In many ares of medicine, there is the ability to undergo additional training for specialization. For most specialties, additional training via fellowship usually means increased income. One example of increased income is a physician who completed an internal medicine residency and then goes on to complete a cardiology fellowship.

Internal medicine is a 3 year program. Cardiology is at minimum another 3 years of fellowship beyond internal medicine training. The pay as a cardiologist or GI physician is drastically higher than a general Internal Medicine physician. However, while in fellowship physicians in training have very low-income compared to graduated non specialized physicians. Some physicians who choose not to specialize will say that they are completing a financial fellowship post graduation by working like a resident and living frugally.

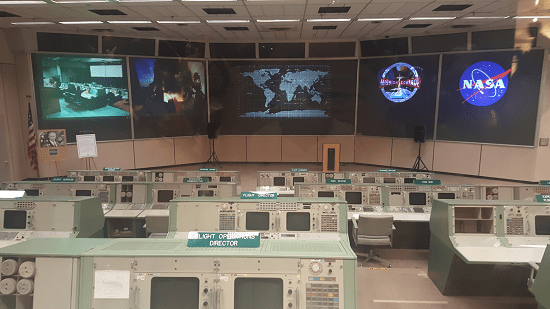

Picture is from recent trip to NASA and is the actual mission control room for Apollo missions.

What Is A Financial Fellowship

Financial fellowship is a term that physicians who did not specialize are more frequently using. They will sometimes describe a financial fellowship as working for extra income and living frugally, like a fellow. This effectively minimized some of the income difference between those who did and did not specialize.

For example. the average cardiologist salary according to Medscape is $410k while the average internal medicine who did not go to fellowship is $215k. The difference in training between the two is as little as 3 years.

By choosing to work “like a resident” for the 3 years post residency and complete a financial fellowship, the difference in pay becomes less dramatic over time. However, lets not kid ourselves. The specialized physician will out earn me and other un-specialized physicians over the span of their lives if the medical environment does not drastically change.

How Much Money Is Saved Up During Financial Fellowship

Lets say I live like a resident, picking up extra shifts and live like a doctor still in training. In effect I’m completing the financial fellowship with a savings rate of 50% of my gross pay or more by living frugally. At this savings rate, I can expect to contribute at least $175,000 to my account for the 3 years while the cardiologist or other specialty physician finishes fellowship.

Putting the money in an index fund with a 6% rate of return gives a total of $788,344.48 after 3 years. This assumes that the cardiologist in training puts little money towards savings. Part of this assumption is because interviews eat up savings and are costly.

The first truck that InvestingDoc ever owned is still on the road. Interior is bright red

How Long Until The Specialized Physician Has A Higher Net Worth

Lets assume the internal medicine physician decides to complete the financial fellowship then drop down to average income ($215k). After all, no one can be expected to work like a resident forever. The cardiologist would have to work only an additional 5-6 years after their graduation before having a higher net worth.

Assuming that the average physician took no breaks in education, the cardiologist would theoretically have a higher net worth at 39 years old. After 39 years old, the physician who specialized will have a much higher life long earning potential. The difference in savings will be dramatic by the time of retirement between the physician who did specialize and did not specialize.

The Financial Fellowship Is Only Temporary

The financial fellowship lasts only as long as the hard-working physician is willing to keep up the same pace. I think living and working like a resident is not a long-term solution. This is most likely a large reason why you don’t see very many old hospitalist.

I’m not using the financial fellowship as an argument not to specialize. I don’t think anyone would advocate for a lower pay specialty unless they really feel a calling.If a young physician is willing to work hard, it is possible to complete a financial fellowship to see a huge boost in income to get rid of student loans, pay for a house, or save for their children’s college fund. This helps minimize the financial hit that non specialized physicians take after graduation.

I’ll keep working hard for the next 2 years in an effort to complete my financial fellowship. As of right now I’m on track to out save even my own estimates as above!

Cardiologist sure do make a lot and a financial fellowship is a great idea. Problem is most of us won’t do it. We want too much and too quick after fellowship. Key is figuring what makes you happy and maximizing time and money on that.

I agree that most of us don’t actually follow through with the idea of completing the financial fellowship. We as physicians delay so many life milestones that upon graduation its not uncommon to want everything all at once like you said. Many of my friends love their week off too much as a hospitalist to even consider picking up extra shifts. To each their own!

Agree with the mentality here. I believe you should subspecialize only if you’re truly interested in it. I feel like some people force themselves into fellowship because of peer pressure, ego, money, etc. For those without a strong subspecialty interest or who don’t mind general medicine, doing outpatient or inpatient IM can be a pretty good gig and can give you a jumpstart on savings. Many of my friends who stayed as generalist (either in/outpatient) started off in the $200k-$300k range, depending on location, academic, hours, etc. For most of these people, there’s plenty of extra time to moonlight, doing 1-2 moonlighting shifts per week can tack on an extra $50k-$100k. Working in a LCOL or no-income tax area can boost your savings further, and these places typically pay more too. Do this for a few years, hustling hard while you still have the energy, pay off loans and pad your savings then you can start considering backing off a bit, slowing down and cutting hours, doing a lower key position, maybe moving to a higher COL and desirable area since you don’t have to worry about savings as much, etc.