The fiancée and I are getting closer to saying “I do” and part of our conversation of things to do before the wedding turns into a discussion about finances. I run a personal finance and investing blog for doctors, so this should not be a huge surprise to my readers. Luckily, my future spouse and I appear to be almost on the same page financially with our wants and needs. The main difference is that she is slightly less able to accept risk with investing and I am okay doing so since we have time on our side to recoup any potential short-term losses. Below is a list of things that I think need to be discussed prior to marriage or any long term serious relationship.

Whats your number?

I’m not referring to how many partners your significant other has been with, I mean debt. How much debt is the other person in? Most individuals who have gone to college or some level or higher education have student debt. Finding out how much debt the potential person you may marry should be one of the earliest conversations to have. This doesn’t need to be a heavy conversation on the first date, but within the first several months I think this question should be answered if the relationship is heading towards potential marriage material.

My dad always told me that if you want to really know someone, manage their money. How people spend their money can tell you a lot about their habits, their ability to take risks, and if they are planning for the future. As much as I love my significant other, if I heard she was $500,000 in debt then I would have to either accept that this debt would significantly alter both of our lives or choose to move on. This might be a little controversial to say, but marrying someone with an excessively high amount of debt will alter your future and delay big purchases such as a house for years.

What is the plan to pay off any debts

Now that you know how big the mountain of debt is, if any, then the next step is how do they see this debt being tackled. There are many different methods to paying down debt including:

- Public Service Loan Forgiveness

- Income based repayment plans with eventual PSLF

- Employer debt repayment

- Expecting family to help with debt repayment

- Expected windfall (such as a trust fund payment expected at a certain age)

- Refinance to a 10, 15, or 30 year payoff date

- You, the significant other

Every problem needs a well thought out plan, even if it doesn’t go exactly as expected. Debt can be a big problem and it needs a plan to destroy it. Asking the person you plan to marry what their plan is will give you a better outlook at what they think the financial path looks like to being debt free. Getting on the same page is the next step.

Create a budget together

It’s not sexy, but sitting down and creating a budget will help avoid overspending. It’s easy to overspend on the person that you love and experiences that both people want to have to form memories together. Creating a budget will help keep expenses reasonable for current income and create opportunities for rewards. For example, my significant other and I put some money away each month with the plan of a yearly nice vacation. This way we don’t overspend on the vacations and have something to look forward to. Here is our budget when I was a resident.

Another one of my friends realized that when he and his now wife moved in together that their budget did not go as planned. He was spending his money on living expenses and instead of her saving the money she made, she was spending it on buying new dresses and shoes. The budget should include shared expenses such as rent and personal expenses for each individual.

Who will be working once children are added to the household

Currently we are a dual income, no kids (DINK) couple. Once we have children, my fiancée plans to stop working for the first year. We will save money on day care and a nanny but will lose her income. Having this discussion early will avoid putting a new family in the position of not having an option to pause working to take care of the children because the budget relies on both incomes. As doctors, our incomes are often at levels where we have the luxury of having the option for one person to stay home. Know what the other person expects and budget accordingly.

Insurance

There are a lot of different types of insurance for various needs. First, figure out what your financial needs are as a couple. Then determine what kind of insurance and how much insurance your family will need. If you are the breadwinner, your family will depend on you financially. Its important to know that if a disaster were to happen that there is enough disability or life insurance present to help the family though such a terrible time. You don’t realize how bad you need insurance till you actually need it. In my about me section on this website, I talked about how I lost everything without proper insurance. It was an expensive financial lesson, and a mistake I wont make again.

Prenuptial agreement

Early in a new graduates career, most doctors will not have any assets to their name. This means that a prenuptial agreement may have little to no benifit for a couple who is deeply in debt with no physical assets. However, if one person has a lot of assets prior to the marriage that they would like to be protected, then it is worth talking about a prenuptial agreement. An example of when this may helpful is if one person has inherited part of a family business prior to marriage and would like to keep things separate in the event of a divorce. The more assets that one person has before entering into a marriage, the more I think this should be considered.

Retirement

Who will be contributing to retirement and in what ways? If one person in the couple does not plan on working, then a discussion needs to occur about opening an IRA. Talk about how both of you plan to save for retirement and how much money is needed at retirement to pay for the desired lifestyle. The earlier savings begin, the more you can take advantage of compounding interest.

Who manages the money

Some couples have a joint account, separate accounts, or both. Discuss how money will be split, shared, and who will be responsible for keeping track of the finances. Each individual can maintain their own autonomy and accounts. However, a discussion needs to occur who will be filing taxes if jointly, and who will be in charge of paying large bills monthly. The couple needs at lease one person checking in on finances and taking the lead.

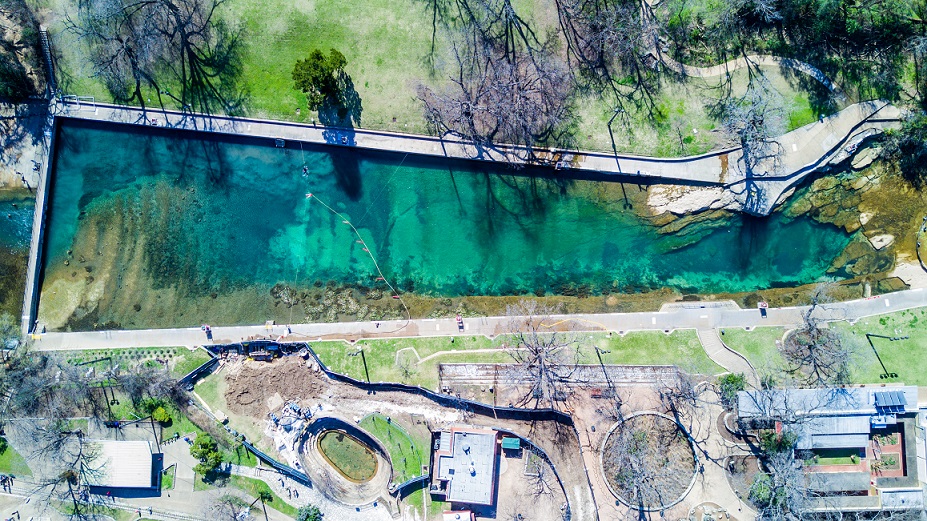

I hope you enjoy the pictures above taken around Austin, TX with my new Drone! The first is downtown with the state capital, the second is Barton Springs Pool.

Nice overview, ID. So many considerations. My wife and I went through a bit of mandatory pre-marital sessions with the Catholic church. They ask a lot of money questions to make sure you know each other’s habits and understanding of financial issues.

I didn’t consider a pre-nup either, but there are reasons it might make sense that I never could have conceived. I guess that’s why we have lawyers, and why they sometimes write up clever guest posts (http://www.physicianonfire.com/divorcecourt/)

Cheers!

-PoF

Funny you mention that PoF, we are both Catholic and will be going through those sessions soon. Thanks for the link, somehow that’s one of your articles that I missed!

Those sessions should give you good fodder for another post. Peace be with you.

PoF always has the best guest posts 🙂

Definitely consider a prenup regardless of existing assets as of the date of marriage. It can help both parties deal with changes in circumstances down the road without risk of ending up broke or, you know, hiring me to prevent that!

Thanks for the comment, I really appreciate that! Having the prenup conversation was not as big of a deal as I thought it would be. I wondered if she would react negatively, but so far so good. It’s definitely not a fun talk but an important one.