What a difference several months can make. It seems like it was not long ago I ran out of money waiting for my first paycheck and now I have six months of money saved up while I have dramatically increased my debt payoff. I couldn’t have done it without living frugally while having a huge increase to my income. Several people have asked about my debt payoff is going, so I decided to provide a post to update how things have been going and where I plan to attack my debt in the future.

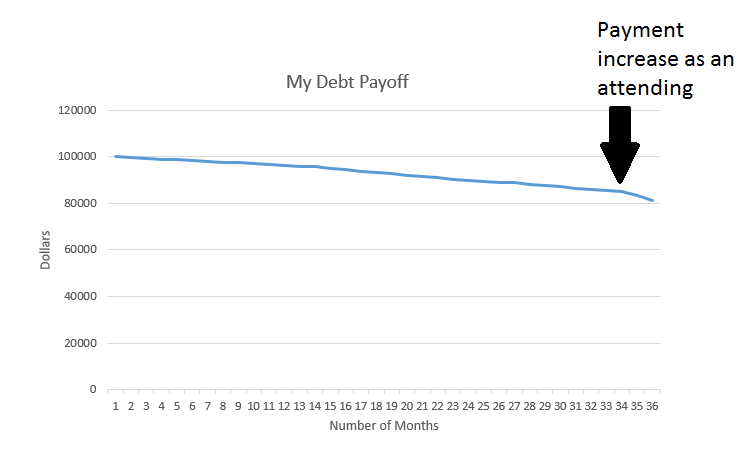

In another post, I mentioned that I initially had $110k in loans. About 10k of that was paid off in a large chunk due to moonlighting shifts. Since those shifts were a result of non regular pay as a resident, I did not include them in the graph. My payments per month have varied from as low as $250 to as high as the recent $3,000 per month. The amount that I have paid each month increased each year I was in residency. When I was given a raise, instead of increasing my lifestyle, I increased my contributions to debt pay off.

I’m excited that after graduating from residency my loans were about $17,000 lower as a result of the monthly payments

I’m excited that after graduating from residency my loans were about $17,000 lower as a result of the monthly payments- The initial year of my debt payoff was slightly depressing. The line is almost flat, but it is not increasing!

My goal:

My plan now for my debt includes a 2 year payoff plan. I arrived at this plan for 3 reasons:

- This will give me a payoff date around the same time I would have graduated fellowship, if I would have chosen to complete one

- This will allow me to save up for a down payment for a house plus a six month emergency fund. Ideally I would like to have 20% down.

- I could pay the loan off in less than a year, but the difference between paying the loan off in one year vs two years in interest is $1,348 at my current interest rate. This is hardly a lot of money to service $80k in debt over two years instead of one.

Looking back, the debt payoff curve felt almost flat for 3 years. Each payment felt like almost all of the money was going to interest and I was having any effect on the principle. I’ll admit that at times I questioned if I should be spending my money elsewhere since hardly any principle was being affected with each payment. In retrospect, I’m glad that I didn’t change my lifestyle when I received a raise and instead used that to make my debt burden even less upon graduation. I’m proof that some people can pay down medical student loans while in residency without accumulating more debt. I’ll be sure to post when the debt is completely gone!

Thanks for sharing and I’m loving the progress! Keep them coming!

Thanks Future Proof! I’ll keep posting occasional updates. They also serve as good motivation to pay off the debt.

A two-year payoff plan? Great! Nice work thus far.

Wishing you success!

-PoF

Thank you PoF. I’m looking forward to being debt free!