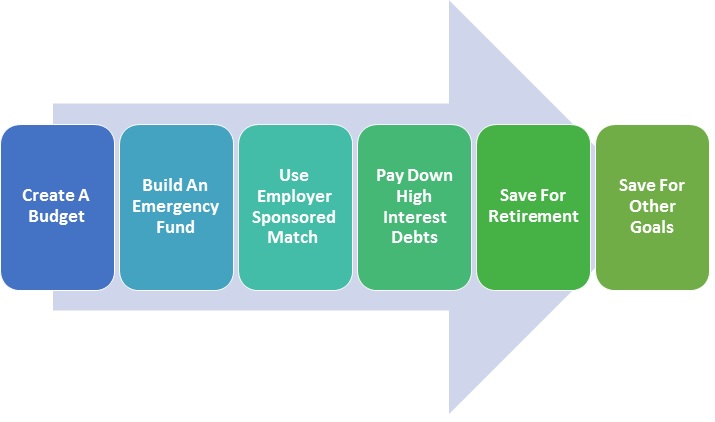

Graduating medical school, residency, or fellowship is an exciting time as you turn to the next chapter of your career. After all the years of hard work, the paychecks have finally started to roll in. The next problem is deciding what to do with the money from those larger paychecks. I previously wrote about financial changes from going to a resident to an attending. This post is a complement to that post and will discuss the first financial steps needed to budgeting and allocating money for new doctors.

Financial Step One, Create A Budget

If you have not started working yet, then take a look at your contract to estimate how much money you will be making each month. Once you have a rough idea, use an online calculator to subtract taxes and figure out your estimated monthly net pay. If you already have a job where income can fluctuate, take an average of the last 3 paychecks to determine potential yearly income.

These gross estimates will give you an idea of how much money there is to use each month. Before I started working, I asked my group what the average salary for doctors in their first year with the group. I then subtracted 10% from that amount to give myself some wiggle room when estimating my budget. If you’re not savvy with budgets, no worries. Here are the two that I have tried before and recommended.

- Mint (Free)

- You Need A Budget also known as YNAB (Not Free)

Build An Emergency Fund

One of the first goals is to first have 3 to 6 months of expenses set aside in a savings account. Ally is one of the savings accounts that I use since they offer 1% interest. There are many other banks that may offer a competing rate and feel free to message me ones you use, I’ll be happy to include it. The goal for an emergency fund is to have the money in a liquid account, which means the money can be accessed within 24 to 48 hours without any stipulations.

For single individuals with minimal assets, a 3 month emergency fund may be adequate. For families or individuals with fluctuating incomes, 6 months of expenses may be more appropriate. Find out what your comfort level is, but having less than 3 months available is not advisable. The emergency fund should be set aside and not used for anything else. This is not savings for a house down payment or any other large purchase.

Use Employer Sponsored Match

If your employer offers a match, take advantage. Its free money and basically an instant 100% return on your money put into the account. For example, if your employer offers a 3% match of gross income towards 401k, then if you put in 3% they also put in 3%. Its free money and money that should not be passed up. There are very few occasions in life where 100% return on money is guaranteed as is the case with a company match.. Avoid high fee retirement accounts since they will end up costing you thousands over the years till you retire.

Pay Down High Interest Debts (Especially Non Deductible Interest)

High interest debt is anything over 4-5%. The odds of obtaining a higher return on investments at this level of interest is quite small. Some people will argue that they want to invest in the stock market to try and make higher returns than the interest on the loans. At most doctors tax brackets, assuming 33%, then you would have to earn 7.4% return in order to have post tax returns equal to that of the student loans (assuming average interest rate of 5%). You might be able to pull it off, but shooting for 8% returns or higher per year in the stock market is highly ambitious. Most of the time a 6% return per year is assumed to be the expected average over many years.

Another reason to pay off high interest debts such as student loans debts is that this debt can not be tax-deductible at doctors level of income. The income cutoff for a tax deduction on student debt is $80,000 for single individuals, or $160,000 for couples who file jointly. The same can be said for car loans or other personal loans. Housing loans are different. The interest can be tax-deductible and this is a slightly different situation for another post in the future. Pay down interest on these accounts where you are losing the tax benefits.

Save For Retirement

Open a Roth IRA and max out 401k/403b plans. Other tax beneficial plans include HSA for health care and 529 plans for college tuition. Take advantage of the tax deferred accounts and start saving for retirement. Starting early in your career will allow for decades of compounding interest. Develop a habit early to max these retirement accounts and avoid decreasing contributions for lifestyle inflation. You want to have the luxury of being able to retire early on your own terms. I don’t know of many doctors who want to continue taking 24 hour calls into their 50’s or 60’s. I know that I want to be able to retire eventually on my terms not work till I’m 70 because I can’t afford to retire

Save For Other Goals

At this point you have reached all the above goals. You have maxed out tax beneficial plans as above and can start choosing to spend money elsewhere. Congratulations since this is the money where you can put towards the goals or wants that you have. Allocate your money for whatever your needs are. For example, if the plan is to buy a house soon, start saving for a down payment. If the plan is to save even more money for early retirement, then open additional investment accounts and continue to save. Whatever your financial goals alternative to above are accomplished in this step.

On a doctors level of income, all of the above steps should be obtainable. If student debt is too high, take these steps in determining how to attack a high level of student debt.

Do you have any other tips for financial steps for new attendings? Were you able to achieve all of these steps?

Great points, concise and accurate. I’m sure you could have spent pages on each topic alone.

I would advise any new attending to draw out a life-plan for themselves. Debt can seem daunting, starting a new job scary and the thought of more debt in case of a home nauseating.

The money you make as a doc is gonna be insane amount of money, make a plan with it and if you don’t know how ask someone to help you and then set out to achieve it.

I agree doctor Mo. The money can seem like an insane amount of cash for new graduates but there are lot of ways to spend it if not wise.

I agree with everything that you said. First all, a budget should be established and followed.