A Financial Advisor Argues For Actively Managed Funds

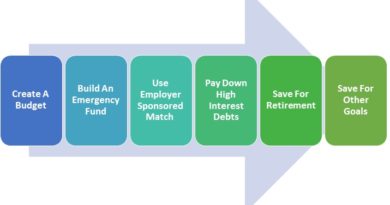

Financial planners, also known as financial advisors, can be helpful for doctors who don’t have the time, energy, or the desire to take control of their financial plan. I decided to meet with a financial advisor when our group offered to pay for a meeting. There can be advantages and disadvantages to using a financial advisor. I felt like an hour meeting could do little harm, so I gave it a shot. For me, I enjoy investing and personal finance which is why I have not used one to date. Our discussion, and this post, ended up focusing mainly on actively managed funds vs index funds.

What Is An Actively Managed Fund

An Actively managed fund is when an asset is being bought and sold based on market fluctuations. For example, a hedge fund may have a group of stocks that they invest in. As news of the market becomes more or less favorable, these assets will be bought or sold to hopefully make money. The person buying or selling the asset is betting that they know which way the price for the asset is going to move. If the price move in their favor then they make money. If the price goes opposite of what they thought, they lose money.

An extreme example of market stipulation was characterized in the big short, where Michael Burry (a doctor and investor) shorted (bet against) the housing market. He identified a market where he believed he could make money and placed a wager on his research. He actively managed the funds money to make a lot of money when others were losing a fortune.

Low Costs Index Funds

On the other end of the spectrum of actively managed funds are index funds. These are a group of assets that are held long-term with low turnover. Due to low turnover and lack of active trading, fees typically tend to be lower. The amount of assets in these funds can be very diversified. Spreading out risk will hopefully avoid a large loss if one asset becomes largely unprofitable.

During my meeting with this particular financial advisor, he commended my portfolio for maxing out my retirement accounts by saving $54,000 a year. He also noted that I choose to invest in low-cost index funds. This is something which he admitted would likely save thousands in fees over time. We both spoke a little bit about how low-cost index funds have been one of the most popular ways to invest in the past 10+ years. Overall, his impression was the same as mine. Low cost index funds are most likely the most cost-effective way to invest retirement funds in the stock market for the average investor.

Prior to medical school I worked on a farm to earn some money. I worked too hard for that money to see it go towards fees

The Pitch And His Argument For Actively Manage Funds

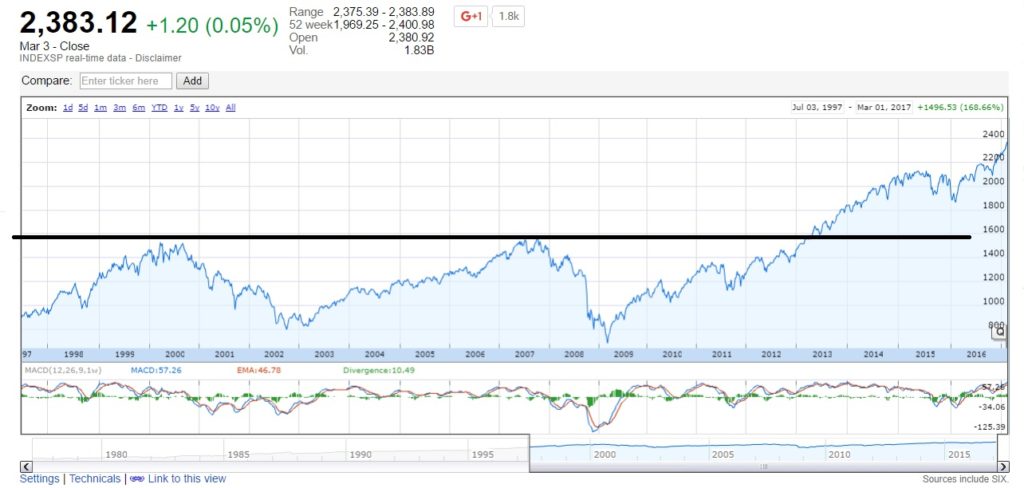

The financial advisor I met with pitched the idea of letting him actively manage part of my investment account. His first argument for doing so was that from the year 2000 to 2007 the S&P 500 was essentially flat. The same can be also said about 2007 to 2013. He proposed that if he picked the right stocks during that time period that he could have made his clients money when the S&P funds were flat.

The most famous investor of our time, Warren Buffett, made a famous bet against any actively traded fund. He bet that his passively invested index fund would beat an actively traded fund over a decade. My first thought was that if no one was able to beat one of the best investors of our time, what makes this advisor so special? he felt that he could somehow pick stocks that would have a better outcome over a given period of time that the market. I pushed him to give details to his plan but his answer was often telling me that its complicated. Investing does not have to be complicated.

At of the time of this publication, Mr. Buffett’s investment in an index fund was up 85% since the bet started 9 years ago. The best actively managed fund that competed with him was up 62%. Not only did his passively invested fund produce better returns, but fees between the two would have accounted for thousands of dollars in fees in the actively traded fund. In effect, the outcome between the two is even further apart.

- Be cautious if someone tells you they can beat the market or one of the best long-term investors of all time

What If Active Funds Can Save Money In A Market Downturn

His second argument was that he could mitigate losses or even make money in a market downturn. He proposed that since the stock market was at a peak right now, that a drop may be in the future at an unknown date. When there is a downturn in the future, he argued that money could be made in an actively traded account. If my retirement accounts were to stay as is with no changes, then I would stand to lose money as the market down turned. We spoke about how he could buy options and other complex means to help of set risks to try to increase reward. All of these method, take extra time, fees, and some degree of luck. My counter argument was to mitigate risk by using asset allocation.

What About Asset Allocation and Rebalancing In A Downturn

He may end up saving his clients money in a downtown or even make them money. There are no guarantees to his method. Betting on his plan, is in essence betting on him that he will somehow do better than a well-balanced fund. His argument for saving his clients money in the downturn assumed that someone had 100% in the S&P 500 with no other asset classes. Even the most aggressive retirement investments, including mine, usually do not have 100% of their retirement in one asset.

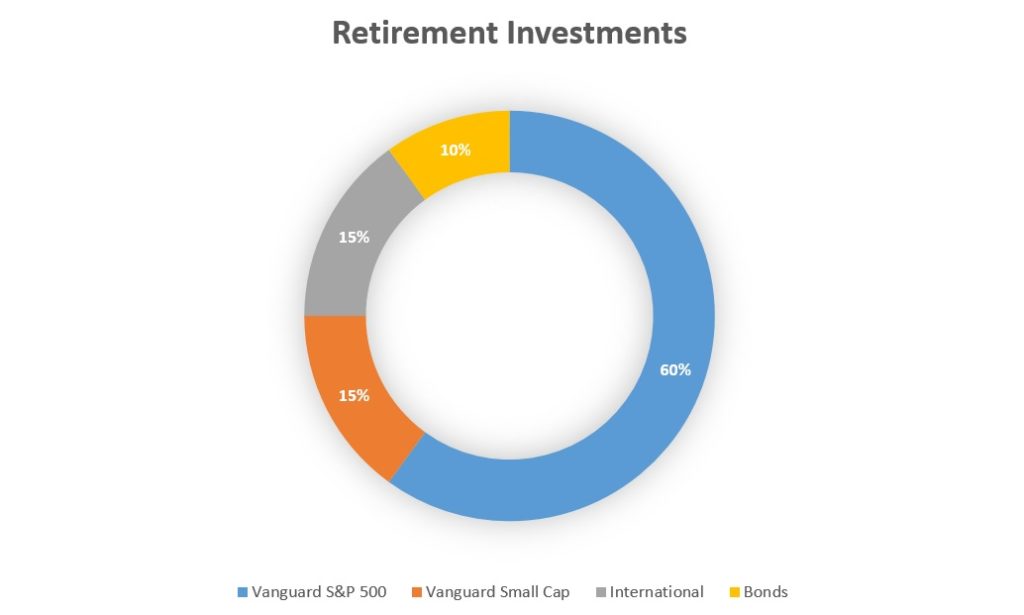

Lets run some numbers with a similar situation. We will assume that in one year the S&P will peak and that there will be another downturn similar to that of the previous two seen above. By that time I will have over $100,000 in my retirement and investment accounts, but lets round to $100,000 to make it easy. My current portfolio is:

Market Downturn

In this situation, lets assume that the market goes down by 30%. At that time, about $75,000 of the initial $100,000 will be in US stocks. At the peak of the downturn, assuming a 30% loss and I do no re-balancing, I will have $52,500 left in US stocks. My asset allocation to US stocks now makes up 64% of my retirement account due to the drop in price, down from 75% prior to the drop.

Lets make another assumption. I keep my job and continue to contribute to retirement at the same rate. I have my retirement portfolio set up to re-balance with each contribution. If the next downturn in the marker is anything like the past, it may take 5 plus years to have a return of 0% on my initial investment in US stocks as noted by the chart above.

What if I reallocated?

If I wanted to get back to 75% of my investment in US stocks, then I would have to reallocate. This is done by buying $6,000 worth of US stocks to re-balance my portfolio. At the end of the recession, the $6,000 has a chance to take advantage of the cheaper price I paid per stock and gain money while I await the S&P to get back to its previous level. At the end of 5 years when the recession is over, I will then have $7,800. UP from my initial $6,000 investment to re-balance my portfolio.

If I became jaded and decided to not invest any more in the stock market, my final total at the end of the recession would be $82,000 in US stocks. This gives a total year over year return during the recession of 0.44% for this one asset class.

What if I keep contributing

The assumption above is that there is a 30% downturn and it takes 5 years to return to baseline. If I continued to contribute the usual $54,000 a year to my retirement, I would have an extra $270,000 for my retirement. Of which, 75% which would go to US stocks (lets round to $200,000). A 30% return in 5 years is a 5.5% year over year return. At then end of the 5 years I would have accumulated $304k total in the US stock account. This means my year over year total return of 3.8% per year during the 5 years of an overall flat S&P.

No guarantee

In the scenario above, there were a lot of what if situations presented. I’ll concede that. However, the takeaway is that assert allocation can help minimize risk. Applying re-balancing to once portfolio, financial gains can be made during downturns and risk can be minimized. The financial advisor that I visited is right that my initial investment in the S&P 500 would be unchanged over the years presented above. However, if I were to continue investing, when the market recovers there are gains to take advantage of. His assumption is that he will know how to time the market.

- I’m skeptical enough to know that no one knows what the future holds.

After President Trump was elected some investors predicted a drop in the stock market. If I would have sold all of my US stocks I would have missed out on 15% gains since then. In fact, the days after he took office the stock market dropped almost 2%. I decided to buy more stocks and walked away with additional gains after not trying to time the market. No one knows what the future will hold. My investment strategy works for me and allows me to sleep at night. I’ll stick to avoiding putting money with individuals who think they can outsmart the market.

What do you think about actively managed funds? Do they have a place in your portfolio?

Great post! You bring up many good points about active vs passive management. For the 5% of equity fund managers that end up beating the S&P on a regular basis, I tip my cap. Warren Buffett himself, one of the greatest active managers of all time, even recommends passive investing for the average investor.

I think you bring up a great point about mitigating risk through asset allocation and rebalancing. Timing the market is impossible, so spreading your portfolio across multiple asset classes and continuing to rebalance on a regular basis should give you an advantage when a downturn turns into an upturn.

I personally use a mixed active and passive strategy. A large piece of my retirement is in index funds, but I like to also choose specific funds or individual stocks in the sectors and regions I believe will outperform over a time period. I also like to use active management when it comes to fixed income strategies. In recent years active bond managers have had greater results than their equity counterparts.