How I Paid Off $150k In Loans In 1.5 Years

About one and a half years after graduating residency, I paid off all my student loans! In total, I paid off about $150k in student debt. Yes, this post is a bit delayed since I paid off my debt almost 2 years ago but it is one of the most common questions that I get emailed to me. How did you pay off all your debt so quickly? My debt payoff required a lot of sacrifice and a lot of delayed gratification. At my peak, I was paying off about $9,000 a month towards my loans.

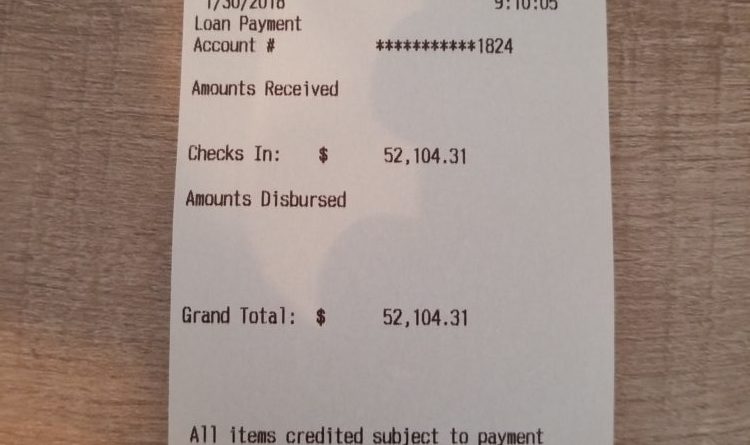

If it was not for my debt being paid off, I’m not sure I would have had the mental strength to take a risk and start up my own practice. Below are some of the tips on how I paid off my student loans. The above picture is my final loan payment of $54,104 after I grew tired of making the monthly payments and had enough cash to simply pay off the loan.

A day at Barton Springs in Austin, TX.

Make Paying Down Debt A Priority

We all have about 16 hours a day where we dedicate our time to tasks that we feel are important to us.

Step one in getting rid of debt is making your debt a priority. Without making debt payoff a priority, it is likely that excuses will eat away at your desire to be debt free.

The simplest way to motivate yourself to get out of debt is to tell yourself the truth…you’re broke. When I graduated residency I realized that I had a negative six figure net worth. Actually I was worse than broke, I was in debt not backed by anything other than a degree.

Choosing to climb out of debt and start on your journey of positive net worth is step one of turning your degree into wealth.

Make A Budget

Most new doctors fresh out of residency have no idea how much money they are earning and spending.

Make two columns. One with monthly income and another with monthly liabilities.

Any major life change, give yourself three months to average expenses and make a realistic budget. For example, if you recently had a child. Take the first three months and see how much are you really spending on diapers, food, and childcare.

Once you know how much money you are spending each month, then you can eliminate waste and maximize income.

Work Your Butt Off

There is no substitute for hard work. I worked as a hospitlaist right out of residency making about $250-300k per year. My schedule was a week on and a week off with 12 to 16 hour shifts.

On my weeks off I gave myself a few days off but then did locum tenens shifts the other days about 4 hours away. I was getting paid about $190/hour to go to a town in the middle of nowhere and take care of patients in the hospital.

All of my locum tenens money (minus taxes) went towards paying off my student loans. In my first 9 months alone I made over $100k doing locum tenens shifts.

Once I burnt out on these shifts for a variety of reasons, I turned to medical director in my own city. The money is not near as lucrative but growing and knowing the business and management side was invaluable to me. I was working almost every day out of the year, living like a resident a bit longer so one day I didn’t have to anymore.

Live Frugally But Not Cheaply

Continuing to live like a resident is only possible so long. After all, residency is one of the hardest periods of a young physicians life. Take the foot off the gas a bit and don’t forget to live your life.

I would argue that splurging on a slightly nicer apartment for the tune of $500 a month is not going to make a dent in the average medical students debt but may make a huge increase in overall happiness. There is a happiness factor that you need to achieve post graduation that is balanced with frugality.

As long as a new physician is focused, dedicated to paying down debt, and working hard, the odds are that they will do just fine. You can not be lazy and severely in debt with nothing more than a hope to become debt free in the future.

Refinance Student Loans

When I graduated, my student loans were set at 6.8% interest. Interest was accruing at $10,000 a year!

I set out to refinance my student loans. There are many places you can refinance your loans with, some can be found here.

In the end I refinanced my student loans at an interest rate of about 2.5%, saving me about $6,500 in interest a year and about $20,000 overall.

No Magic Answer

There is no magic answer that I hit a stock very lucky, married rich, or had some kind of windfall. I increased my quality of life a bit, knew my financial numbers, worked hard and didn’t have excuses.

Now that I’m student debt free, I’ve opened my own clinic that is bringing in over $100k a month.

You can do it too, you just have to get angry at the debt and want it gone.

At 2.5% interest why didn’t you pay the minimum and invest the rest in index funds? Wouldn’t you have made more money in the long run?

Good questions.

Yes, I would have most likely made more money investing the difference. The 2.5% interest was a fixed interest rate for 5 years then set to turn into a variable rate after that. I knew that I was going to start up my own practice and did not want a student loan payment hanging over my head in the event I run into cash flow issues. I had no idea how busy I would be and didn’t want to over leverage myself, forcing myself to work locums every weekend if my M-F practice was not covering the bills.

If I didn’t plan on starting up my own practice, then I would have most likely kept the loan at a low interest rate for a long time. For me, it was a huge mental factor to not have the financial unknown of a new practice with a mortgage payment and student loan payment to worry about. It helped me sleep better at night and to me that was worth more than the lets say theoretical 3.5-4.5% difference I could have had investing the money instead.