How to file your taxes as a Med Student and Resident for free

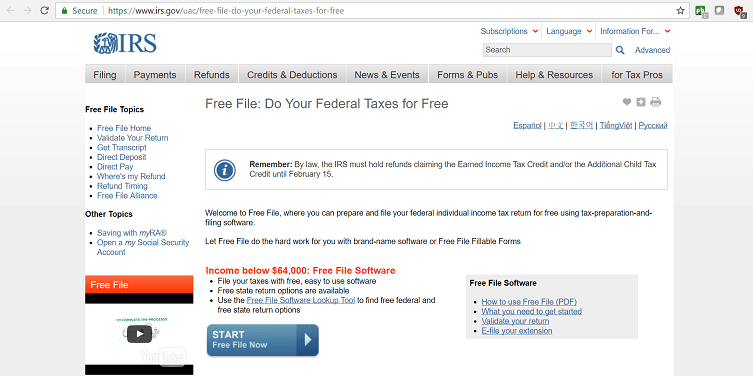

The IRS offers a service where almost any individual making less than $64,000 a year can file their taxes for free. Sounds too good to be true, well the catch is that you have to be comfortable with some basic math. In past years, I have taken advantage of the service and it worked quite well. Filing taxes may seem daunting and expensive, but rest assure – the thought of filing is worse than the actual process. Most resident physicians and future doctors fall into the category of quality for this program. Below are the items that will be needed and steps to take in order to file your taxes for free. The bottom of the page includes organizations that will help file your taxes with their software for free if you make less than $64,000 a year.

First go to the IRS website

Click on the Start button on the website and enter in an email account to get started.

Next step is to have all of the necessary forms

1. Personal Information Needed

- Last year’s tax return

- Social Security numbers

2. Income and Receipts

- Any and all income received needs to be reported

- W-2

- Forms 1099-INT: Interest paid to you throughout the year if applicable

- Form 1099-G: Any refund or credit of state and local taxes if applicable

- Forms 1099-DIV and Forms 1099-R: Dividends and distributions from retirement plans if applicable

- Any income from work, insurance payouts, unemployment, child support, etc. needs proof and documentation

3. Affordable Care Act Filing

- There are three possible forms per the IRS website. Form 1095A, 8962, or 8965 for proof of insurance or proof of exemption.

4. A valid Email Address

The path to filing your taxes doesn’t have to be complicated.

Once all this information is inputted, the next step if to fill out the forms and do the required math. If this sounds a little complex, don’t worry. The businesses below off tax fling for free via their software for free depending on income level.

- Free1040TaxReturn.com

- FileYourTaxes.com

- TurboTax

- H&R Block’s Free File

- OLT.com

- 1040.com

- TaxSlayer

- TaxAct

Be sure to read the fine print since not every website has the same cut off as the federal government. Almost every business from this list uses a cut off of $64,000 to file taxes for free, but not all. For example, turbo-tax cuts off at $33,000 for its free file service. Filing taxes no longer has to be difficult or expensive. Medical students, residents, and fellows save money by filing taxes for free.

A great informative post you shared on this page about calculating the tax returns of a successful business easily by using online system softwares , I read this post and remember the best points especially ” customer service management ” mentioned in this article which help me for running a business successfully with the help of professional accounting .If you want to start a business successfully then you must read this article carefully and keep it in your mind all the best points of a great article which help you to running a business successfully with the professional accountant .

Thanks