Buying A House With A Doctor Mortgage

After 11 months of searching for a house, I’ve finally bought a home. The paperwork associated with buying a house is most likely not as difficult as soon to be new home owners think. The hardest part of the process was finding a house that I wanted to buy. For those who have been following this website, you know I’ve been searching for a long time.

I ended up using a what many refer to as a doctor mortgage. I put 5% down, I did not have to pay PMI, and I had a very competitive rate to a standard 30 year mortgage. Here are some of the things that I wish I would have known when going about buying my first house with what many describe as a doctor mortgage.

Documents Needed For Doctor Mortgage

- The past 2 year tax returns

- W2 from previous employers for the past 2 years

- All bank, investment, retirement accounts for the past 2 months

- Past 2 pay-stubs

- Picture of your Medical School, Residency, +/- Fellowship diploma

- (Possibly your employment agreement) My mortgage company did not ask for this. My friend went with Regions Bank and they asked him for his contract.

There may be other documents that your bank will require. Mine (Bank of America), only requested the bullet points above. Banks will ask for signatures for your consent to run a credit, background, and employment check. Each bank may have their own requirements beyond the papers above.

Castle House Near My Hometown

100% Financing For A Doctor Mortgage

In Texas, the big lenders who offer 100% financing are UFCU and Regions Bank. Both were more than willing to loan 100% of the value of the house. There were several trade offs working with an organization that was willing to loan 100% of the value of the house.

- Interests rates were often over 1% higher than a conventional 20% down loan.

UFCU wanted to split the loan into two loans what they described as an 80%/20% loan to cover the property. The smaller loan of 20% the value of the house had an interest rate of more than 6%. Regions offered one loan at a blended average of around 4.5-4.7% interest on a 30 year fixed loan. Fees for both were about $1,500 to $3,000 higher than companies who were offering 5% down loans. If you plan on using 100% financing, just know that you will most likely end up paying a premium for a lender.

- Almost every other bank, credit unit, or lender was willing to give a loan for 5% down without PMI for doctors. It seems that pretty much every other bank or credit union has finally caught on.

- The only exception to this was Wells Fargo.

For Wells Fargo, their minimum down payment was 10%, excluding loans such as VA loans. They would not make an exception for physicians or other doctors.

SunTrust Bank is another bank that does 100% financing for a doctor mortgage but is not available in my state.

No Money Due At Closing, It’s A Trick

The 100% financing banks as above will often add an extra service to cash poor new doctors. They will often lead with no money due at closing!

If you’re asking yourself how this can be, well it’s because they are rolling these fees into your mortgage. Here is how it works.

Mortgage lenders check rates every day. Those rates change with many factors including bonds and other factors in the stock market which is beyond the scope of this article.

A doctor who is getting a loan can pay down the interest rate by buying points.

For example, I could have paid $1,900 up front for a 0.1% reduction in my interest rate. Well, moving in the opposite direction has a reverse effect. A 0.1% rise in interest rate above market rate will allow the lender to give you a $1,900 credit. These credits can be applied to closing costs and in essence, rolled into the mortgage. So instead of a 4.5 interest rate, the bank will offer you a 4.7% rate with no money due at close.

In effect, you’ve spread out the maybe $5,000 in closing costs over a 30 year period. If you kept the loan until the end, you would end up paying $4,335.48 in interest to have this privileged. Not to mention the extra money you paid on your entire loan because of the higher interest rate.

Just say no to this option. You never want an interest rate above market value. You’re not ready to buy a house if you can’t pay closing costs.

Steps To Buy A House

- Get Pre-approved for a mortgage: Call around and ask about interests rates plus estimated fees. Pick a bank and start the pre-approval process. When you submit an offer on a house they will want a pre-approval letter. The pre approval letters are usually good for 90 days. If you decide to run your credit with multiple agencies, don’t panic. Multiple credit pulls are treated as one within at least 14 and up to 30 days of one another.

- Find the house you want to put in an offer.

- Compare prices to comparables in the neighborhood and submit your offer. The offer will include many things. The most important are purchase price, financing amount, option period, earnest money, and date of close. At the same time, call banks and get up to date good faith estimates on loans and lock in a rate with the bank of your choice (They will require documents as described below).

- Once the offer is accepted, get an inspector out as soon as possible for a primary survey. I say primary because the inspector is not an electrician, structural engineer, or plumber. If the inspector describes any of theses types of problem, you may need to find a professional to give a quote for how much to fix the problem.

- Before option period expires, re-negotiate terms of contract. Back out if you are unhappy and get your earnest money back.

- If you agree on terms, option expires and move forward to close.

- Obtain insurance, survey, pay title company, and many other fees paid which the bank and your realtor will walk you through.

- Sign the paperwork on the day of closing and move in!

It may sound complicated but in reality, it was much easier than I would have thought. Once I submitted my documents, I had my doctor mortgage loan approved within 10 business days and all inspections done within 7 days from when we were under contract.

In A Commissioned Based System, Who Really Has Your Best Interest At Heart?

Real estate agents and mortgage loan officers work hard and I’m by no means trying to insinuate that they should not get paid. However, when they make a percent commission based off my transaction, I cant help but wonder if they have their clients best interest at heart. The bigger the transaction, the more they make.

If you search online for doctor mortgages, you’ll find several websites with paid advertisements by people who claim to “specialize” in these types of doctor mortgages. In reality, the bank approving your loan has someone who reviewed thousands of these and has seen all kinds of doctors buy houses. Nothing against paid advertisement in order to drum up business, but lets call a spade a spade.

My realtor is a fantastic person. However, there is one circumstance that left a sour taste in my mouth. Once we submitted my offer, she told me her favorite people to work with who do a lot of physician loans. When I told her that I called them and their prices were not competitive, she was slightly annoyed that I went with a large bank. I have since come to learn that often times realtors who refer someone to a mortgage broker will in one way or another get a kick back. Sometimes they call this a gift, other times, they buy advertising in some form or fashion after the referral is made. When I found out she didn’t disclose this to me, I made sure to voice my dissatisfaction.

Church Near My Hometown – All Photos Taken With My Drone

Good Faith Estimate

When asking mortgage companies for their rates, it’s all playing with numbers until they show you the good faith estimate. One bank will proudly say they have an interests rate of 3.5% while another will have an interest rate of 3.9%. What the bank with the lower rate will fail to mention without digging deeper is that the doctor getting the loan is most likely paying for points on their mortgage.

- Paying down points is a way to pay money up front for a lower interest rate. It rarely works out in your favor.

Good faith estimates clearly list out interest rates, fees by the bank, and 3rd part fees (such as inspection, survey, and other required documents that the buyer can shop around for).

Until you see a good faith estimate, the percent rate is likely just a teaser to draw you in. Sometimes the lowest advertised rate is not the cheapest loan option since fees can be quite high.

Don’t Expect Huge Savings

After looking at good faith estimates, you will find the same thing that I did. Each company more or less had similar costs.

After bidding the good faith estimates against each other, I then came to the lowest bidder. In the end, I ended up saving $700 by shopping 6 different mortgage companies. When you figure that inspection of the house will most likely run $500 and other fees are close to $5,000, the savings seem quite small. I was expecting more variation while purchasing a house for well into six figures. Mortgage rates are set and there is so much competition already that what you pay from bank to bank will most likely not vary by a huge amount.

You Are Still Paying PMI

Doctor loans sell themselves as no PMI, or private mortgage insurance. The way the lender gets around PMI is to increase fees or interests rates high enough to blend the PMI into the life of the loan. In effect, you are still paying PMI, only it may never go away. It will be there for the life of the loan, making a doctor mortgage a potentially more expensive mortgage over the long run.

Consider an ARM

Adjustable rate mortgages (ARM) received a lot of negative publicity around 2008-9 during the mortgage meltdown. Now, many people are frightened to obtain an ARM because of all the bad publicity.

I would argue that a doctor loan just may be a perfect candidate for an adjustable rate mortgage (ARM). This assumes that this doctor will continue practicing, recently graduated from residency or fellowship, and will avoid excess spending. Here are the reasons why I sometimes advocate for an ARM for physician loans

- Mortgage rates will almost always have lower interests rates compared to 30 year fixed.

- Most new attending physicians (and non physicians) will not stay in their first house longer than 5 to 7 years.

- Secure job market. Even if a physician gets let go from a group due to a takeover. There are always locum tenens or other jobs that can easily be found. This is often not the case for other industries where it can take a year or more to find a similar job..

Let me give you an example of rates that I received from the same bank. Lets assume a $440,000 purchase price with 5% down. The two offers were:

- 3.4% interest on a 7/1 ARM

- 4.4% interest on a 30 year fixed

- Fees for the ARM loan were actually $1,000 cheaper than 30 year fixed.

In the ARM loan the doctor will be paying $63,100 in principle and $93,138 towards interest over 7 years before the loan rate resets. Total remaining balance on the loan at 7 years is $336,900

In the 30 year fixed loan, the doctor will be paying $54,849 in principle and $119,416 in interest up until 7 years when the ARM rate would have reset if he or she choose to get an ARM loan instead. Total remaining balance on the loan at 7 years is $345,151.

When The Rate Resets

Most people who are anti adjustable rate mortgages will argue about what happens when the loan resets. Most of the time, we expect the interest rate to go up. Almost everyone falls into two categories that holds an adjustable rate mortgage near time of loan interest rate resetting.

- The house is sold before the 7 year mark for one of many reasons. Many the doctor now has a big family and needs a larger house

- Refinance to another ARM or 15 year fixed mortgage to take advantage of the lower interest rates.

Doctors who get into trouble with adjustable rate mortgages either bought too much house for their debt to income ratio, their lifestyle + spending habits are above their income level, or an event happens to minimize their income and they did not have proper insurance coverage.

15 Year Fixed Mortgage – A Brief Mention

A shorter interest term such as a 15 year fixed mortgage with 20% down will always come out as the least expensive way to buy a house. However, most people looking at a doctor loan are cash poor and early in their career. For this reason, many new doctors avoid a 15 year mortgage while more senior physicians who have saved money use this type of mortgage to save money in the long run.

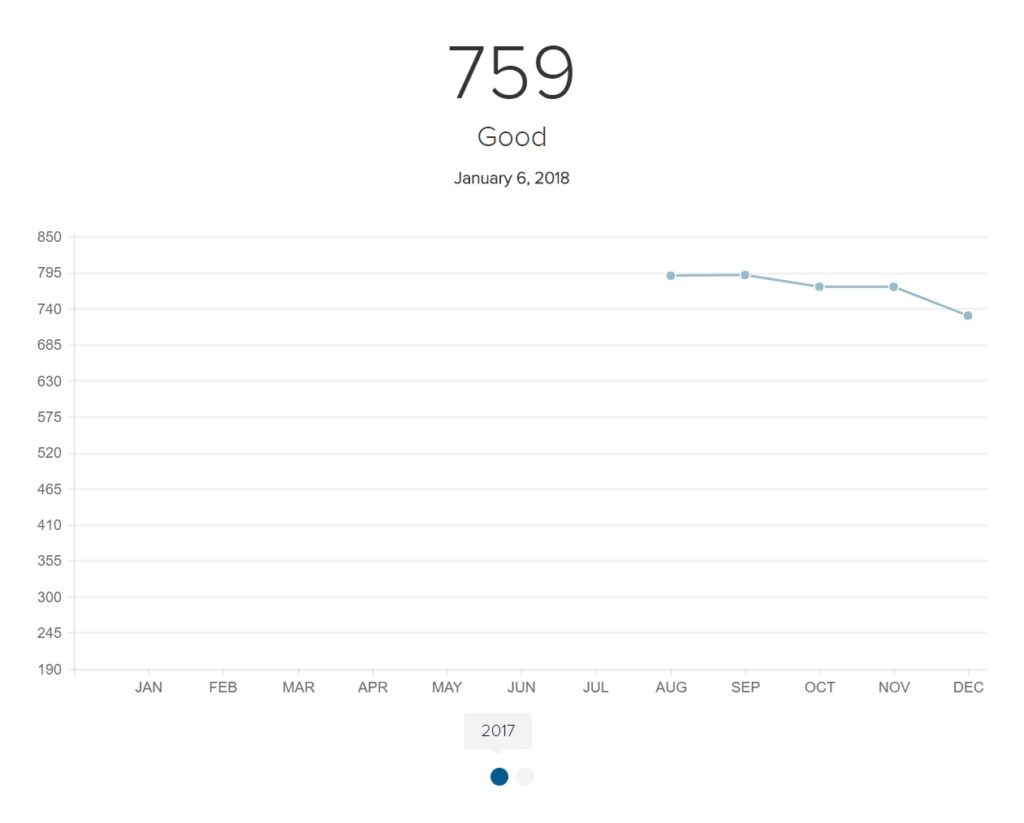

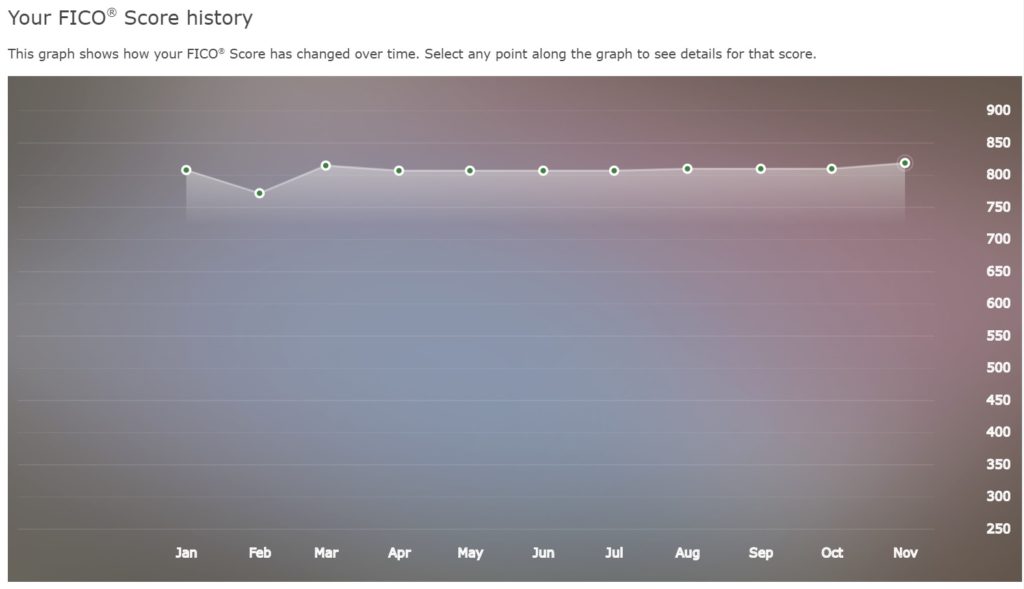

What Happened To My Credit Score After The Purchase

Wells Fargo has been tracking my credit score for much longer than capital one. You can see the dip in February when I was under contract with a house then backed out due to structural issues. Wells Fargo still shows an excellent credit rating while capital one shows a drastically different number. I suspect this is due to Wells Fargo not having December FICO score listed yet. It appears my credit score has dropped about 40-45 points taking out a new mortgage. I honestly expected it to drop more with such a large purchase.

Capital One FICO Score

Wells Fargo FICO Score

What I Would Advise

I personally don’t believe that the doctor mortgages with 0% down are a good idea. When a doctor uses this kind of loan it often means a combination of three things.

- The job is most likely new and it is unknown how things will work out long-term at this job

- There most likely is not enough cash reserves for an emergency. If a doctor can’t afford 5% down + closing costs + emergency fund, you shouldn’t be purchasing a house. What happens if a pipe busts when you move in and you need to pay a plumber to fix it?

- Doctor loans have PMI built into the interest rates (Rates are often higher than conventional loans + PMI) and will cost more over the life of the loan. As stated above, fees may be much higher with 0% down loans.

Wait until you have at minimum 5% down plus closing costs plus an emergency fund before buying a house. Half of the people who I work with moved within the first two years of joining my group. The transaction costs for those who bought right away with no money down put them into a tough situation when they realized this job wasn’t for them and they needed to sell. Take your time, rent, and put at least 5% down. Consider an ARM if it is right for you!