are numerous reasons to use a financial planner. Some of the most common include having a lack of personal finance and wealth building. Another reason that my colleagues or family have used them is to help with asset allocation in complex and large retirement portfolios.

If ever lucky enough to build a large amount of wealth, it may be beneficial to have someone managing all the different assets since this can take a considerable amount of time. Of course, any individual is free to invest as they please and not use a financial advisor. Some websites such as Vanguard have created target retirement dates that have a “set it and forget it” kind of mentality. The asset allocation is done for you and changes over time to mitigate risk. These funds also have fees since you are paying this company to manage your retirement funds.

Ask about their experience and do a background check

When I helped manage the family business I learned a key lesson. You can never judge a book by their cover. There was one lady in particular who we were going to high to help with accounting. We gave her a conditional job offer upon a background check. About 48 hours after the meeting the background check returned positive for 2 counts of money laundering. We asked why she didn’t mention it in the interview and she told us she was under the impression her lawyer had those records sealed and it wouldn’t come up. So much for complete honesty.

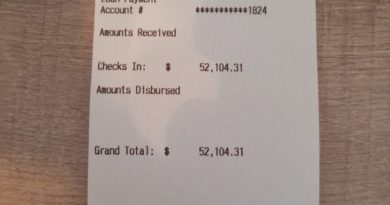

Hiring a financial advisor will give someone access to as much of your accounts as you allow. This is one opportunity where I would do a thorough search to ensure that the company and person helping has the clients best interests at heart. The $50 background check may save you a lot of money and heartache in the long run.

Avoid people who make outlandish claims

If a financial advisor claims to make you a 10% rate of return per year, that’s a huge red flag and I would walk away. Be realistic in your expectations and look for an advisor who will be realistic with meeting your needs. This may mean mitigating risk at the sacrifice of possibly increased returns. Or, this could mean taking an aggressive approach with more risky investments knowing that possibly more money could be lost than if invested in other ways.

Ask how often investments will be monitored

No investment advisor will be watching a single clients portfolio every day, or even every month. It is important to know how often they will be giving you feedback and monitoring your portfolio. Having someone only look over your finances one or two times a year and paying them 1% might not be the best fit for their type of services. If all you need is one time advise, there are individuals who would be happy to look over a portfolio and give their opinions for a fee without actively managing.